My dad has been in the Indian stock market for the last 35 years. I have grown up listening to such conversations: company fundamentals, trends, bull or bear. One of the most common discussion topics was about the commission charged by a trading firm on a particular trade. When I started trading in 2014, my trader charged 0.5% on a single transaction. Pretty high, no?

Fast forward to 2021; we have companies that charge zero commission on trading. US-based Robinhood is one such company that has pioneered commission-free trades of stocks, exchange-traded funds (ETFs), and cryptocurrencies via a mobile application. What if I tell you that Robinhood made $565 million in Q2 of 2021 alone. You must be wondering if Robinhood does not charge a commission, then how does it even make money? Robothood’s business model allows the firm to charge zero commission on trades. How?

What is Robinhood?

Founded in 2013, Robinhood is on a mission to democratize finance for all. The story began at Stanford, where co-founders Baiju Bhatt and Vladimir Tenev were roommates and classmates. After graduating, they packed their bags for New York City and built two finance companies, selling their trading software to hedge funds.

There, they discovered that big Wall Street firms were paying next-to-nothing to trade stocks, while most Americans were charged a commission for every single trade. They wanted to change that, so they headed back to California to build a financial product that would give everyone—not just the wealthy—access to financial markets. And because of this mission, the company was named Robinhood.

The stock market is widely recognized as one of the greatest wealth creators of the last century. But systemic barriers to investing, like expensive commissions, minimum balance requirements, and complicated, jargon-filled paperwork, have dissuaded millions of people from feeling welcome or able to participate. Robinhood leverages technology to deliver a new way for people to interact with the financial system.

Let me share some startling statistics about Robinhood. According to its internal brand study, more than 50% of 18–44-year-olds in the United States know who Robinhood is. With more than 17Mn monthly active users, Robinhood has $81 bn in Asset under management (AUM), and 80% of users are through word of mouth.

Robinhood currently operates five products on its platform: Stocks, Options, Gold (a premium offering), Cash Management, and Crypto. In its Gold offering, investors can access research reports and advanced market data, more considerable instant deposits, and borrow money at a 2.5% interest rate for a mere $5 a month. Under its cash management offering, users can get Robinhood’s debit card and use it to get a paycheck, pay bills, send checks, etc.

What makes Robinhood’s business model so innovative?

As claimed by the company in its SEC filing that, as of March 2021, assets of Robinhood users have appreciated by $25 bn. Robinhood’s business model is attracting finance geeks looking to make money through trading and attracting a whole new breed of small-time investors like gig-economy workers, construction workers, and millennials.

As of 2021, Robinhood has 31 million users, of which 50% trade on the application on a daily basis. Robin business model is built on four values:

Safety First: Robinhood calls itself a safety-first company as it prioritizes consumers’ privacy and financial literacy. Such financial knowledge helps customers make an informed decision while trading stocks. Let’s talk about that a bit later.

Participation is Power: Robinhood aims to give everyone access to the financial system, regardless of their background or bank account balance. Robinhood has uniform interest rates, no account minimums, and a product designed from the ground up for small accounts.

Radical Customer focus: Robinhood has always prioritized getting direct feedback on its products and incorporating it in product development.

First-Principles Thinking: First-principles thinking is about breaking a complex problem into fundamental premises and then reassembling them from the ground up. Robinhood incorporates this thinking by developing hypotheses, designing related experiments, and debating rigorously.

As I mentioned in Safety First value of Robinhood, the company emphasizes the financial literacy of its users. This aspect of Robinhood also makes its business model unique. Robinhood is educating its users via two channels through Robinhood Learn, which had over 7 million viewers as of March ’21.

Library of content on Investing Basics: Over 50% of Robinhood users are first-timers who do not know stock investing but are curious to learn and use it to make money.

Robinhood Snacks: Robinhood Snacks was previously MarketSnacks, a media company that makes financial news digestible. Jack Kramer and Nick Martell founded MarketSnacks in 2012 and have not missed a day since then. Robinhood acquired MarketSnacks in 2019. MarketSnacks gives bite-sized, digestible daily financial content to over 32 million subscribers. This furthers the cause of Robinhood to educate its users (educated users will trade more).

To summarize, Robinhood’s value proposition is threefold: Commission-free trading, Account protection, and keeping users on top of their portfolio through its educational program. Robinhood strives to operate a transparent business model. Robinhood currently dedicates a portion of its website to describe how it makes money. So, let’s now dive deep into how Robinhood makes money?

How does Robinhood make money?

