David vs. Goliath. This is a story we have all heard since times immemorial. Recent renditions have taken the shape of business case studies where an “underdog” (early-stage startups) takes on well-established behemoths. One such modern version is the story of a disruptive idea that began with a viral video and became a billion-dollar success story. The company? Dollar Shave Club. The product – the humble razor.

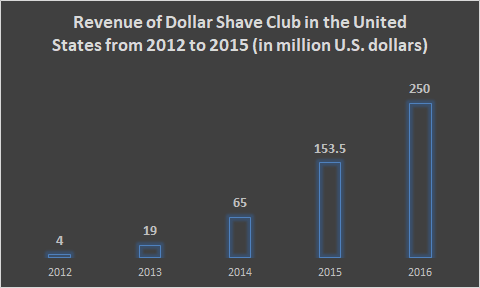

They grew from a base revenue of $4 million (approx. INR 30 Crores) in 2012 to $240 million (INR 1800 Crores) by 2016. It had about 3 million subscribers when the FMCG giant Unilever finally acquired it for $1 Billion in cash in July 2016. Presently, DSC is one of the most popular subscription businesses in the US.

From Rags to Riches

Michael Dubin started the Dollar Shave Club. At the time, Dubin was a thirty-three-year-old unsuccessful entrepreneur. During the financial meltdown of 2009, Dubin was laid off from his digital marketing job at Time Inc.’s Sports Illustrated Kids. He had applied to a bunch of business schools but was turned down by all of them. He dabbled with a few other projects before venturing on his ambitious idea of taking on a Goliath named Gillette.

The idea for a subscription-driven razor company came to him at a holiday party where he met Mark Levine. Mark had purchased a wide assortment of consumer products, including razors and blades. He had a tough time unloading them and enlisted Dubin’s help in selling them.

The conversation got Dubin thinking about the unpleasant experience of shopping for a Gillette blade at the time. For example, Gillette’s top-of-the-line blade cartridges were priced ridiculously at $5 (INR 375) for a single piece. The blades were seldom stocked since retailers tended to keep the cartridges in locked cases. Their small size made them easy to steal. This became the genesis of DSC.

The Power of Subscription

While looking to sell the spare blades online, Dubin realized that most people would come once, buy their supplies, and disappear. He decided to test a subscription model to address an important metric known as customer acquisition cost or “CAC.” He wanted to tap into a pool of people his age, did not have money to spend on expensive blades, and wasn’t as loyal to Gillette as most older men. This would be the foundation for Dollar Shave Club’s business model.

DSC began with a plan where they would ship high-quality razors to your residence for a dollar each month. The promise was simple: a cheap shave with a quality razor and the convivence of doorstep delivery. While the actual cost would vary between 3-9 dollars depending on the quality of the razor, it was still cheaper than Gillette’s $20 per month. But the true genius lies in the way they communicated their value proposition to set off a wildfire of word-of-mouth promotions.

Dubin decided to create an improv video with a tiny advertising budget to communicate a unique selling point: Price, quality, and Convenience. Dubin used humor as a way of connecting with his audience. With $4,500 (INR 3,37,500), the video titled “Our blades are f**king great” was launched. The YouTube video attracted an unanticipated amount of traffic, which crashed the company’s server in the first hour.

In its first 72 hours, over 12,000 people subscribed, implying a CAC of a mere 37.5 cents (Yes, I know. That’s virality done, right). The company stocked out, but as is customary with any direct-to-consumer company, DSC was prompt in their communication and begged customers to be patient.

Direct-to-consumer (D2C): Core of business model of Dollar shave club

Essentially, Dollar Shave Club built a business model by eliminating the middleman, i.e., wholesalers and distributors, to sell to the customer directly. DSC was one of the first proponents of the D2C revolution. Their supply chain was straightforward. The company procured razors from a Korean manufacturer, Dorco, and would fulfill customer orders through partnerships with 3PL companies (Typical Ecommerce Playbook).

The more critical component for DSC was to build a loyal subscriber base that could justify the low prices to ensure that the Lifetime Value (LTV) of any subscriber was significantly higher than the cost of acquiring the subscriber (CAC). As is evident from the video, Dubin and the team had a knack for humorous, on-point marketing videos that were organically shared repeatedly.

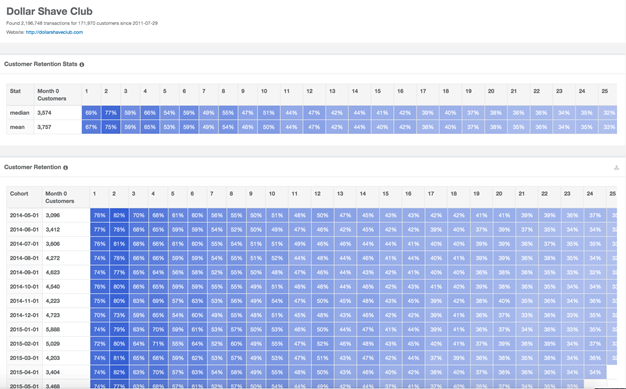

To dig deeper, let’s examine the customer retention cohort data screenshotted from Second Measure, a service that uses anonymized credit card data transactions to reflect companies’ performances.

You’ll notice that the company could retain over a third of its consumers even after two years! That’s a flex that not many startups can boast of. An extremely loyal subscriber base was the moat in Dollar Shave Club’s business model.

They achieved this through an excellent customer experience. For example, customers could easily skip a month’s shipment without hassles if they did not need it. When was the last time you could cut service without 100s of customer service agents calling you?

