Today, life is digitally convenient. Payments can be made with a click of a button, thanks to UPI. Developed by the National Payments Corporation of India (NPCI) in 2016, Unified Payments Interface was introduced by the government as a major step towards progressing India to a digital economy. How UPI helps is that it allows the transfer of money from one bank account to another instantly via mobile phone. Harnessing this power of UPI, are apps like PhonePe, Google Pay, and Paytm. These apps have found their space in the mobiles of millions of Indians.

These apps are becoming increasingly popular and relevant today, as the pandemic has ushered us into a life of digital interactions. In fact in this ever so growing digital payments market, the number of UPI transactions have crossed 2.2 billion in the month of November itself this year. And what’s even more fascinating is that PhonePe is leading with close to Rs 1.75 lakh crore worth of transactions!

Presently, PhonePe is valued at $5.5 billion after the recent round of funding where they raised $700 million. It is one of India’s leading digital payments platform with over 250 million registered users. One in five Indians is a PhonePe user. And what’s more?

PhonePe aims to become profitable by 2022 and will file for an IPO in 2023.

So, how has PhonePe paved its path to becoming one of India’s leading digital payments platforms?

Enabling local discovery

Founded by Sameer Nigam and Rahul Chari, PhonePe is built with the aim to create an open platform that helps small businesses build their digital presence. Through its in-app feature ‘Stores’ users can locate and chat with local stores, merchants and kiranas near them that are open and delivering.

PhonePe is also working with delivery fleets like Swiggy Genie to deliver goods to customers from their offline network of stores. In fact, this service has been adapted by over 13 million offline shops across the country!

To further accelerate its reach, PhonePe aims to enable digital payments for over 25 million small merchants across India in the next one year. By providing an open platform to interact with customers virtually, PhonePe is digitally empowering small merchants through its various commerce solutions.

And this is part of a larger strategy at PhonePe.

Phonepe: One App for all your digital payments

What if you could pay all your bills, transfer your money, book a cab, shop the latest trends in fashion and lifestyle, book a doctor’s appointment, or buy the insurance and mutual funds, all from one app! Well, that is PhonePe’s key proposition – a one-stop destination for all your transactions.

The ‘Open Platform Strategy’ enables PhonePe to integrate third-party PWAs (progressive web apps) or mobile-sites so that you can make your purchases without leaving the app.

PhonePe has thus partnered with brands from across portfolios – from education, travel, and entertainment to food, fashion, and fitness, to offer perks like cashbacks and discounts to constantly engage with its users through its in-app feature – PhonePe Switch.

PhonePe has also launched several financial services like mutual funds and insurances to further add to its proposition. It is now one of the fastest-growing insurtech platform after having sold over 5 lakh insurance policies within a short span of 5 months.

Furthermore, PhonePe has emerged as the largest platform for buying ‘digital gold’ with over 35% market share. PhonePe is increasingly inculcating the culture of purchasing gold every month through monthly reminders. Hence, it also added a milestone feature to help motivate customers to achieve their saving goals by investing regularly.

These diversified and robust offerings are key in making PhonePe a one-stop-shop for all your digital payments!

Digitally educating and enabling customers

While digital payments is still an unfamiliar space for many Indians, PhonePe aims to educate users through a series of informative campaigns on FAQs while using the app, internet fraud and how to safe yourself from it, how to make quick and easy utility payments and how to purchase insurance and gold from the app.

Check out their Faces of Fraud campaign here:

With the aim of creating awareness and drive usage among consumers as well as small businesses especially in the smaller towns, PhonePe has signed Aamir Khan and Alia Bhatt as brand ambassadors to reach the older generation and target the millennials.

Being one of the sponsors for IPL 2020 has also added to the proposition of PhonePe, as IPL proved to be an effective platform to reach a population of a billion Indians. Well, where would you expect our cricket-loving nation to be when IPL is on? Glued to the TV / Digital devices of course!

Check out their IPL campaign here:

With these new marketing initiatives in place, PhonePe aims to reach the 500 million user mark by 2022!

So what really worked for PhonePe

Firstly, PhonePe is a digital payments facilitator. Unlike mobile wallets, PhonePe integrates with every payment mode, so you can pay via a range of instruments – UPI, cards, third party wallets or gift vouchers. Thus making the transacting experience simple, quick and easy.

