Recently Reliance Retail announced that it is all set to acquire a controlling stake in Just Dial with an $800-$900 million transaction. Presently the managing director of Just Dial VSS Mani and his family controls 35.5 percent of the company’s stake, which is valued at Rs. 2387.9 crore.

Reliance is planning to buy partially from Mani and partially by buying 26% of the company’s equity. If successful, this deal will make Reliance a 60% majority stakeholder in Just Dial, with Mani as the minority stakeholder.

But why is Reliance so keen to buy a major stake in Just Dial and infusing so much capital for the same? The answer lies in the business model of Just Dial.

Business Model of Just Dial

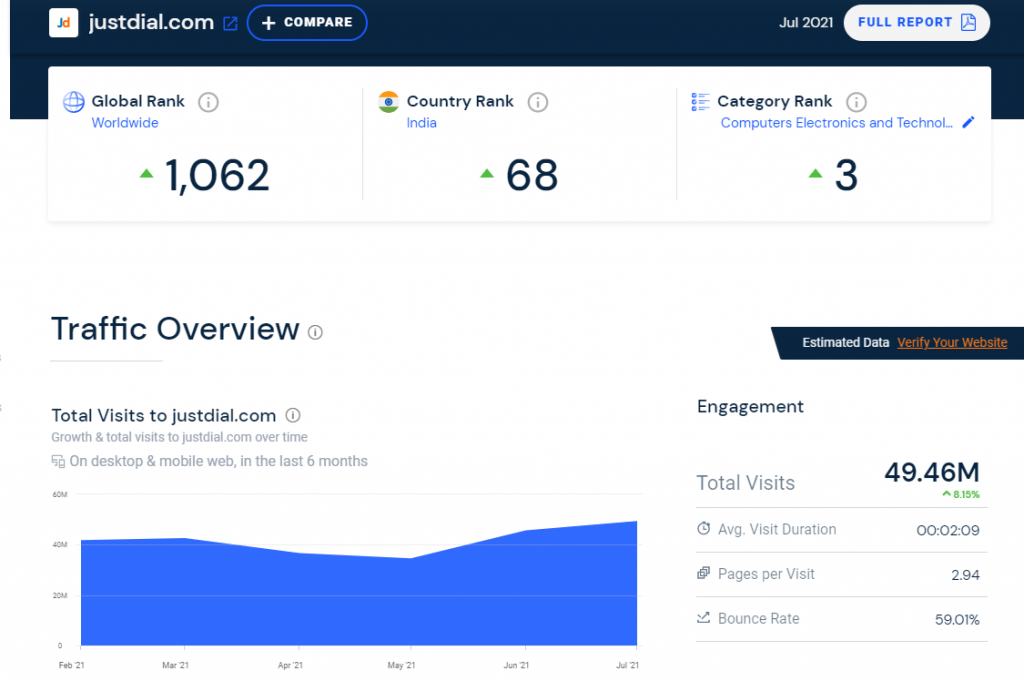

Started in 1996 by a first-generation entrepreneur VSS Mani, Just Dial is a significant player in the local search engine market segment with an average of 150 million unique quarterly visitors across different platforms such as websites, apps, and telephone hotlines.

To understand Just Dial’s business model, let us assume I own a repair shop and provide car repair services in a particular area. As a car repair service provider, I want my business to be visible to locals in the locality of my operation. So, I will pay some amount to Just Dial, and they will list my business on their platform. This will help me to get more leads from Just Dial users.

Now, if you live in my locality and need a car repair service, you can search on Just Dial about car repair services, and it will show me as one of the service providers. This will help me to convert you as one of my customers.

In simple terms, Just Dial provides listing space to businesses on its platform in exchange for some amount of money. If a business provides some amount, it gets listed on Just Dial, and potential customers can reach out to the businesses by checking on Just Dial. The listing company’s major business strategies revolve around:

- Creating an extensive database of businesses.

- Garnering paid campaigns through the database.

- Increasing search users through marketing and brand building.

- Technological innovations.

Just Dial, which has been in the listing business for years now, has an extensive database of businesses through listings on their platform. The company has successfully converted the database entries into paid campaigns as businesses see value in getting listed. Just Dial has worked hard on its marketing and brand image, increasing its search users. As more users started using the listing services, businesses got leads.