Dollar Shave Club offers three plans: “The Humble Twin” (two blades per razor, five razors per month, $4 per month), “The 4X” (four blades, four razors, $7) and “The Executive” (six blades, four razors, $10). Each subscription comes with a compatible handle.

Now dollar shave club is not just about razors. The brand sells all kinds of personal grooming products. Although the company primarily markets its products to men, approximately 20% of its customers are women.

The Best A Man Can Get? Think again

Gillette dominated the razor and blades market for over a century with its multiple patents and its obsessive attention to quality and detail. It had seen numerous competitors during this time, but any loss in market share was quickly recovered through the might of its R&D, manufacturing, and marketing.

It garnered over 70% market share (in 2010) that was unheard of in the consumer market, selling $4 Billion in razors and blades every year with rich profit margins of 50-60 percent. The consumer product giant, Proctor & Gamble, bought Gillette in 2005 for a whopping $57 Billion.

How then did Dollar Shave Club disrupt the market and chip away at this behemoth’s market share?

The answer lies in Dollar Shave Club’s business model and its unique marketing strategy. Razor is a product that is frequently bought, used on a weekly or bi-weekly basis, and needs constant changing. This combination lends itself perfectly to a subscription model where the whole purchasing process is “automated” for a customer. Moreover, DSC made the online experience simple, fun, and personalized to each person’s needs.

Their marketing playbook never changed: Humorous content conveying their unique selling point of convenient, cheaper shaves. The quality of their razors could never match Gillette’s, but it did not have to. The price reduction and increase in convenience meant consumers were willing to forego a higher quality product towards a “good enough” one.

Is it the end of Gillette’s golden era?

Gillette failed to take DSC seriously until it was too late. Since the beginning, Gillette boasted of its higher-quality razors. Yet, they completely overlooked the consumer purchase journey. Online sellers like Dollar Shave Club dinged Gillette in the U.S. Market share was down significantly over the past decade from 70% in 2010 to below 50% in 2017, per Euromonitor.

We are very aware of what happening in the North American landscape and we are very focused on addressing some of the challenges that we face. We need to do a better job of telling guys we are available for them at a multitude of price points.

Gillette spokeswoman Kara Buckley in 2017

As a tepid response to DSC’s success, they tried their club but could not circumvent their distribution network and potentially angered their partners. This was the chink in their armor since they could not match DSC’s convenience. Gillette’s market share kept hemorrhaging in the face of Dollar Shave Club’s business model, which would go on to command an 8% market share in the United States.

Gillette failed to reduce its prices and resorted to desperate attempts to stop DSC. In Dec 2015, they sued DSC, alleging patent infringement as is typical of the moves used by entrenched giants. The suit was settled on undisclosed terms, but DSC continued to grow. At the time of DSC’s acquisition in 2016, Dubin made a $100 million payday for his stake while some of his early backers saw manifold returns. FYI: In January 2021, the founder Dubin has stepped down as CEO, now planning to disrupt something else.

More importantly, in the spring of 2017, Gillette had no choice but to reduce the prices of its razors by an average of 12%. Trying to win back its past glory, it took to a one-page ad on New York Times and Wall Street Journal: “YOU SAID YOU WANTED TO BEST SHAVE AT LOWER PRICE. DONE.”

What could’ve been an opportunity for Gillette by investing a few million dollars in Dollar Shave Club went on to become a multimillion-dollar disruption. It loses approx. $100 Million each year on account of its price reductions, on top of the hundreds of millions it lost to DSC’s market share gains.

-AMAZONPOLLY-ONLYWORDS-START-

Also, check out our most loved stories below

Why did Michelin, a tire company, decide to rate restaurants?

Is ‘Michelin Star’ by the same Michelin that sells tires, yes, it is! But Why? How a tire company evaluations became most coveted in the culinary industry?

Johnnie Walker – The legend that keeps walking!

Johnnie Walker is a 200 years old brand but it is still going strong with its marketing strategies and bold attitude to challenge the conventional norms.

Starbucks prices products on value not cost. Why?

In value-based pricing, products are price based on the perceived value instead of cost. Starbucks has mastered the art of value-based pricing. How?

Nike doesn’t sell shoes. It sells an idea!!

Nike has built one of the most powerful brands in the world through its benefit-based marketing strategy. What is this strategy and how Nike has used it?

Domino’s is not a pizza delivery company. What is it then?

How one step towards digital transformation completely changed the brand perception of Domino’s from a pizza delivery company to a technology company?

BlackRock, the story of the world’s largest shadow bank

BlackRock has $7.9 trillion worth of Asset Under Management which is equal to 91 sovereign wealth funds managed. What made it unknown but a massive banker?

Why does Tesla’s Zero Dollar Budget Marketing Strategy work?

Touted as the most valuable car company in the world, Tesla firmly sticks to its zero dollar marketing. Then what is Tesla’s marketing strategy?

The Nokia Saga – Rise, Fall and Return

Nokia is a perfect case study of a business that once invincible but failed to maintain leadership as it did not innovate as fast as its competitors did!

Yahoo! The story of strategic mistakes

Yahoo’s story or case study is full of strategic mistakes. From wrong to missed acquisitions, wrong CEOs, the list is endless. No matter how great the product was!!

Apple – A Unique Take on Social Media Strategy

Apple’s social media strategy is extremely unusual. In this piece, we connect Apple’s unique and successful take on social media to its core values.

-AMAZONPOLLY-ONLYWORDS-END-