Visa is one of the world’s leaders in digital payments. Visa’s mission is to connect the world through the most innovative, reliable, and secure payments network — enabling individuals, businesses, and economies to thrive.

Through innovative technologies and a business model, Visa facilitates global commerce and money movement across over 200 countries and territories among consumers, merchants, financial institutions, businesses, strategic partners, and government entities.

Since Visa’s inception in 1958, Visa has been in the business of facilitating payments between consumers and businesses. With new ways to pay, Visa has evolved into a global company that is a trusted engine of commerce, working to provide payment solutions for everyone, everywhere.

Visa focuses on extending, enhancing, and investing in its proprietary network, VisaNet while seeking new ways to offer products and services and become a single connection point for facilitating any payment transaction using its network, other networks, or a combination of networks.

In this strategy story, we will break down the different aspects of the business model of Visa and learn how does Visa work and make money?

Let’s first understand how does Visa work.

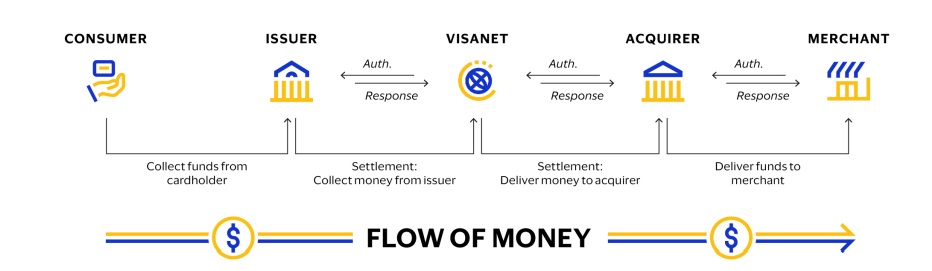

An example of a typical Visa C2B payment transaction is the consumer purchases goods or services from a merchant using a Visa card or payment product.

The merchant presents the transaction data to an acquirer, usually a bank or third-party processing firm that supports acceptance of Visa cards or payment products, for verification and processing.

Through VisaNet, the acquirer presents the transaction data to Visa, which contacts the issuer to check the account holder’s account or credit line for authorization.

After the transaction is authorized, the issuer effectively pays the acquirer an amount equal to the value of the transaction, minus the interchange reimbursement fee, and then posts the transaction to the consumer’s account.

The acquirer pays the purchase amount, minus the merchant discount rate (MDR), to the merchant. As per Corporate Finance Insitute, A merchant discount rate, or MDR, is a rate charged to a merchant for processing debit and credit card transactions.

Visa is not a financial institution. Visa does not issue cards, extend credit or set rates and fees for account holders of Visa products.

Interchange reimbursement fees reflect the value merchants receive from accepting Visa’s products and play a key role in balancing the costs and benefits that account holders and merchants derive from participating in Visa’s payment networks. Generally, interchange reimbursement fees are collected from acquirers and paid to issuers.

Visa uses interchange reimbursement fees as transfer fees between acquiring banks and issuing banks for each Visa card transaction. Visa uses these fees to balance and grow the payment system for the benefit of all participants.

Merchants do not pay interchange reimbursement fees—merchants negotiate and pay a “merchant discount” to their financial institution, typically calculated as a percentage per transaction. Merchants can receive various processing services from financial institutions that may be included in their merchant discount rate.

What are the Core Products in the business model of Visa?

Visa has products in three primary areas — consumer payments, new flows, and value-added services.

Consumer Payments

Visa’s growth has been driven by the strength of its core products — credit, debit, and prepaid products.

Credit: Credit cards and digital credentials allow consumers and businesses to access credit to pay for goods and services. Credit cards are affiliated with programs operated by financial institution clients, co-brand partners, fintech, and affinity partners.

Debit: Debit cards and digital credentials allow consumers and small businesses to purchase goods and services using funds held in their bank accounts. The Visa/PLUS Global ATM network also provides debit, credit, and prepaid account holders with cash access, and other banking capabilities, in more than 200 countries and territories worldwide through issuing and acquiring partnerships with financial institutions and independent ATM operators.

Prepaid: Prepaid cards and digital credentials draw from a designated balance funded by individuals, businesses, or governments. Prepaid cards address many use cases and needs, including general purpose reloadable, payroll, government and corporate disbursements, healthcare, gift, and travel. Visa-branded prepaid cards also play an essential part in financial inclusion, bringing payment solutions to those with limited or no access to traditional banking products.

Net Flows

Visa’s network of networks approach creates opportunities to capture new sources of money movement through card and non-card flows for consumers, businesses, and governments worldwide by facilitating P2P, B2C, B2B, B2b, and G2C payments.

Visa Direct: Visa Direct is Visa’s global, real-time push payments platform, which reverses the traditional card payment flow by allowing payment originators, through their acquirers, to push funds directly to eligible debit and prepaid cards or accounts. It enables businesses and consumers to send money directly to a bank account or card, including domestic or cross-border payouts and payments, P2P payments, small businesses, and corporate, worker, insurance, and government payouts.

