What comes to your mind when purchasing something online – the product or the platform?

Say you want to buy a flight ticket; will you go to the Airline’s website? If the answer is an obvious no, it is worth noting that answers to such questions aren’t always so obvious.

The consumer decision-making journey for a specialized beauty product purchase is often more complicated. According to recent research by Google, there is a ‘messy middle’ zone where customers experience multiple cycles of exploration and evaluation before zeroing in on a purchase. In this context, Indian D2C brands have been at the forefront of product discovery in recent years.

What strategies make L’Oreal the unbeatable beauty company?

MyGlamm Business Model: Journey of becoming a large D2C Conglomerate

MyGlamm is one such case study in D2C business model that created a solid product and platform recall, evident from the fact that 98% of its online sales occur through its website and app. The brand started as an on-demand beauty service in 2015 through which customers could book a home spa or beauty service.

In Oct 2017, Myglamm pivoted its business model to introduce beauty products under the same brand with a new logo. MyGlamm went through four distinct phases in its growth journey to become a digital powerhouse, as explained in detail below.

The Launch (Oct 2017 to Nov 2018)

It started with a niche TG – Busy, independent, confident women. MyGlamm’s first ad campaign presents six women with six different beauty needs and usage occasions, be it on the move in a cab or lift or quick touchups before a party or leaving the workplace after a long day. It had a tagline – Makeup that multitasks for you.

Extensive product education was imparted by the brand through social media, particularly the video content format. Globally, there was a 62% increase in beauty video views in 2018 from the previous year. However, videos of big beauty brands accounted for only 3% of total Youtube views on beauty while individual bloggers controlled the rest.

MyGlamm leveraged these changing beauty discovery trends by creating Youtube content through Celebrity makeup artist Namrata Soni, beauty vloggers & micro-influencers. Other reasons for the early success of MyGlamm can be attributed to the following:

- Country of Origin: European beauty (created in Germany & Italy)

- Product innovation & novelty: Claimed to reduce women’s makeup routine by half

- Premium & convenient Packaging: Compact, Stylish, and multi-functional kits

- Brand equity: On-demand beauty service imparted credibility

- Association with L’Occitane: First global beauty company to invest in any Indian beauty startup

The Touch of Celebrities (Dec 2018 to Mar 2020)

MyGlamm created ad campaigns with celebrities using clutter-breaking storylines. The campaign #TurnOnYourEyes with Lisa Haydon talked about women’s empowerment. Popular Bollywood star Sidharth Malhotra was roped in to launch LIT, its vegan cruelty-free makeup range. The campaign #TestedOnSID gave a funny spin to the context where Sidharth says the products are tested on him instead of animals. For the first time in India, a male celebrity was used to promote a cosmetic brand.

MyGlamm did another first in the industry by co-branding its premium new launch with fashion designer Manish Malhotra in Dec 2018. Then came the launch of POSE, a range of camera-ready makeup promoted by Bollywood star Sonakshi Sinha. To create buzz, the brand released a teaser on social media where Sonakshi was shown to be handcuffed and taken into police custody. The actor then revealed the new launch on her Instagram page.

3Cs at play – Content, Community & Commerce (Apr 2020 to Mar 2021)

According to a Facebook India & BCG report, Lockdown led to a 1.35x increase in online beauty buyers in India. MyGlamm saw this surge as an opportunity to increase its user base aggressively. While the brand grew by 400% in the past 12 months to hit an annualized revenue of 140 cr, high CAC (Customer Acquisition Cost) and low LTV (Lifetime Value) were the cause of concern.

What marketing strategy makes Nykaa so unique?

New customer acquisition is usually six to seven times more expensive than customer retention. Multiple D2C brands jostling for the attention of the same online audience pushed CACs higher. Hence, MyGlamm came up with a plan to reduce CAC by focusing on three things:

- Boosting conversion – Focused on performance marketing. For instance, one of its early conversion campaigns increased new user conversion from 12% to 19% and 166% increase in users with abandoned carts.

