Sometime in the mid-2000s, my grandfather (a bank employee) gave me my first exposure to plastic cash or card payment systems. He paid for my birthday present without providing any cash. To my eyes, all he did was hand over a plastic card to the cashier, who then handed it back after some time.

It’s been 15 to 20 years since I have been using many credit and debit cards as part of my daily life. It occasionally turns into a nightmare when I have not been sure which card had how much balance left or which card was better to use in which outlets. I just wished for a way to manage all my different cards much more quickly and conveniently. So let us see how CRED can ease this particular issue.

What is CRED?

CRED is a fintech company founded in 2018 by a celebrated entrepreneur and co-founder of the payments platform Freecharge, Kunal Shah. It is an NPCI approved platform that primarily handles credit card bill payment transactions. CRED was one of the fastest startups to become a unicorn in 2021 and is currently valued at $2.2 Billion as of April 2021. Check out our Infographic on Indian Unicorn Startups in 2021

There has always been a demand for a credible mechanism that ensures that all credit card bills are paid on time and that ensures that the customers do not incur a penalty for defaulting on the payments schedule. CRED taps into this demand. In addition to ensuring that the customers pay their bills on time, they are also given rewards for each transaction made on the platform.

But then the big question is how does CRED make money? What are CRED’s business and revenue models? This strategy story will tell you everything you need to know about CRED’s business strategy and earning model.

CRED Business Model

Customer Value Proposition

CRED offers a variety of value propositions primarily through its mobile application downloaded from either Google Play Store or iOS App Store. Users then are required to submit their mobile numbers, email addresses, and name to the application.

The platform then uses the provided information to set up a user profile and adds all the credit cards linked to the provided mobile number to the newly created user profile. CRED has designed a straightforward and easy-to-use UX/UI. The users are delighted with the application, which is reflected in its 4.7 rating on the Google Play Store.

- Bill Payments– Facilitating the payment of credit card bills through the platform

- CRED Coins– All bill payments are rewarded with CRED coins that can be redeemed as offers or cashback in Cred Store. The differentiating aspect here is that the user receives the same amount of CRED coins as the bill amount that was paid.

- CRED Cash– It is a short term low-interest instant credit line provided in partnership with IDFC bank.

- CRED Store– It is an e-store that contains product offers and listings from the partner brands. Cred Commerce is where all the cred coins earned by the customers are redeemed.

- CRED Rent Pay– Recurring payments such as rent and other EMI payments that can be routed through the linked credit cards

- CRED Mint– Person to Person lending facility that will match lenders who have surplus funds and borrowers who need funds on the platform. Lenders will earn a fixed interest of 9% on the amount invested.

Target Customer Segment

CRED aims to capture the financially well-off section (falling in the NCCS A and NCCS B category) who have access to one or more credit cards. In addition to the economic segmentation, CRED further refined its target customers by allowing only customers with a CIBIL score of 750 or more.

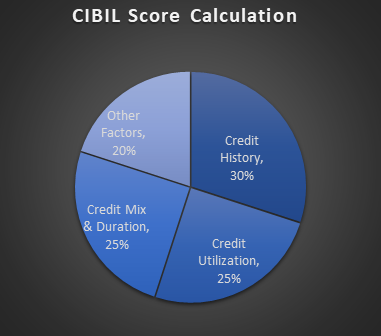

Any applicant with a lower credit score is sent to the waitlist until their credit score improves or the company policy changes. This results in CRED having an affluent customer base with a proven track record of honoring their credit commitments, reducing the probability of fraudulent customers negatively impacting the platform’s operations. The graphic below explains factors on which CIBIL score depends:

- Credit History – All personal and credit related information including outstanding amount, write-offs etc. is collated by the Credit Bureau.

- Credit Utilization – How much of the available credit amount has been availed by the individual. It is calculated by dividing the credit limit by the credit availed.

- Credit Mix & Duration – Composition of the loan portfolio between secured loans( with collateral such as automobile, house loan) and unsecured loans.

- Other Factors – Number of credit applications and other factors.

How does Cred Make money? What is its revenue model?

CRED makes revenue on the following fronts: –

Listings from partner brands

CRED displays offers and products from various businesses on its CRED Store platform in exchange for a fee. This is similar to how brands and product owners pay a fee to Ecommerce aggregators like Amazon to display their products. The offers vary from Amazon gift cards to fashion retailers and more.

CRED recently has initiated a tie-up to collaborate with various brands such as “The Man Company,” “ixigo,” “Cult.fit,” etc. Every single time a customer avails of the offers through the application, CRED receives a commission.

Commission from CRED Rent Pay

CRED allows users to set automatic recurring payments such as rent, EMI, etc. In exchange for this service, CRED charges a commission of around 1% to 1.5% of the transaction amount as a commission from the customer.

Commission from CRED Cash

CRED Cash is a quick low-interest credit line provided in the CRED app by IDFC bank. For each successful loan disbursement, CRED charges around 1% to 2% commission of the transaction amount from IDFC bank.