Secondly, the digital financial inclusion journey has gained momentum in this post-Covid-19 world as more and more users are preferring digital payments as a key mode to transact. In fact, PhonePe has witnessed greater growth especially across tier 2 and 3 cities.

Lastly, through strategic brand partnerships with IPL. With brand ambassadors like Amir Khan and Alia Bhatt, PhonePe is marketing heavily to increase their aided brand awareness especially among small businesses and small towns. With a wholesome budget of Rs 800 crores, it will be interesting to see how PhonePe continues to ‘Karte Ja. Badhte Ja’.

Also, check out our most loved Startup Strategy Stories below

How one man is enabling Rural India to be financially independent?

Mayank and his startup SumArth are transforming farming from an occupation to a respectful profession in rural areas of Bihar?

How a few professionals are reducing unemployment due to COVID-19?

Retain The Star has come up with Talent loan concept where a company provides its employees on a contract basis to other companies looking for similar skillset

How did one man leave a career of 25 years to live the “GREAT AMERICAN DREAM”?

Would you leave a comfortable life and a stellar career to start something? Read about Vivek’s journey to live the Great American Dream

Is there a right age to start your entrepreneurship journey?

Is there a minimum age into the entrepreneurship world? Guess not. Atharv Patil started his first venture at the age of 13. Find how?

Does entrepreneurship always mean chasing passion and taking risks?

Over the course of a decade Manasvi Singh has launched 3 successful ventures. His Mantra is don’t chase passion, chase opportunities. Read how?

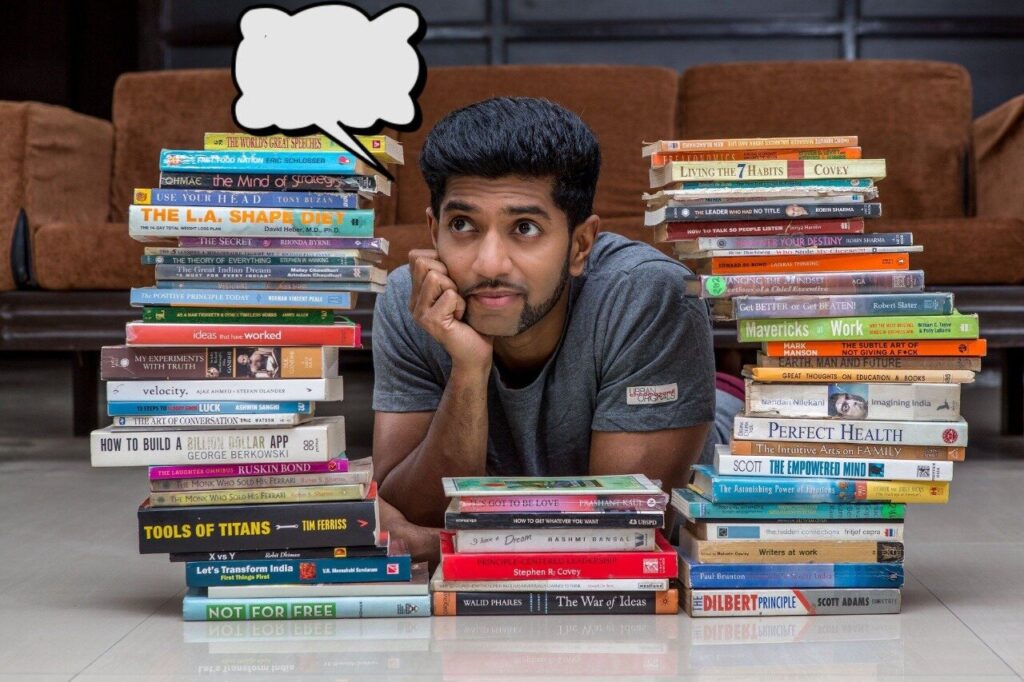

How Amrut Deshmukh is on a mission to make India read?

Would you give up a 6-digit monthly salary to do something for free? Read on to find out why Amrut Deshmukh gave up all things nice with a higher purpose in mind “To Make India Read.”