- Marketing Automation – Deeper engagement with the agency WebEngage helped the brand target user cohorts on different stages of the purchase journey efficiently.

- Developing relationship with customers – Acquired content platform POPxo, a community with nearly 50 mn women and 75k influencers through Plixxo (its influencer marketing wing).

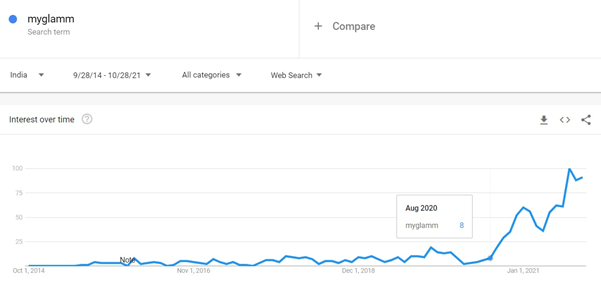

Within a month of the acquisition, new users for MyGlamm products shot up from 30k to 60k. According to the founder, onboarding POPxo alone would lead to $4-5 mn cost saving in marketing. With this solid top-of-the-funnel marketing and reduced CACs, MyGlamm clocked 50% higher revenues than pre-COVID levels with a retention rate of 45%. The gains are also evident from the consumer interest generated by the brand since Aug 2020, as shown by Google Trends below.

MyGlammXO was formed to co-create beauty products with consumers. In Nov 2020, MyGlamm launched India’s largest experiential beauty store, a 3000-square feet flagship store, in Bollywood stars’ nest, Juhu in Mumbai. It is six times the usual size of any beauty store in India.

Estée Lauder Companies Inc: Story of beauty and aspirations

The Digital FMCG conglomerate (Apr 2021 to date)

It was time for a new brand vision – To transform the beauty journey of millions of women at every life stage from tween to teen to a grown-up adult. Hence, in Sep 2021, MyGlamm announced the formation of Good Glamm Group, the parent entity in its journey of becoming a digital House of Brands. This grand ambition was powered by a funding of Rs 785 cr (175 cr in Mar ’21, 355 cr in Jul ’21, and 255 cr in Sep’ 21) – the highest ever series C round in the Indian beauty space. The Group’s valuation stood at over Rs 2000 cr in July ’21.

Bollywood star Shraddha Kapoor came on board as an investor and ambassador to add wings to its ambition. The new vision attracted top industry talent, including Apratim Majumdar, a marketing veteran from HUL who joined as its new CMO. Interestingly, this round also witnessed Amazon debuting its investment in beauty D2C.

Good Glamm Group is now relying on a series of strategic acquisitions to win in new categories. Founder Darpan Sanghvi envisions a $5 bn opportunity for the company and IPO in 2023. Its new journey started from the Mom and Baby segment with the acquisition of BabyChakra, a parenting platform with 25 mn families as its users. This was followed by the acquisition of The Moms Co for a mammoth 500 cr, the largest D2C beauty brand acquisition in India to date.

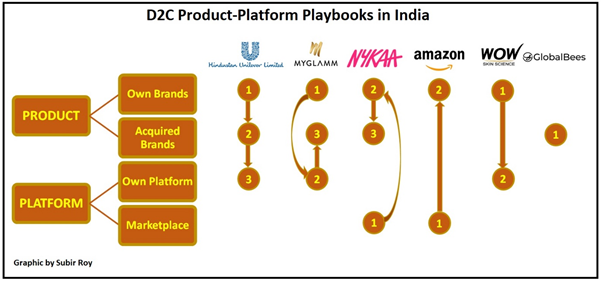

With this, Good Glamm Group entered into direct competition with the booming Thrasio-style D2C aggregators like Mensa Brands, Goat Brand Labs, UpScalio, GlobalBees, Powerhouse91, and the likes. This move has multiple implications on how founders and investors will look at the D2C space. The new playbook created by Good Glamm Group can be best explained with the help of the below chart:

D2C brands can pick three elements from this framework to craft their strategic journeys:

- the starting point,

- the direction of movement, and

- the boxes ticked.