Robinhood’s business model is characterized by efficient new customer growth and substantial expansion within its customer base. Most new customers (80%) join Robinhood organically or through the Robinhood Referral Program, helping to maintain low average customer acquisition costs and rapid payback. Robinhood focuses on deepening relationships with its customers by offering to help them manage their financial aspect in a single place.

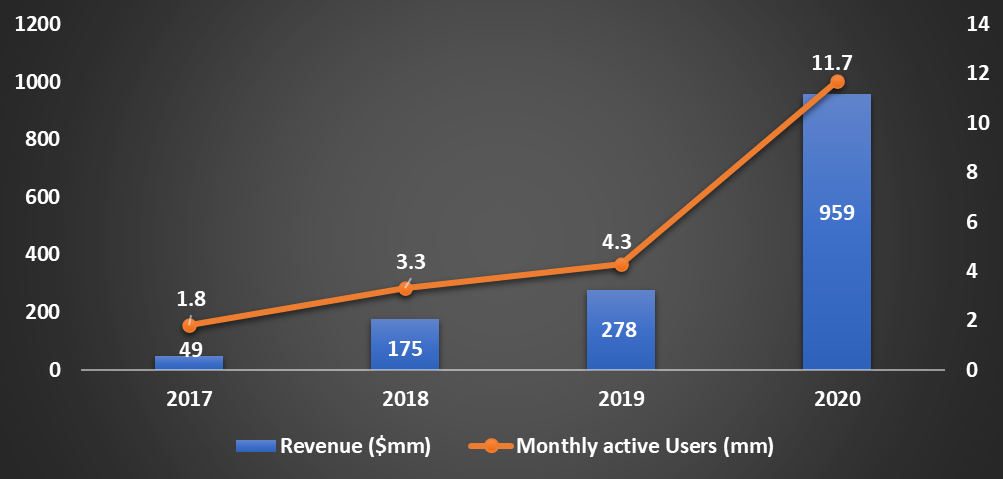

Robinhood’s success and ability to increase revenues and operate profitably depends partly on such customers continuing to utilize its platform, even as global social and economic conditions shift. Robinhood generated $959 Mn in revenues in 2020, a 245% increase from 2019, and generated $7 Mn profits in 2020 compared to $107 Mn loss in 2019.

Let’s now understand how Robinhood makes money and how it can charge zero commission. There are three revenue streams: Transaction-based revenue, Net interest revenue, and other revenues.

Transaction-Based Revenue: Robinhood generated $720 Mn+ revenues from this revenue stream. This stream made 75% of the revenues for Robinhood. Robinhood has a unique revenue stream called “payment for order flow (PFOF).” Transaction-based revenues consist of the amount earned from routing customer orders to market makers.

When customers place orders for equities, options, or cryptocurrencies on its platform, it routes them to market makers. It receives a fee from those brokers instead of trading on a public exchange like the NYSE. For equities and options trading, such fees are known as PFOF. The company claims that Market makers typically offer better prices than exchanges.

Net interest Revenue: Robinhood generated $177 Mn+ revenues from this revenue stream. This stream made 18.5% of the revenues for Robinhood. Net interest revenues consist of interest revenues fewer interest expenses.

Robinhood earns interest revenues and incurs interest expenses on securities lending transactions. It makes interest revenues on margin loans to users and segregated cash, cash and cash equivalents, and deposits with clearing organizations.

Other Revenues– Robinhood generated $61 Mn+ revenues from this revenue stream. This stream made 6.5% of the revenues for Robinhood. Other revenues primarily consist of Robinhood Gold, a monthly paid subscription service that provides users with premium features such as enhanced instant deposits, professional research, Nasdaq Level II market data, and, upon approval, access to margin investing. Other revenues also include proxy rebate revenues and miscellaneous fees charged to users.

In Dec ’20, The Securities and Exchange Commission (SEC) of the U.S. charged Robinhood a $65 Mn fine. According to the SEC, between 2015 and 2018, Robinhood made misleading statements and omissions in customer communications, including in FAQ pages on its website, about its largest revenue source when describing how it made money – namely, payments from trading firms in exchange for Robinhood sending its customer orders to those firms for execution, also known as “payment for order flow.”

As the SEC’s order finds, one of Robinhood’s selling points to customers was that trading was “commission-free,” but due in large part to its unusually high payment for order flow rates, Robinhood customers’ orders were executed at prices that were inferior to other brokers’ prices.

Although Robinhood made profits in 2020, it suspects that it may not be profitable in the future. Because a majority of its revenue is transaction-based (including payment for order flow, or “PFOF”), reduced spreads in securities pricing, reduced levels of trading activity generally, and any new regulation on PFOF may result in reduced profitability, increased compliance costs, and expanded potential for negative publicity.

