I first learned about Klarna while searching for a job in the pandemic. Klarna was one of the few firms hiring even in those dark days. In July ’21, Klarna became Europe’s highest-valued fintech with $639m fresh funding, making Klarna Europe’s most valuable fintech unicorn. That made me so curious about Klarna and what made it so successful. I was curious to learn about Klarna’s business model and how Klarna makes money? Let’s first clear some basics.

What is Klarna?

As per Investopedia, Buy Now, Pay Later (BNPL) is a type of short-term financing that allows consumers to make purchases and pay for them at a future date, often interest-free. Also referred to as “point of sale installment loans,” BNPL arrangements are becoming an increasingly popular payment option, especially when shopping online.

Founded by three entrepreneurs- Sebastian Siemiatkowski, Niklas Adalberth, and Victor Jacobsson in 2005 in Sweden, Klarna, is a Swedish fintech company that provides online financial services such as payments for online storefronts and direct payments along with post-purchase payments.

Klarna, which is now valued at over $45 bn and has 3500 employees, was once ignored in the Stockholm School of Economics annual entrepreneurship award in 2005. But the rejection did not deter the enthusiasm of the three founders.

By 2007, venture capital firm Investment AB Öresund invested in the company. Klarna started selling its services in Norway, Finland, and Denmark three years later. Klarna also started its operations in Germany and the Netherlands in 2010, and in May the same year, San Francisco-based Sequoia Capital entered as investors.

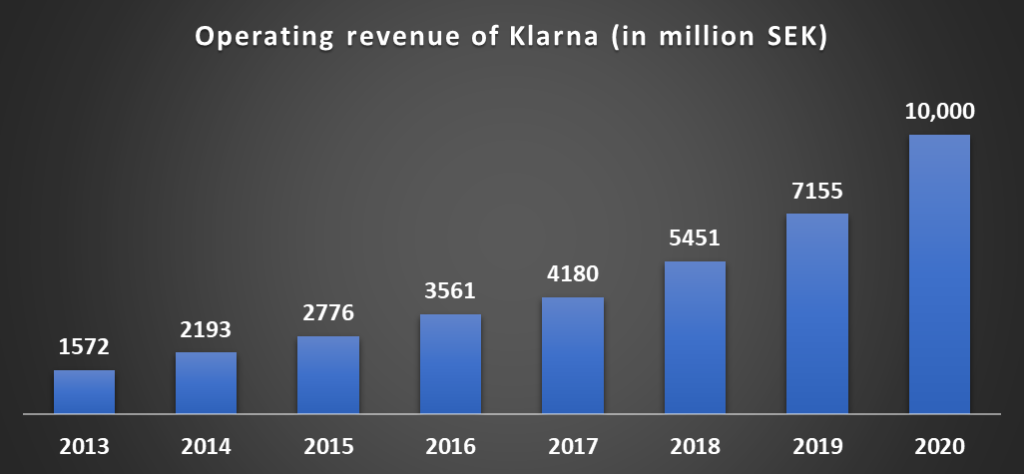

During 2010, Klarna increased its revenues by over 80% to US$54 million. In early 2011, British newspaper The Telegraph listed Klarna as one of Europe’s 100 most promising young tech companies

By 2015, Klarna entered the US market and became its principal growth driver. After multiple rounds of funding from investors like Ant Financials, Dragoneer Investment Group, Commonwealth Bank of Australia, HMI Capital, Merian Chrysalis Investment Company Limited in different years, Klarna in 2021 is valued at $45.6bn post its $639Mn funding from SoftBank.

Buy Now Pay Later is not a new concept. Short-term and Long-term credit lending is old as 1950. Like Klarna, your typical credit card also follows this business model. Klarna is a new version of this “Buy Now Pay Later” business model. New-age fintech like Klarna found a more efficient, consumer-friendly, and cheaper way. Klarna is committed to helping consumers shop, pay, and bank easily.

With over 14 Mn customers in the US alone, Klarna has a Net Promoter Score of 80+ when the average US NPS in financial services is 34.

What makes Klarna’s business model so unique?

Klarna’s business model primarily comprises payment solutions and consumer lending products designed specifically for e-commerce. Today Klarna’s services have expanded beyond traditional e-commerce, for example, by managing payments for public transport, media, and increasingly in physical stores.

Value Proposition

Users: Klarna through its range of direct and credit payment options, including card payments and direct banking, as well as options like invoicing, sales financing, and instant payments.

Klarna aims to reduce unnecessary friction in the shopping journey so the consumers do not abandon their purchases in frustration.

Klarna’s solution is a better solution for people because it is free of interest, it doesn’t have additional late fees, it is not trying to make money that way, and so it is better for the consumer using this.

– Sebastian Siemiatkowski, CEO and Coĩfounder

More than 87 Million customers chose Klarna. That’s pretty amazing. Klarna surveyed 7100 UK Klarna customers to find out the reason. As per the survey

- 67% use Klarna to spread the purchase cost into smaller, more manageable amounts. Klarna offers various flexible payment solutions and app features that empower consumers to responsibly manage their finances and budget.

