Swipe Left to Read the Full Story

Apple and Tesla have split their stocks in 4 for1 and 5 for 1 respectively. But why? What does “Stock Split” mean? What are the advantages?

Just swipe the slides and read the above story in an interactive way or you can read the story below

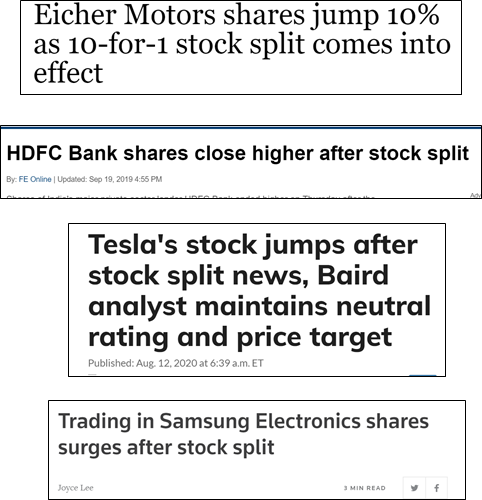

Apple and Tesla have announced stock splitting.

On July 30, 2020, Apple announced a four for one split of Apple common stock and trading will begin on a split-adjusted basis on August 31, 2020

Tesla announced in September’20 that the Board of Directors has approved and declared a five-for-one split of Tesla’s common stock in the form of a stock dividend.

What does stock split mean?

A stock split is a decision by a company in which a company increases the number of its outstanding shares by issuing more shares to current shareholders.

The primary motive of a stock split is to make shares seem more affordable to small investors.

Let’s take Apple Case

Current Apple stock price = $500

No. of Apple shares you own = 10

Total value of shares you own= $5,000

Apple has announced 4 to 1 split. That Means:

Stock price will become = $125

No. of Apple shares you own = 40

Total value of shares you own= $5,000

But why companies do this?

- To lower the stock price to make the stock more affordable for small investors

- To increase liquidity in the market, providing higher flexibility in trading

- Also To Enhance investor’s interest in the future, having a positive effect

As per a study, In August 2003 Mr.Ikenberry from the University of Illinois looked at companies from 1990 to 1997. His research included 2-for-1, 3-for-1 and 4-for-1 stock splits. His results were startling.

Shares of split stocks on average outperformed the market by 8% the following year and 12% over the next three years.

Academic research in 2009 found that liquidity improvements following stock splits reduced average companies’ cost of equity capital by 17.3%, or 2.42 percentage points per annum, providing a non-trivial economic benefit to corporations and investors.

Fun Facts

Walmart, for instance, has split its shares as many as 11 times on a 2-for-1 basis from the time it went public in October 1970 to March 1999. An investor who had 100 shares at Walmart’s initial public offering (IPO) would have seen that little stake grow to 204,800 shares over the next 30 years.

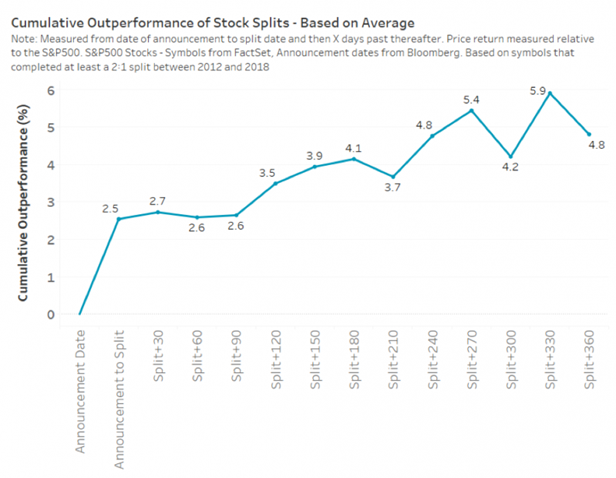

Stocks doing splits outperform the market, typically as early as the announcement of a split

Nasdaq

But Some companies don’t believe in stock split

MRF has never split their stocks. It’s trading at Rs. 60,000. It’s the most expensive stock market in the Indian stock market.

Being an expensive stock brought an exclusivity and less fear of acquisition.

Why do you think MRF never chose to split? Does stock splitting make sense?

Enjoyed our 1 Minute Strategy Story? Check out more such insightful stories.

Read our top 1-minute Strategy Stories

How just one insight changed the fate of Pampers

Pampers once tried to understand what drive its customers parents? This consumer insight changed Pampers marketing strategy entirely

What is Scent Branding? Invisible yet most effective.

How brands are using Scent branding to create a stronger bond with consumers and thus increase the business from those customers?

How KitKat Japan is the best example of “adaptation strategy”

Kitkat Japan is a classic example of adaption and development #strategy. Consumers prefer new flavors. Hence KitKat Japan has 300+ Flavors.