A brief on what goes into getting Amazon customers to transact…

Imagine a physical marketplace filled with n number of stores selling anything and everything. What do you reckon the general pricing model would be?

A simple answer would be that low sales-generating items would be listed with discounts, whereas the top products would have their prices nudged up constantly as customers do not require to be incentivized to purchase those products.

Now, if we were to completely shift this marketplace to the internet, aggregate it on a platform that has over 310 million global customers with algorithms designed to move the prices up or down in a matter of minutes based on prevailing market conditions, then we could state that we have begun scratching the surface of Amazon’s pricing strategies.

In today’s day and age, it is very convenient for customers to look up products, compare the current retail prices in brick-and-mortar stores, realize that it is slightly cheaper online, and purchase it from aggregators such as Amazon. For the curious ones among us, it would be interesting to understand how Amazon consistently prices its products so competitively and to learn the various pricing strategies and tools at play.

Understanding Amazon’s ‘Buy Now’ Box

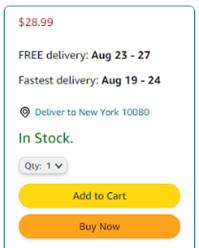

The buy box is a button that directly takes the listing viewers to the checkout page. Historically, this is a feature that has resulted in stellar conversion rates. It is estimated that over 80% of all Amazon sales in the US come from the ‘Buy Now’ box.

‘Buy Now’ offers sellers immense value, and they would naturally want the ‘Buy Now’ button against all of their listings to drive higher traffic, sales, and growth.

Given the potency of the ‘Buy Now’ feature, Amazon often curates the availability of the same. An excellent example of this would be removing over 6000 sellers from the global marketplace in 2020 for violating their fair-pricing policies by price-gouging products related to the COVID-19 pandemic.

However, you would encounter product listings with no ‘Buy Now’ button against it from time to time. At that point, it would appear quite ironic that Amazon is hindering merchant sales and growth. The explanation for the same can be understood from the following quote.

Sellers set their own product prices in our store. If a product is not priced competitively by a seller, we reserve the right to not feature that offer. Customers can still find all offers on the offer listings page.

An Amazon Spokesperson during an Interview with Inc.

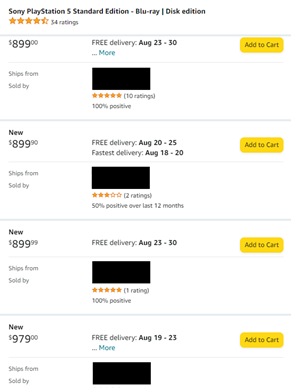

As an example, when a vendor prices a PlayStation 5 console for over USD 800 on Amazon despite it having a retail price of USD 499.99, you can be assured that such a listing would lack a ‘Buy Now’ option since Amazon would want to show you other vendors who offer the same product at different price points.

As you can see in the snippet above, due to a prevailing Gray market markup for this particular product, multiple seller’s pricing is displayed against the listing, with the cheapest and top-rated seller featuring at the top of the list.

Other factors that determine the ‘Buy Now’ button eligibility for the sellers are as follows:

1. The seller must have a Professional Seller account with Amazon

2. The product must not be a used item

3. High seller AHR, Account Health Rating. The following factors improve the AHR

3.1. Low ODR, Order Defect Rating

3.2. Low CR, Cancellation Rating

3.3. Low LSR, Late Shipment Rating

3.4. High VTR for self-fulfilled (Not fulfilled by Amazon) orders, Valid Tracking Rate

3.5. High OTDR for self-fulfilled (Not fulfilled by Amazon) orders, On-Time Delivery Rate

4. Product pricing

5. Shipping costs

6. Customer feedback

7. Optimized inventory management

Repricing Strategy of Sellers at Amazon

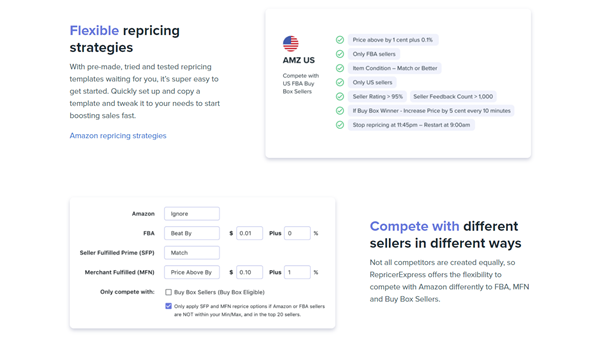

Sellers often undercut their competition, both on Amazon and elsewhere, by negligible amounts ranging from $0.01 to $10. The reason for this tweaking is quite simple; such listings would get featured higher in marketplace based-searches.

This tactic is called repricing, and it can be accomplished both manually and automatically using various seller-oriented tools such as RepriceIt, Bqool, Aura, Informed.co, Seller Snap, Xsellco. Most of these tools leverage machine learning to determine constraints at which they deploy repricing on the listings.

For instance, if Christmas is around the corner and a seller wishes to clear their inventory of premium artificial Christmas trees, the tools mentioned above would do the following in sequence.