Visa Business Solutions: Visa offers a portfolio of business payment solutions, including small business, corporate (travel) cards, purchasing cards, virtual cards and digital credentials, non-card cross-border B2B payment options, and disbursement accounts, covering most major industry segments around the world.

Business solutions are designed to bring efficiency, controls, and automation to small businesses, and commercial and government payment processes, ranging from employee travel to fully integrated, invoice-based payables.

Value Added Services

Issuer Solutions: Visa Debit Processing Service (DPS) provides a wide range of debit, prepaid, and credit value-added services to clients, including call center services, data analytics, campaign management, fraud and risk solutions, and a white-label branded mobile app. Visa also provides other services and digital solutions to issuers, such as account controls, digital issuance, branded consumer experiences, and buy now pay later (BNPL) capabilities.

Acceptance Solutions: Cybersource is a global payment management platform that provides modular, digital capabilities in addition to the traditional gateway function of connecting merchants to payment processing. Visa also offers dispute management services, including a network-agnostic solution with Verifi that enables merchants to prevent and resolve disputes with a single connection.

Risk and Identity Solutions: Visa’s risk and identity solutions transform data into insights for near real-time decisions and facilitate account holder authentication to help clients prevent fraud and protect account holder data. Visa helps protect financial institutions and merchants from fraud and solve payment security challenges.

Advisory Services: Visa Consulting and Analytics is Visa’s payments consulting advisory arm. Visa Consulting and Analytics offers consulting services for issuers, acquirers, merchants, fintech, and other partners, spanning the entire customer journey from acquisition to retention.

How does Sezzle work and make money: Business Model

How does Visa make money? What is the business model of Visa?

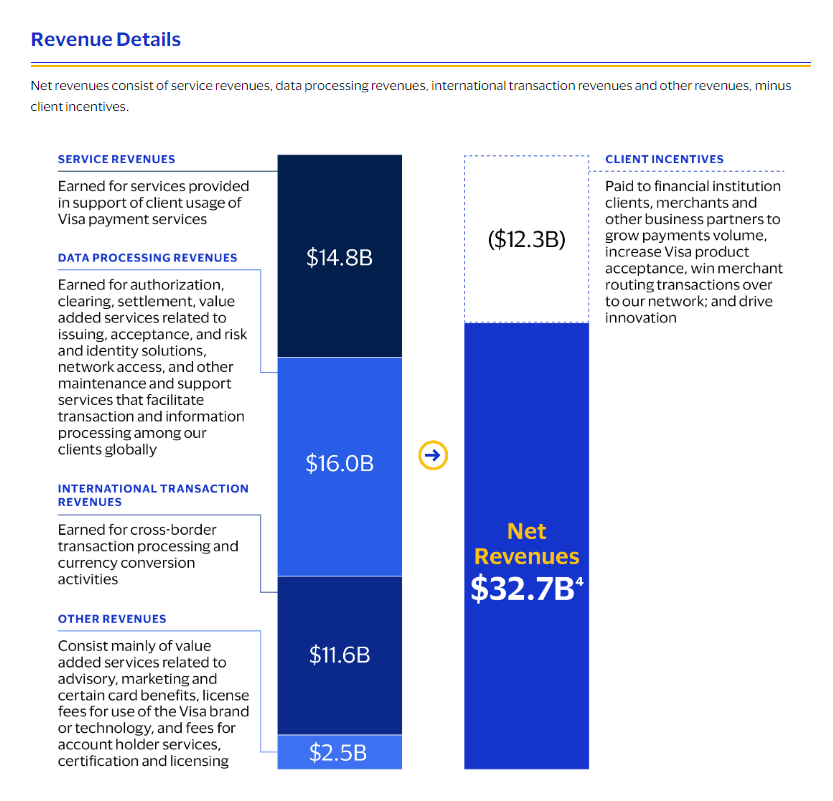

Visa made $32.7 billion in 2023. Visa makes money by facilitating movement of money among consumers, merchants, financial institutions, businesses, strategic partners, and government entities, through innovative technologies. Net revenues consist of service, data processing, international transaction, and other revenues minus client incentive arrangements Visa has with its clients.

Service revenues consist mainly of revenues earned for services that support client usage of Visa payment services. Payments volume is the primary driver of service Revenues.

Data processing revenues consist of revenues earned for authorization, clearing, settlement, value-added services, network access, and other maintenance and support services that facilitate transaction and information processing among the Company’s clients globally.

How does Expensify work & make money: Business model

International transaction revenues are earned for cross-border transaction processing and currency conversion activities. Cross-border transactions arise when the country of origin of the issuer or financial institution originating the transaction is different from that of the beneficiary.

Other revenues consist mainly of value-added services, license fees for using the Visa brand or technology, fees for account holder services, certification, licensing, and card benefits, such as extended account holder protection and concierge services.

Client incentives: Visa enters into long-term contracts with financial institution clients, merchants, and strategic partners for various programs that provide cash and other incentives designed to increase revenue by growing payments volume, increasing Visa product acceptance, winning merchant routing transactions over to Visa’s network, and driving innovation.