Interest Income on Deposits

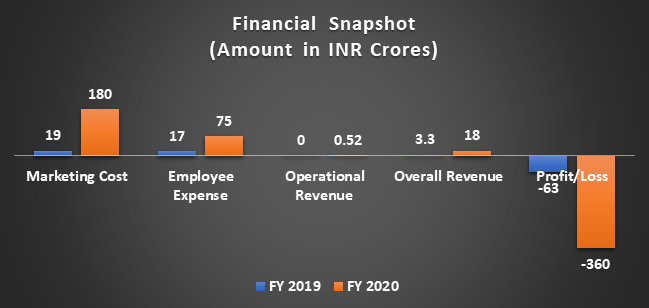

CRED earns interest on money deposits by users. This was the highest and almost only revenue generated by CRED in both FY 2019 at INR 3.03 Crore and FY 2020 at INR 17.5 Crore.

CRED’s Marketing strategy

CRED is focused on scaling up by increasing its customer base, and the marketing strategy has revolved around this requirement. Hence CRED has focused its marketing strategy on primarily ATL (Above The Line) activities such as TV advertisements and event sponsorships to grab attention towards the platform and its benefits.

The advertisements have been very effective in grabbing attention with their quirkiness and the impressive roster of stars from various fields. The roster includes yesteryear celebrities such as Bappi Lahiri, Anil Kapoor, and Madhuri Dixit to Rahul Dravid and Olympic gold medalist Neeraj Chopra.

To gain a higher share of customers’ mind space and credibility, CRED also signed a deal with the ultra-popular Indian Premier League to be its official sponsor from 2020 to 2022.

The IPL season is akin to a festive season in India with a viewership that exceeds any other program or genre, including the most trusted GEC (General Entertainment Category – TV serials and other entertainment channels) category. However, this has resulted in CRED’s marketing costs increasing by 850% from INR 19 Crores in FY 2019 to INR 180 Crores in FY 2020.

CRED has a strong understanding of Topical Marketing strategy. Marketing is to take a current story or event and create a campaign around it. The objective is to piggyback on a subject that has already gained momentum in media channels. Check out our detailed article on Topical Marketing and how CRED has mastered it.

With almost all of its advertisements CRED has been able to create a buzz for its brands by choosing the right advertisements at the right time. The recently launched advertisement with India’s javelin star Neeraj Chopra got a lot of appreciation.

How has CRED performed so far?

The credit bill payments space is a highly fragmented industry, with individual banks relying on their mobile application and website through which bill payments are completed. The majority of these apps are clunky to use and are prone to frequent crashes. This creates a significant bottleneck and pain point for new and existing users of credit cards.

CRED eases these pain points with its easy-to-use UI and the convenience of aggregating cards belonging to multiple providers. The incentive plan of rewarding bill payments has worked with CRED, already acquiring around 7.5 million users, and currently accounts for 20% of all the credit card payments in India.

Despite having access to an affluent base, CRED is not profitable currently and was heavily criticized by multiple industry commentators for incurring heavy losses while generating a comparatively negligible revenue.

Check out the financial snapshot of CRED for the past two years.

Conclusion

The CRED platform aims to transform the way customers use their credit cards and pay their bills. The platform already has acquired close to 7.5 million affluent customers with a proven track record and has seen its overall revenue increase six times YoY to INR 18 Crores in 2020.

However, CRED has posted massive losses and has not come up with any specific monetization path so far. With great anticipation, the entire industry and observers will be waiting for CRED to find a monetization strategy that leverages its customer base.

As we eagerly anticipate the next step, the most important question will be on the topic of the revenue generation plan. Will CRED reduce the freebies and incentives and instead start charging customers for conducting transactions, or will CRED go in an entirely new direction to find a sustainable revenue stream.

Will the services such as RentPay and CRED Mint create a sustainable revenue stream? Only time will tell. For now, go and enjoy CRED’s services.

-AMAZONPOLLY-ONLYWORDS-START-

Also, check out our most loved stories below

Why did Michelin, a tire company, decide to rate restaurants?

Is ‘Michelin Star’ by the same Michelin that sells tires, yes, it is! But Why? How a tire company evaluations became most coveted in the culinary industry?

Starbucks prices products on value not cost. Why?

In value-based pricing, products are price based on the perceived value instead of cost. Starbucks has mastered the art of value-based pricing. How?

Nike doesn’t sell shoes. It sells an idea!!

Nike has built one of the most powerful brands in the world through its benefit-based marketing strategy. What is this strategy and how Nike has used it?

Domino’s is not a pizza delivery company. What is it then?

How one step towards digital transformation completely changed the brand perception of Domino’s from a pizza delivery company to a technology company?

Why does Tesla’s Zero Dollar Budget Marketing Strategy work?

Touted as the most valuable car company in the world, Tesla firmly sticks to its zero dollar marketing. Then what is Tesla’s marketing strategy?

Yahoo! The story of strategic mistakes

Yahoo’s story or case study is full of strategic mistakes. From wrong to missed acquisitions, wrong CEOs, the list is endless. No matter how great the product was!!

Apple – A Unique Take on Social Media Strategy

Apple’s social media strategy is extremely unusual. In this piece, we connect Apple’s unique and successful take on social media to its core values.

-AMAZONPOLLY-ONLYWORDS-END-