- Look at the historical pricing trends for similar products at the same time

- Identify the best performing product

- Identify the best performing seller

- Predict the GMV based on historical conversion rates at various pricing points

- Predict the net revenue after Amazon’s commission and charges at different pricing points

- Recommend/Implement (if authorized by the seller) the ideal pricing based on pre-set constraints

Once this cycle is complete, the data from this year’s Christmas would be stored for future reference, making the sellers and their tools even more informed about what to price their products at.

Amazon Basics: Providing Opportunity To adopt a competitive pricing strategy

For those who are familiar with the Amazon marketplace, Amazon basics would need no introduction. It is a group of products that Amazon brands, ranging from simple charging cables to premium travel bags.

Amazon basics is just the most visible example of in-house brands. Given the company’s flair for acquiring multiple businesses in a short period, Amazon wholly or partly owns plenty of other brands.

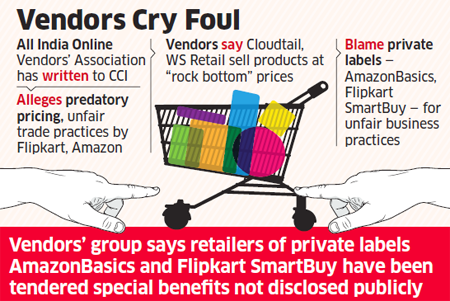

Now we come to the part about predatory pricing. Wikipedia would tell you that it is a pricing strategy, using the method of undercutting on a larger scale, where a dominant firm in an industry will deliberately reduce its prices of a product or service. This is relevant because Amazon has complete access to this data when a seller on Amazon sells its products.

Thereon, Amazon would look into the feasibility of developing the best-selling products in-house. This is why Amazon basics products are primarily simple to manufacture and fulfill while indispensable at the same time. Although predatory pricing is illegal, vendors in past have accused eCommerce giants like Amazon and Flipkart of adopting this pricing strategy.

As far as sellers are concerned, this is a catch-22.

In order to grow, they have to list themselves on Amazon. When they grow too much, Amazon will take notice and, if possible, merchandise the products at a lower price point as an in-house product.

Conclusion

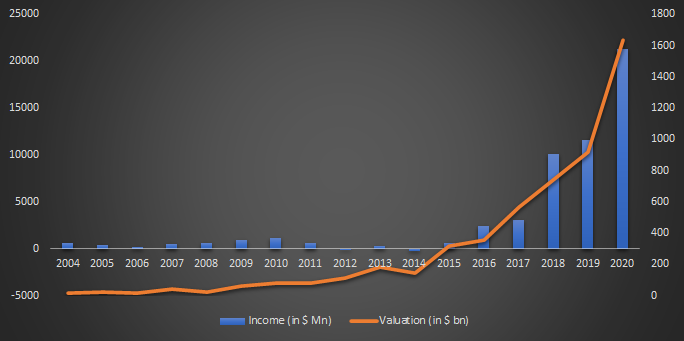

Amazon is often scrutinized for being a firm that is worth so much yet makes very minimal profits. That is because they have grown a lot from being a simple online bookstore in the 90s to a super-app equivalent whose services are used daily by nearly everyone. Amazon is labeled as the world’s most valuable brand and one of the most influential economic and cultural changes forces.

The company is valued at over $1.7 trillion, and the pandemic has only served to accelerate such numbers even further.

However, their net income trends are at one-hundereth of that valuation figures. It should come as little or no surprise that a company that constantly undercuts competition and prioritizes delayed gratification over short-term financial gains is turning over such tiny profits. Honestly, In absolute terms, it’s not even that tiny.

To give you a perspective, in FY20, Reliance Industries Valuation/Income ratio was ~20 whereas for Amazon it was 77.

Based on trends, Amazon’s pricing strategy would continue to follow the same principle.

-AMAZONPOLLY-ONLYWORDS-START-

Also, check out our most loved stories below

Why did Michelin, a tire company, decide to rate restaurants?

Is ‘Michelin Star’ by the same Michelin that sells tires, yes, it is! But Why? How a tire company evaluations became most coveted in the culinary industry?

Starbucks prices products on value not cost. Why?

In value-based pricing, products are price based on the perceived value instead of cost. Starbucks has mastered the art of value-based pricing. How?

Nike doesn’t sell shoes. It sells an idea!!

Nike has built one of the most powerful brands in the world through its benefit-based marketing strategy. What is this strategy and how Nike has used it?

Domino’s is not a pizza delivery company. What is it then?

How one step towards digital transformation completely changed the brand perception of Domino’s from a pizza delivery company to a technology company?

Why does Tesla’s Zero Dollar Budget Marketing Strategy work?

Touted as the most valuable car company in the world, Tesla firmly sticks to its zero dollar marketing. Then what is Tesla’s marketing strategy?

Yahoo! The story of strategic mistakes

Yahoo’s story or case study is full of strategic mistakes. From wrong to missed acquisitions, wrong CEOs, the list is endless. No matter how great the product was!!

Apple – A Unique Take on Social Media Strategy

Apple’s social media strategy is extremely unusual. In this piece, we connect Apple’s unique and successful take on social media to its core values.

-AMAZONPOLLY-ONLYWORDS-END-