India is a country of hundreds of millions of young and aspiring consumers who are underserved for payments and financial services products that serve their needs. Millions of small businesses in India benefit by having increased access to affordable software, technology, and financial services.

If there is one space where India has shocked the world in its adaptation to new tech, it is the digital payments system. And the pioneer in this space is none other than Paytm. From college students to small merchants to shopkeepers, everyone said the same “Paytm Karo.” Not to mention those judgemental looks I’d get whenever I said I don’t use Paytm (always been a late adopter).

In terms of business, Paytm controlled over 14 percent of the market through 53.8 crore transactions worth Rs 60,094 crore in September’21. Paytm’s total payments made to merchants (GMV) through transactions was over Rs. 4 lakh crores in 2021. As a business enthusiast, that made me curious to learn about the business model of Paytm and understand how Paytm makes money?

How does Leapfrogging strategy make Paytm invincible?

Evolution of Paytm

Paytm was founded in August 2010 by Vijay Shekhar Sharma with $2 million. At first, it functioned as a recharge platform mainly for pre-paid mobiles and DTH services. It later added a data card, postpaid mobile, and landline bill payments in 2013.

In October 2013, Sapphire Ventures invested $10 million. From 2014, Paytm started to expand its portfolio. By January 2014, Paytm Wallet was launched. Uber and Indian Railways were the first to add Paytm Wallet as a payment option. By 2015, it provided payment services from metro recharges, electricity, gas to water bill payments and had a user base of around 10.4 crores. It also ventured into the travel business and facilitated 20lakhs ticket bookings per month.

In March 2015, Paytm received investments from the Alibaba group, where it took 40% stock as part of a strategic agreement. Soon after, it received backing from TATA group’s MD, Ratan Tata. In August 2016, it raised funding from Mountain Capital. During this year, Paytm launched events, movies, amusement parks ticketing, flight ticket bookings, and Paytm QR.

In May 2017, Softbank invested in Paytm, bringing the companies valuation to $8 billion. Berkshire Hathaway invested $356 million for a 3%- 4% stake in Paytm in August 2018. By 2017, Paytm was India’s first payment app to cross over ten crore app downloads.

What makes Paytm’s business model so unique?

Paytm is India’s leading digital ecosystem for consumers and merchants. Paytm has built one of the largest payments platforms in India based on the number of consumers, number of merchants, number of transactions, and revenue as of March 31, 2021, according to RedSeer.

Paytm offers payment services, commerce and cloud services, and financial services to 337 million registered consumers and over 21.8 million registered merchants as of June 30, 2021.

Paytm’s two-sided (consumer and merchant) ecosystem enables commerce. It provides access to financial services through its financial institution partners by leveraging technology to improve the lives of its consumers and help merchants grow their businesses. Consumer and merchant engagement is core to Paytm’s business model and unit economics. Let’s see how.

Paytm for Consumer:

Payments: These include Bill payments, Peer-2-Peer money transfers, Online Payments, and In-store payments. Paytm just like other recharge services providers, charges commissions from various operators such as DTH service providers, mobile operators. They also have incentivized recharging through various cash-backs and offers.

Commerce: This includes Paytm Mall, along with ticketing services such as movies, flights, and trains. Paytm entered the movie/event ticketing market, where BookMyShow was the primary player. It provided good competition, charging lesser convenience fees. Foraying into these areas, it competes with niche players such as MakeMyTrip or Yatra.

Financial Services: Paytm also provides financial services, such as Credit Card, Savings account, insurance, etc. Since most of the processes, such as account opening and verification of documents, can be done digitally, Paytm gets a boost in acquiring new customers in this category.

Paytm for Business:

Consumer Payments: This facilitates various merchants to accept payments from consumers. It can be divided into two categories, online and offline. The online payments include payment gateway, links, UPI payments, subscription-based payments, settlements.

Business Payments and Software: These include payouts, nodal accounts, POS Billing software, Advertising, Business Khata. These are services that provide ease of business to merchants. Merchants no more have to get into the technical nuances of these processes.

Financial Services: Much like in the consumer segment, Paytm offers many of the same services to business users. From salary accounts, benefits to pension, mutual funds, and Paytm Gold, Paytm tries its best to cover every aspect of money. Loans and insurance are also part of these services.

Developer Services: These include API services and PAI(Paytm AI). To elaborate a bit, API is a common language that software speaks. Imagine you are making buying something from a website. There are two entities here, the website and your bank(through which you make the payment). API facilitates this exchange. PAI is Paytm’s fraud management system.

How does Paytm make money?

