Mastercard is a technology company in the global payments industry that connects consumers, financial institutions, merchants, governments, digital partners, businesses, and other organizations worldwide, enabling them to use electronic forms of payment instead of cash and checks.

Mastercard provides various payment solutions and services using the brands Mastercard, Maestro, and Cirrus. Mastercard operates a multi-rail payments network that provides choice and flexibility for consumers and merchants, using a core global payments network.

Through this strategy story, we will analyze the business model of Mastercard and understand how does it work and make money.

How does the Multi-rail network of Mastercard works?

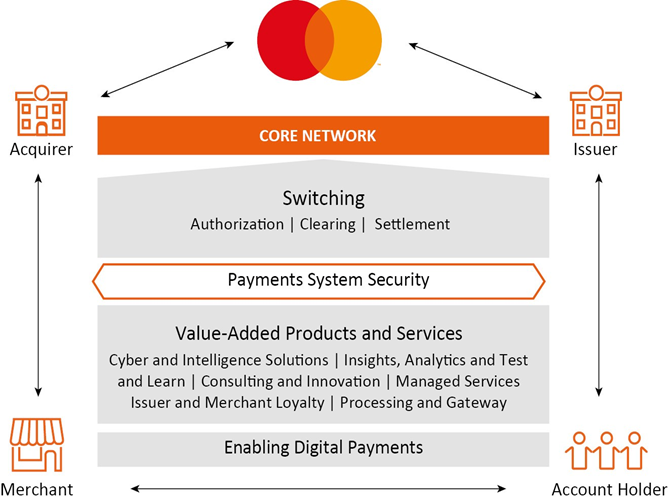

Mastercard enables a wide variety of payment capabilities (including integrated products and value-added service solutions) over its multi-rail network among account holders, merchants, financial institutions, businesses, governments, and others, offering customers one partner for their payment needs.

Mastercard’s core network links issuers and acquirers to facilitate the switching of transactions. Mastercard provides a payment method for consumers to access their funds and a channel for businesses to receive insight through the information derived from its network.

Mastercard’s core network supports what is often referred to as a “four-party” payments network and includes the following participants:

- The account holder (a person or entity who holds a card or uses another device enabled for payment).

- The issuer (the account holder’s financial institution).

- Merchant and acquirer (the merchant’s financial institution).

Through its core network, Mastercard enables the routing of a transaction to the issuer for its approval, facilitates the exchange of financial transaction information between issuers and acquirers after a successfully conducted transaction, and settles the transaction by facilitating the exchange of funds between parties via settlement banks chosen by Mastercard and Mastercard’s customers.

In a typical transaction, an account holder purchases goods or services from a merchant using Mastercard. After the issuer authorizes the transaction, the issuer pays the acquirer an amount equal to the value of the transaction, minus the interchange fee and other applicable fees, and then posts the transaction to the account holder’s account. The acquirer pays the amount of the purchase, net of a discount (referred to as the “merchant discount” rate), to the merchant.

Interchange Fees: Interchange fees reflect the value merchants receive from accepting Mastercard products and play a key role in balancing the costs and benefits that consumers and merchants derive. Generally, interchange fees are collected from acquirers and paid to issuers to reimburse the issuers for a portion of the costs incurred.

Issuers incur these costs in providing services that benefit all participants in the system, including acquirers and merchants, whose participation in the network enables increased sales to their existing and new customers, efficiencies in the delivery of existing and new products, guaranteed payments, and improved experience for the customers.

Additional Four-Party System Fees: The merchant discount rate is established by the acquirer to cover the costs of participating in the four-party system and providing services to merchants. The rate considers the amount of the interchange fee the acquirer generally pays to the issuer.

Additionally, acquirers may charge merchants processing and related fees in addition to the merchant discount rate. Issuers may also charge account holders fees for the transaction, including, for example, fees for extending revolving credit.

Mastercard has a multi-layered strategy to protect the global payments ecosystem. Mastercard protects the network from cyber and information security threats as part of this strategy, providing resiliency and security protection.

How does Mastercard make money? What is the business model of Mastercard?

Value Proposition

- making electronic payments more convenient, secure, and efficient

- delivering better, seamless consumer experiences

- Providing consumers with choices, empowering them to make and receive payments in the ways that best meet their daily needs

- protecting consumers and all other participants in a transaction, as well as consumer data

- providing loyalty rewards

Products & Services

Mastercard provides various integrated products and services that support payment products that customers can offer to consumers and merchants. These offerings facilitate transactions across Mastercard’s multi-rail payments network and platforms among account holders, merchants, financial institutions, digital partners, businesses, governments, and other organizations in markets globally.

- Core payment products: Consumer debit and credit, Prepaid, and Commercial Credit and Debit

- Net payment flows: Disbursements and Remittances, B2B Payments, and Consumer Bill Payments.