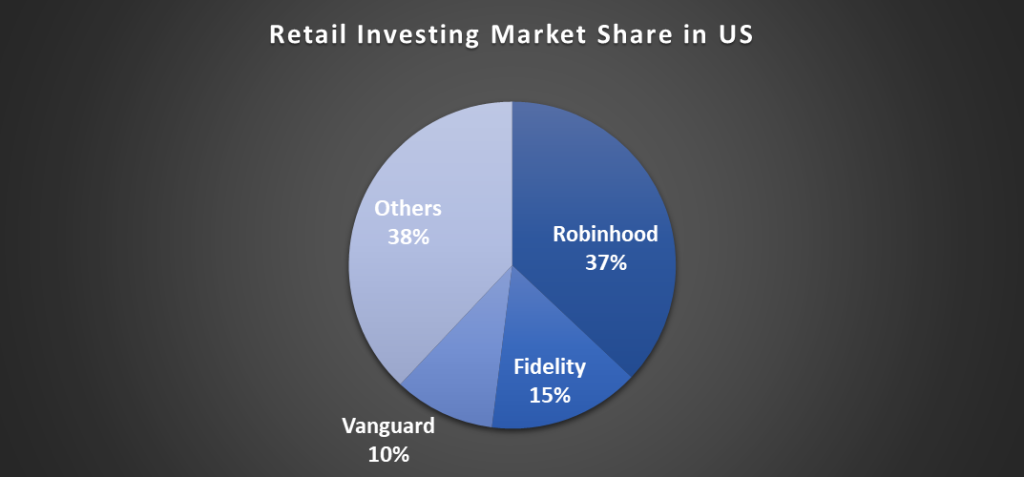

Robinhood has commanded the largest share of the retail investment market in the United States since at least early 2020, with its market share fluctuating between one-third and one-half of the market over this period. As of June 2021, the market share of retail investing in the US is as follows:

What’s new in Robinhood’s business model?

On July 28, 2021, Robinhood sold shares in its IPO at $38 per share ahead of its public debut on the Nasdaq on July 29, raising close to $2 billion. The company, which will trade under the ticker symbol HOOD, sold 52.4 million shares, valuing it at $32 billion, which was slightly lower than forecast. As of writing this story in December 2021, Robinhood was trading at $19.

Although Robinhood strives to make itself the most trusted, lowest cost, and most culturally relevant application globally, Robinhood has received criticism for encouraging risky behavior among beginner investors.

Robinhood strives to provide additional value to its users by charging a lower fee as it achieves more significant scale and operational efficiency. Robinhood also aims to launch new products in the future with a higher possibility to cross-sell and increase revenue.

Since 2018, Robinhood has been placing big bets on cryptocurrency trading. In Dec ’21, it acquired Cove Markets, a cross-exchange trading platform that makes it easier for people to manage their crypto accounts. Robinhood currently charges 0% commission on Crypto trade and allows users to buy Crypto for as low as $1.

Blockchain and cryptocurrencies were created to decentralize finance and return power to the people—which align perfectly with our mission to democratize finance for all.

– Robinhood Blog

Online trading in the U.S. and globally has shown exponential traction. It allows regular people (commonly termed ‘retail investors’) to influence financial markets in a way not previously possible.

Statista says the global online trading market will increase at a worldwide compound annual growth rate of 5.1 percent per year, increasing to an estimated 12.16 billion U.S. dollars in 2028. This is from a base of around 8.3 billion U.S. dollars in 2020. Though Robinhood is currently present in the U.S., the market potential is unlimited, being the largest trading platform. But only time will tell!

-AMAZONPOLLY-ONLYWORDS-START-

Also, check out our most loved stories below

Why did Michelin, a tire company, decide to rate restaurants?

Is ‘Michelin Star’ by the same Michelin that sells tires, yes, it is! But Why? How a tire company evaluations became most coveted in the culinary industry?

Starbucks prices products on value not cost. Why?

In value-based pricing, products are priced based on the perceived value instead of cost. Starbucks has mastered the art of value-based pricing. How?

Nike doesn’t sell shoes. It sells an idea!!

Nike has built one of the most powerful brands in the world through its benefit-based marketing strategy. What is this strategy and how Nike has used it?

Domino’s is not a pizza delivery company. What is it then?

How did one step towards digital transformation completely changed the brand perception of Domino’s from a pizza delivery company to a technology company?

Why does Tesla’s Zero Dollar Budget Marketing Strategy work?

Touted as the most valuable car company in the world, Tesla firmly sticks to its zero-dollar marketing. Then what is Tesla’s marketing strategy?

-AMAZONPOLLY-ONLYWORDS-END-