With an eye on the burgeoning men’s grooming market, Good Glamm Group next acquired popular lifestyle platform ScoopWhoop, which boasts 1.5 bn impressions with 60% male users. This comes at a time when recent research by Google, Kantar, and WPP revealed that contrary to popular belief, men are highly interested in online beauty buying.

The Road Ahead

MyGlamm expanded into personal care categories like hair care, skincare, and bath & body along with more beauty niches to create a larger branded house with launches like SUPERFOODS, Treat Love Care, Wipe Out, GLOW, YOUTHFUL, and K. Play. According to Darpan Sanghvi, Good Glamm Group has a current annualized revenue run rate of 740 cr and is expected to hit the Rs 1800 cr mark by Mar 2022.

From a D2C point of view, two things that differentiate the brand from contemporaries like Sugar Cosmetics, Plum, Mamaearth, and WOW Skin Science are its offline presence accounting for 40% of the revenue through 15k point of sales across 70 cities and its speed of innovative customer acquisition even after being a late entrant using content, community, and commerce. The below chart explains the gains achieved from the 3C strategy so far.

WOW Skin Science Marketing Strategy – Creating a niche in a multi-brand category

| Company | Sep-20 | Aug-21 |

| MyGlamm | 30,000 new customers per month | 350,000 new customers per month |

| POPxo | 48 million monthly active users | 60 million monthly active users |

| Plixxo | 125,000 influencers on the platform | 220,000 influencers on the platform |

| BabyChakra | 20 million mothers on the platform | Aims to onboard 75 million mothers by 2022 |

The Group plans to reach 100 mn MAU for POPxo and 5 lac influencers through an app for Plixxo over the next few months. After tasting success with its experiential store in Mumbai, the brand plans to open a similar store in Delhi. BabyChakra branded products will be launched by year-end. Capturing a pie in the men’s grooming market will be a feather in the cap. From the current share of 25%, the founder wants to take up the percentage of personal care to 40% of the entire portfolio through product and geographic expansions.

We can only imagine the next giant leap in this journey – the possible acquisition of women’s hygiene and lifestyle brands. Let us wait to see how and when the FMCG giants step up their game.

-AMAZONPOLLY-ONLYWORDS-START-

Also, check out our most loved stories below

Why did Michelin, a tire company, decide to rate restaurants?

Is ‘Michelin Star’ by the same Michelin that sells tires, yes, it is! But Why? How a tire company evaluations became most coveted in the culinary industry?

Starbucks prices products on value not cost. Why?

In value-based pricing, products are priced based on the perceived value instead of cost. Starbucks has mastered the art of value-based pricing. How?

Nike doesn’t sell shoes. It sells an idea!!

Nike has built one of the most powerful brands in the world through its benefit-based marketing strategy. What is this strategy and how Nike has used it?

Domino’s is not a pizza delivery company. What is it then?

How one step towards digital transformation completely changed the brand perception of Domino’s from a pizza delivery company to a technology company?

Why does Tesla’s Zero Dollar Budget Marketing Strategy work?

Touted as the most valuable car company in the world, Tesla firmly sticks to its zero dollar marketing. Then what is Tesla’s marketing strategy?

Yahoo! The story of strategic mistakes

Yahoo’s story or case study is full of strategic mistakes. From wrong to missed acquisitions, wrong CEOs, the list is endless. No matter how great the product was!!

Apple – A Unique Take on Social Media Strategy

Apple’s social media strategy is extremely unusual. In this piece, we connect Apple’s unique and successful take on social media to its core values.

-AMAZONPOLLY-ONLYWORDS-END-