- Value Added Services: Cyber and Intelligence Solutions; Insights, Analytics, and Test and Learn; Consulting and Innovation; Digital Services; and Issuer and Merchant Loyalty

Marketing Strategy of Mastercard

Mastercard has a multi-brand marketing strategy and business model. Mastercard’s brands include Mastercard, Maestro, and Cirrus. Mastercard promotes its brands and brand identities through advertising, promotions, and sponsorships, as well as digital, mobile, and social media initiatives, to increase people’s preference for its brands and usage of its products.

As part of its marketing strategy, Mastercard sponsors a variety of sporting, entertainment, and charity-related marketing properties to align with consumer segments important to Mastercard and its customers. Advertising plays an essential role in building brand visibility, preference, and overall usage among account holders globally.

How does Visa work & make money: Business Model

Mastercard’s “Priceless” advertising campaign, which has run in over 50 languages and more than 120 countries worldwide, promotes Mastercard usage benefits and acceptance, markets Mastercard payment products and solutions, and provides Mastercard with a consistent, recognizable message.

How does Mastercard make money: revenue model

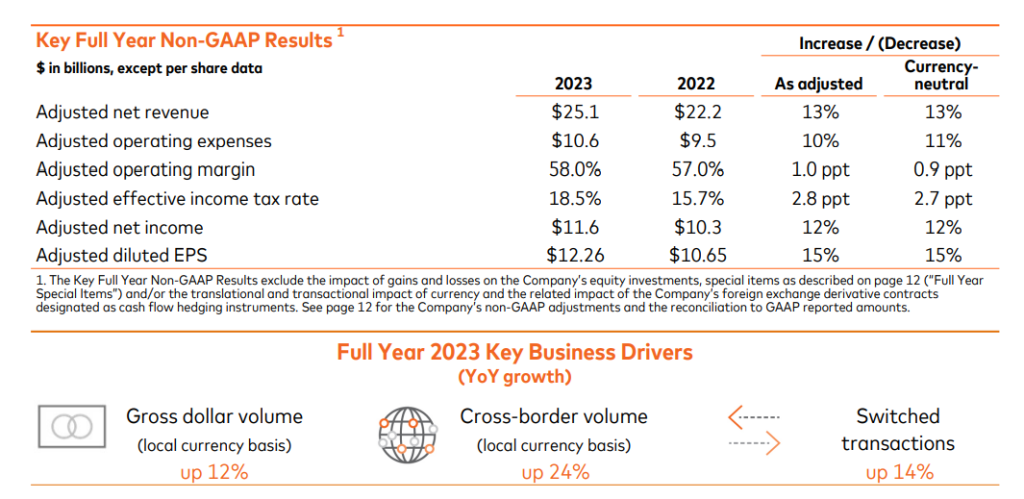

Mastercard made $25.1 billion in 2023. Mastercard makes money primarily from assessing its customers based on the gross dollar volume of the products that carry Mastercard brands, the fees Mastercard charges customers for processing transactions, and other payment-related products and services.

Revenues in the business model of Mastercard are classified into five categories: domestic assessments, cross-border volume fees, transaction processing, other revenues, and rebates and incentives (contra-revenue).

Domestic assessments are fees charged to issuers and acquirers based primarily on the dollar volume of activity on cards and other devices that carry Mastercard’s brands where the merchant country and the country of issuance are the same. Revenue from domestic assessments contributes ~45% to Mastercard’s revenue.

Cross-border volume fees are charged to issuers and acquirers based primarily on the dollar volume of activity on cards and other devices that carry Mastercard’s brands where the merchant country and the country of issuance are different. Revenue from cross-border volume contributes ~25% to Mastercard’s revenue.

Transaction processing revenue is recognized for both domestic and cross-border transactions, including

- Switched transaction revenue: Transaction Authorization (in case the issuer cannot be contacted), Clearing (determination and exchange of financial transaction information between issuers and acquirers after a transaction has been successfully conducted), and Settlement (facilitates the exchange of funds between parties)

- Connectivity fees are charged to issuers, acquirers, and other financial institutions for network access, equipment, and the transmission of authorization and settlement messages.

- Other processing fees include issuer and acquirer processing solutions, payment gateways for e-commerce merchants, mobile gateways for mobile-initiated transactions, and safety and security.

Revenue from transaction processing contributes ~60% to Mastercard’s revenue.

Other revenues include value-added products and services often sold with the Company’s payment service offerings. Other revenues include:

- Cyber and intelligence solutions fees.

- Data analytics and consulting fees.

- Loyalty and rewards solutions fees and Program management services.

Revenue from other services contributes ~15% to Mastercard’s revenue.

Rebates and incentives (contra-revenue) are provided to customers and can be either fixed or variable-based. Fixed incentives typically represent payments to a customer directly related to entering into an agreement. Variable rebates and incentives, such as volume thresholds, are usually tied to customer performance.

They are recorded as a reduction of gross revenue primarily when volume- and transaction-based revenues are recognized over the contractual term. Rebates & incentives reduce the revenue by ~60%.