Financial independence does not mean being wealthy but rather represents the ability to have the financial means to achieve personal objectives at each stage of life, such as owning a home, having a family, or having a career of choice — more simply stated, to have enough money to do what you want.

Financial independence is one of the many markers used to designate the crossover from childhood into young adulthood, and it’s a milestone most Americans (64%) think young adults should reach by the time they are 22 years old, according to a new Pew Research Center study.

But that’s not the reality for most young adults who’ve reached this age. The same study says that only 22% of young adults are financially independent. SoFi was founded in 2011 to help its members achieve financial independence and realize their ambitions.

To achieve its mission, SoFi helps people get their money right, allowing them to borrow better, save better, spend better, invest better, and protect better. As strategy enthusiasts, we decided to evaluate the business model of SoFi. How does SoFi work and make money? What does the competitor landscape for SoFi looks like? Let’s find out.

What is SoFi? How does SoFi work?

SoFi, short for Social Finance Inc., was founded in the summer of 2011 by Mike Cagney, Dan Macklin, James Finnigan, and Ian Brady, four students who met at the Stanford Graduate School of Business. The founders hoped SoFi could provide more affordable options for those taking on debt to fund their education.

SoFi is an American online personal finance company and online bank. SoFi offers a one-stop shop for financial services that, through its Lending and Financial Services products, allows members to borrow, save, spend, invest and protect their money.

SoFi has created a financial services platform to offer products to meet the broad objectives of its members and the lifecycle of their financial needs. The products are designed to provide members with the tools they need to take control of their financial futures.

Some of the current frictions other financial institutions face are caused by a disjointed and non-seamless product experience, a lack of digital acquisition, subpar mobile web products instead of digital native apps, and incomplete product offerings to meet a customer’s holistic financial needs.

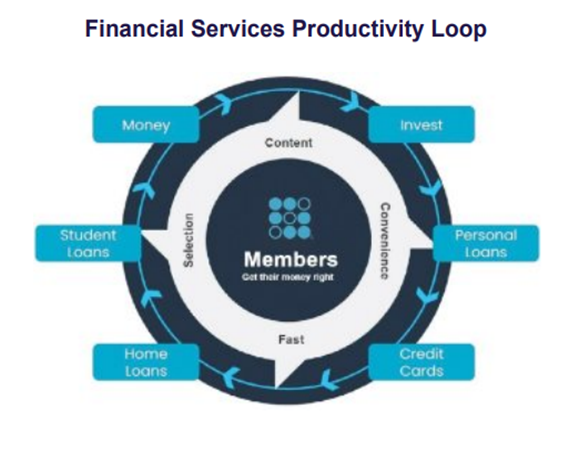

Hence, SoFi works on a “Financial Services Productivity Loop” that is centered around developing a relationship with members and gaining their trust. SoFi earns this trust by offering its members access to its certified financial planners (“CFPs”), career advice services, member events, content, educational material, news, tools, and calculators at no cost.

SoFi offers its members a suite of financial products and services in one native digital application to help them get their money right. In 2011, SoFi started with an innovative approach to the private student loan market and later expanded its lending product offerings to include personal and home loans.

In 2019, SoFi launched SoFi Money, SoFi Invest, and SoFi Relay. In that same quarter, SoFi also redesigned its end-to-end approach to mortgage lending and relaunched home loans. In the third quarter of 2019, SoFi introduced in-school loans, and in the third quarter of 2020, SoFi launched the SoFi Credit Card, which was expanded to a broader market in the fourth quarter of 2020.

In addition, SoFi has built a social area within its digital native application, which it refers to as the member home feed. SoFi shows members what is happening in their financial lives through personalized cards with relevant content, news, and tools.

Through the member home feed, there are significant opportunities to build frequent engagement. To date, the member home feed has been an essential and additional driver of new product adoption for SoFi.

How does SoFi make money? What is the business model of SoFi?

Value proposition

SoFi has designed a business model to help people get their money right. SoFi’s members get access to its certified financial planners (“CFPs”), career advice services, member events, content, educational material, news, tools, and calculators at no cost to the member.

Additionally, SoFi delivers personalized content to members about what they must do that day in their financial life, what they should consider doing that day in their financial life, and what they can do that day in their financial life.

In addition to benefiting its members, SoFi attracts enterprises, such as financial services institutions, that subscribe to its enterprise services called SoFi At Work and have become interconnected with the SoFi platform.

SoFi continues to expand its platform capabilities for enterprises by acquiring Galileo in 2020, which provides technology platform services to financial and non-financial institutions.

Marketing Strategy of SoFi

The marketing strategy of SoFi is designed to drive brand awareness, improve member acquisition efficiency and accelerate its Financial Services Productivity Loop.

SoFi attracts and retains members through multiple marketing channels, including social media, traditional media such as the press, online affiliations, search engine optimization, search engine marketing, offline partnerships, preapproved direct mailings, and television advertising.

SoFi optimizes its marketing strategy by focusing on a full suite of financial products and iterating on opportunities to accelerate the Financial Services Productivity Loop.