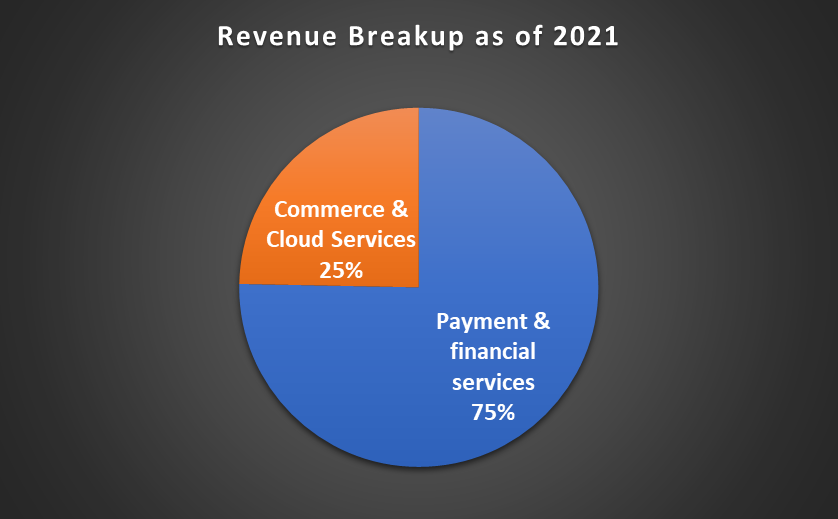

Paytm segregates its revenue under two revenue lines, (i) Payment and Financial Services and (ii) Commerce and Cloud Services.

Payment and Financial Services

For its payment services, Paytm primarily generate revenues from:

- The transaction fee that Paytm charges its merchants is based on a percentage of GMV.

- Consumer convenience fees that Paytm charge its consumers for certain types of transactions.

- Recurring subscription fees from merchants for certain products and services, such as Paytm Soundbox and POS.

The fee percentage that Paytm charges vary by the type of payment instrument used by consumers and the merchant category.

For its financial services, Paytm generate revenue depending on the type of services offered and, through its financial institution partners on its platforms (i.e., lending, insurance, and wealth management) and within each business, the type of product.

Paytm’s revenues depend on the product, the nature of the partnership, and the level of involvement in distribution, product creation, and collections.

For its lending business through its financial institution partners, Paytm earns (i) a sourcing fee from financial institution partners, which is typically earned at the time of disbursal of the loan based on a percentage of the loan amount, and (ii) a collection fee from financial institution partners based on a percentage of the loan amount, for the collection services that Paytm performs and is linked to the amount collected.

For the distribution of credit cards, Paytm charges its financial institution partners an upfront distribution fee per card issued and a percentage of the total annual spend for the card. Paytm also earns incentives from the card networks to drive card adoption. For insurance products, Paytm earns a commission from insurance partners based on a percentage of total premiums for insurance products sold through its platforms.

For its equity broking services, Paytm earns consumer fees, such as upfront account opening fee, transaction fee depending on transaction type and volumes, and an annual subscription fee. Revenue from payment and financial services, as of 2021, constitutes 75% of total revenue.

Commerce and Cloud Services

Paytm generates revenues by charging merchants a transaction fee and consumers a convenience fee, typically linked to a percentage of the transaction value for travel, entertainment, ticketing, and other commerce businesses.

For software and cloud services, Paytm charges its merchants a subscription fee, and in some instances, a fee linked to the volume of activity on Paytm’s platforms.

Paytm runs performance and brand marketing campaigns for merchants and charges them depending on the scale and type of campaign for its advertising business. Revenue from commerce and cloud services, as of 2021, constitutes 25% of total revenue.

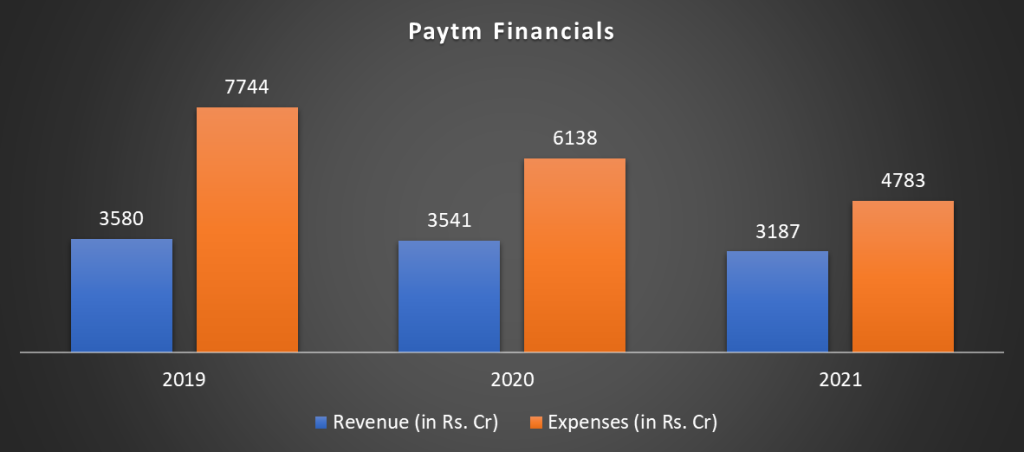

Paytm’s Cost Structure

Paytm’s major expenses include (i) payment processing charges (40%), (ii) marketing and promotional expenses (11%), (iii) employee benefits expenses (25%), (iv) software, cloud and data center expenses (7%), (v) depreciation and amortization expenses (4%), (vi) finance costs (%), and (v) other expenses (12%).