- 48% use Klarna to try on a few different sizes at home and keep the one that fits best. The Klarna app provides an end-to-end, hassle-free shopping experience that helps consumers through every step. From discovering what they love to report a return, it allows consumers to try on their favorite items in the comfort of their home without having to part with any money before deciding what they want to keep.

Merchants: Klarna aims to increase merchant sales and reduce their working capital requirement by providing simple, safe, cost-effective payment solutions and consumer credit products across all e-commerce platforms.

Klarna provides retailers with a smooth operating platform and enhanced customer acquisition which powers their growth. Klarna has 250k+ retail partners across 17n markets. These retailers include best of the best: Macy’s, Ralph Lauren, Sephora, Urban Outfitters, Etsy, North Face, and Lululemon, and many more.

The Klarna app has proven to be a key driver of customer acquisition for its retail partners. As Klarna continues to grow its omnichannel presence, its retailers are meant to benefit from it. Klarna’s customers have a 45% higher purchase frequency than the average shopper, thus providing additional sales for its partners.

Customers, particularly younger ones, were asking for a buy now, pay later option…If we didn’t have it, they might have gone elsewhere… 40% of shoppers using Klarna were new to Macy’s.

– Jeff Gennette, CEO at Macy’s

Financial Performance in 2020

- Net operating income: Klarna recorded USD 1.087bn net operating income, a 40% increase from 2019.

- Gross Merchandise Value: Klarna recorded USD 53bn (+46%) gross merchandise volumes processed on the platform.

How Does Klarna make money?

If there is no fee, no interest, how does Klarna make money? What’s the catch here? Klarna receives revenue from both the merchants and the consumers that use Klarna’s payment solutions. Klarna makes money via merchant fees, late payment fees, interest on consumer loans, interchange fees, and interest on cash. Klarna has three products: Pay in 30 days, Pay in 3 installments, and Financing.

Its most popular products, Pay in 30 days and Pay in 3 installments, are free for the users, but retailers pay Klarna’s payment solutions fee. Typically, this commission paid by the retailer is higher than the credit card commission paid to Visa or Mastercard. You may wonder why a retailer would pay Klarna a more elevated amount? What are the advantages? There are five advantages:

- The company claims that its payment solutions can increase the average order value of retailers by 41% and the conversion rate by 30%. And that’s why you see retailers pay to Klarna. Amount lost in higher commission is covered by the increase in sales.

- Another big advantage for the merchant is that whether or not the customer ends up paying, Klarna already transfers the money for the transaction.

- Marketing solutions provided by Klarna convert high-intent shoppers into loyal customers by leveraging its AI technology that promotes content that sells.

- For pure-play online retailers, many of whom have never had a High Street presence, offering Klarna helps consumers to try before they buy.

- For a generation of shoppers who have turned away from traditional forms of credit such as high-cost credit cards, Klarna is a safe, secure, and interest-free way of spreading the cost of an investment purchase over 30 or 60 days.

Financing is the product where Klarna earns from its users. Financing is when you want longer-term financing to help you spread the cost from 6-36 months, this is only for larger purchases like furniture and technology. Financing has a mix of retailer fees and (sometimes) a small interest charge for the consumer (up to 18.9% APR).

But more and more consumers prefer interest-free Pay in 30 days and Pay in 3 installments products over financing options. So even though net operating income for the company increased by 40% in 2020, its growth in interest income was limited to 17%.

What does the future hold for Klarna?

Klarna continues to establish its leading global payments provider and shopping service by creating an elevated shopping experience, supporting retailer growth, and driving consumer engagement and loyalty.

With a proven concept for market expansion, Klarna plans to grow by entering new markets and diversifying revenue streams, including expanding new non-credit and affiliate services. Klarna is looking to further enhance the offering towards both retailers and consumers across markets and following the successful launch of the savings accounts.

Klarna also plans to further into establishing an integrated banking experience for consumers, by continuing to build global consumer-centric products that create an exciting shopping experience. Klarna may offer services that are even more tailored to each consumer, therefore setting up a platform for driving sustained preference and growth for the future.

-AMAZONPOLLY-ONLYWORDS-START-

Also, check out our most loved stories below

Why did Michelin, a tire company, decide to rate restaurants?

Is ‘Michelin Star’ by the same Michelin that sells tires, yes, it is! But Why? How a tire company evaluations became most coveted in the culinary industry?

Starbucks prices products on value not cost. Why?

In value-based pricing, products are priced based on the perceived value instead of cost. Starbucks has mastered the art of value-based pricing. How?

Nike doesn’t sell shoes. It sells an idea!!

Nike has built one of the most powerful brands in the world through its benefit-based marketing strategy. What is this strategy and how Nike has used it?

Domino’s is not a pizza delivery company. What is it then?

How did one step towards digital transformation completely changed the brand perception of Domino’s from a pizza delivery company to a technology company?

Why does Tesla’s Zero Dollar Budget Marketing Strategy work?

Touted as the most valuable car company in the world, Tesla firmly sticks to its zero-dollar marketing. Then what is Tesla’s marketing strategy?

-AMAZONPOLLY-ONLYWORDS-END-