How does SoFi make money: revenue model

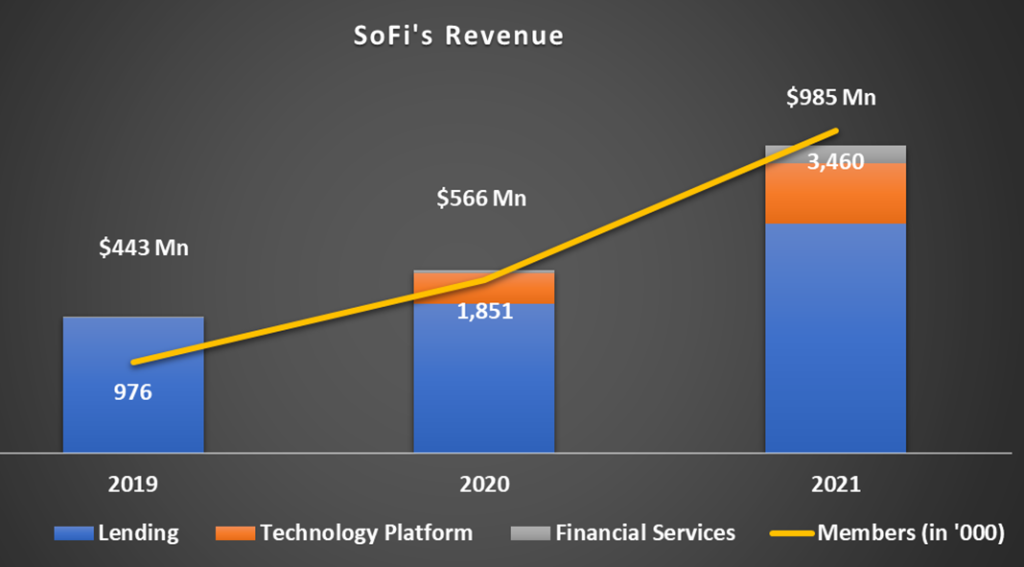

SoFi made $985 Million in 2021. SoFi makes money by offering its members a suite of financial products in three segments: Lending (selling loans), Technology Platform (access to Galileo platform), and Financial Services (cash management and investment services).

Lending: SoFi offers Student loans, personal loans, and home loans. SoFi’s lending business is primarily a gain-on-sale model. SoFi sells its whole loans primarily to large financial institutions, such as bank holding companies, typically at a premium to par and above the costs to originate the loans. Lending contributed 75% to SoFi’s revenue in 2021.

Technology Platform: This segment consists of money, SoFi makes from Galileo. SoFi acquired Galileo in May 2020. Galileo provides services through program, event, and authorization application programming interfaces for financial and non-financial institutions. SoFi makes money by charging a fee for access to the platform and for performing card management services. Galileo contributed 21% to SoFi’s revenue in 2021.

Financial Services: SoFi offers a suite of financial services solutions, including cash management and investment services across SoFi Money, SoFi Invest, SoFi Credit Card, and SoFi Relay products. Financial Services contributed 4% to SoFi’s revenue in 2021.

- SoFi Money is a digitally-native, mobile cash management experience.

- SoFi Invest offers members access to trading and advisory solutions, such as active investing, Robo-advisory, and digital assets accounts.

- SoFi Credit Card helps members save, invest and pay down debt through a variable rewards program, with higher rewards- offerings when redeeming into other SoFi products, such as SoFi Money or deposit accounts held at SoFi Bank, SoFi Invest, or SoFi personal or student loans.

SoFi works on Financial Services Productivity Loop strategy. SoFi initially offers products and makes money at a lower unit economics that helps the platform earn the trust of its members. As a result, when these customers later consider using an additional product, they are more likely to start SoFi, and it has a higher chance that they will select one of SoFi’s products to meet their other financial needs.

How does NerdWallet make money: Business Model & Competitor analysis

This results in more revenue per member with no second-member acquisition costs, resulting in higher lifetime value per member. This also reinforces the benefits of SoFi’s platform, which simplifies the entire financial ecosystem for its members, helping them get their money right. SoFi uses the increased profits to improve member benefits and product experience further.

Financial Services Productivity Loop strategy delivers operating and technology efficiencies to deliver better unit economics per product basis. One of the success factors of SoFi’s lending business is that it is vertically integrated across the technology stack, risk protocols, and operations processes.

Competitor landscape for SoFi

Significant competitors for SoFi are TurnKey Lender, Finflux, G2 Deals, Sageworks Lending, FIS Commercial Lending Suite, Calyx PointCentral, and LoanPro. The business model of SoFi competes at multiple levels, including:

- Competition among other personal loans, student loans, credit card, and residential mortgage lenders;

- competition for money deposits among other banks, some challenger banks, and a variety of technology and retail companies;

- competition for investment accounts among other introductory brokerage firms and a variety of technology and other companies;

- competition for subscribers to financial services content;- and

- Competition among other technology platforms for the enterprise services, SoFi provides, such as platform-as-a-service through Galileo.

Competition to fund prime loans: In this segment, SoFi’s competitors are consumer lenders, including other banks, credit unions, and specialty finance lenders, as well as alternative technology-enabled lenders.

Competition to acquire money accounts: SoFi’s competitors are large banks and some significant technology and retail companies with large consumer bases and balance sheets in this segment.

Competition to acquire investment brokerage accounts: In this segment, SoFi’s competitors are the leading incumbent brokerage firms and neo-brokerage platforms that provide mobile brokerage experience and fractional share investing.