Let’s talk about the famous Paytm’s IPO

Experts have spoken a lot on this topic for a while now, and it would neither do any good to you nor me if I repeat those same here. So let’s look at this from a different perspective. For the uninitiated, Paytm launched its IPO in November 2021, raising Rs 18300 Crore at almost Rs. 150,000 Crore valuations. It was the largest ever IPO in India.

On November 18, 2021, the shares began trading at Rs 1950 on NSE. This was 9.3% below the upper band of the IPO price range and closed down more than 27% at Rs 1560. It was the most significant drop on a listing day in Indian IPO history.

One of the issues this may have happened is its complex business model, which may have failed to appeal to the retail investors.

Paytm will explain its business model better and to more people. Its business model is not a point business model. Paytm acquire a customer for A, and then A makes some money, while more money is made on a derivative of A, which are B, C, D, and then there is an opportunity of E, F, G. It is an A to G business model which is a long number of things to be understood. Because stock markets in India haven’t seen anything like this, it is what it is. I wish Paytm could have explained to a larger audience.

Vijay Shekhar Sharma:

Paytm’s ambitions to become super-app and be present in every business have come at a cost. Generally, retail investors like to invest in leaders or monopolies in their respective categories. Now, if you can do a simple exercise, take a few products of Paytm and think of other players in that category. You’ll find one or two major/niche players in every segment, which is an issue. It makes Paytm a jack-of-all-trades kind of business. Vijay Shekhar Sharma, although had a different take on this:

Its approach has been to expand on its platform exactly in the direction that the customer is in. Paytm is not talking about us being identified as only one line item business. Paytm are like an ice cream Sunday where you have multiple flavors of businesses, and different businesses feed into other businesses to expand.

Vijay Shekhar Sharma:

As delicious as the above statement sounds, do keep in mind, one unfavorable flavor can take the entire desert down the drain. And that is the catch of trying to be a super-app. Numbers speak better than anything else in this data-savvy world, and it is numbers that Paytm is banking upon to prove its mettle.

What does Paytm Want to become in the future?

Paytm’s long-term revenue growth and increase in GMV are dependent on its ability to retain and acquire new merchants on its platforms. Paytm has attracted merchants on its platforms by offering (i) a full suite of payment services and (ii) technology solutions to grow their businesses and Paytm’s share of their payments.

With more merchants being a part of its ecosystem, Paytm offered more use cases to its consumers, increasing the number of transactions on its platform. As of March ’21, Paytm has 21.1 Million merchants on its platforms.

If you haven’t noticed already, Paytm wants to become a “super-app.” It offers a plethora of services, from bill payments to movie tickets, from insurance to POS billing software, basically almost everything in the financial space, both from a consumer and business point of view. Generally, whenever an app or an entity does this, it indicates their need for user acquisition and retention (think Amazon or Flipkart).

Now, going back to its earlier point, what does Paytm intend to do with all the information from its transactions. To elaborate, every transaction made on Paytm says something about the user; when you have this big data (pun intended;), you can use this information for other purposes such as lending money or targeting advertisements.

Right now, or the entire lending industry, a huge issue is the NPAs. It is because of this reason that RBI hugely regulates the lending industry. But wouldn’t it be wonderful if you already had a way to know if the customer will pay you back or not! Let’s take an example, each time a merchant makes a transaction Paytm learns a bit about them, and slowly it’ll assess the creditworthiness of this person.

Say this person needs to borrow money. Who better to facilitate this than Paytm. But, since Payments Bank was launched in 2017 and is relatively new in this space and under various RBI regulations, it would suit them much better to form partnerships with banking companies.

Also, considering how “buy-now-pay-later” schemes from the likes of the amazon-pay, Slice is hot in the market, Paytm can take a slice of this pie. After all, it is one of the leaders for UPI payments. Now, coming to the advertisement front, since Paytm is a super-app, it will perform very well in target-based ads. It can follow the footsteps of the likes of Google and Meta. But for now, my objective was to tell you about Paytm’s business model and how does it make money. Hope the story helps!