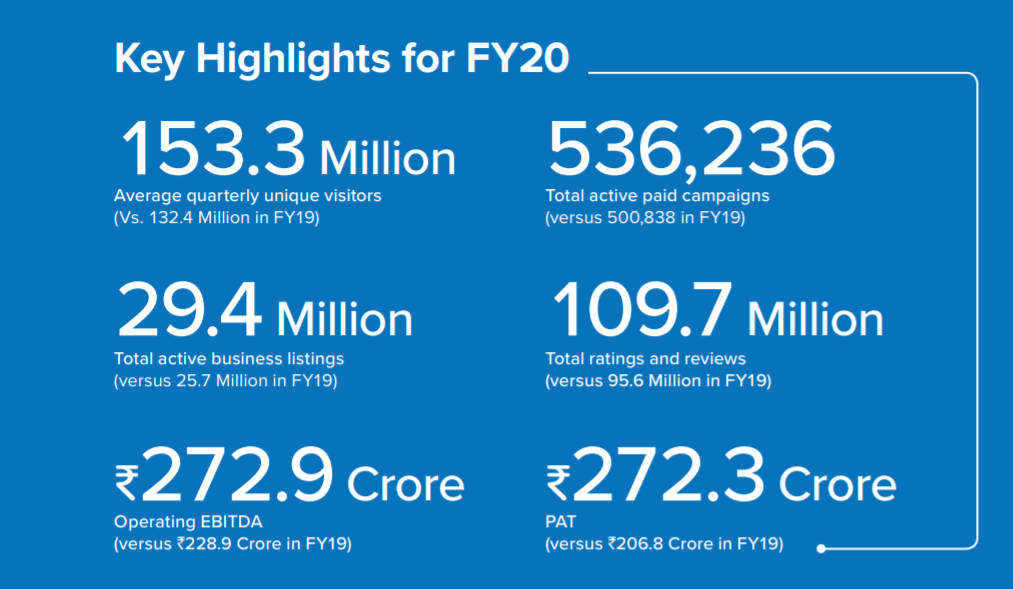

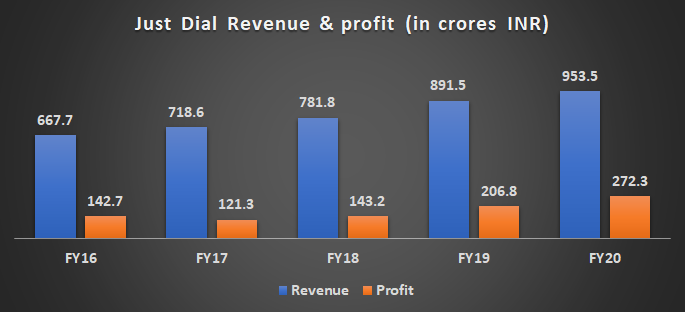

Providing pure voice-based telephone services, Just Dial quickly migrated to a mix of voice and internet-based platforms with the dot com boom in India, which resulted in a steady rise in revenues with a 5-year CAGR of 10.1%.

What Makes the business model of Just Dial so attractive to investors?

Financial Stability: Just Dial follows a prepaid business model for its various paid subscription plans. Customers can either pay upfront for the entire tenure or through monthly advance payment plans. Owing to this policy, it enjoys negative working capital and no receivables. Thus, the Company has remained debt-free since its inception and enjoys healthy revenue visibility.

Pan-India presence: Just Dial has a Pan-India presence and derives about 69.7% of its revenues from the top 11 cities in India. It has stepped up efforts to enhance its reach in smaller towns and cities which are witnessing rapid growth in internet use.

Customized revenue model: Just Dial offers customized packages to customers based on their profiles. Packages at different price points are offered depending on the business of the advertiser, geographies they cater to, and type of listing plan opted for (premium or non-premium), among other criteria. To further provide flexibility Just Dial offers multiple payment plans (upfront or monthly) with options to pay digitally or via cheques.

Listing through transparency: The advertisers can choose between premium or non-premium packages. Premium advertisers get top positioning in category searches and hence have higher visibility. Nonpremium packages are listed in category searches in the order of contribution made by the advertiser vis-à-vis others.

Empowering businesses: Just Dial is a unique platform for its advertisers, who are largely MSMEs, to reach a vast pool of consumers at nominal costs with flexible payment options. The Company runs special, focused campaigns across India to benefit its advertisers. As of March 31, 2020, the Company had 536,236 active paid campaigns.

Strong ground force: The Company has 3,972 employees in telesales, 1,480 feet-on-street (marketing), 3,924 feet-on-street [Just Dial Ambassadors (JDAs), cold calling] sales force selling to SMEs. Its robust manpower network deployed across 250+ cities covers 11,000+ pin codes in India.

Just Dial and the competition

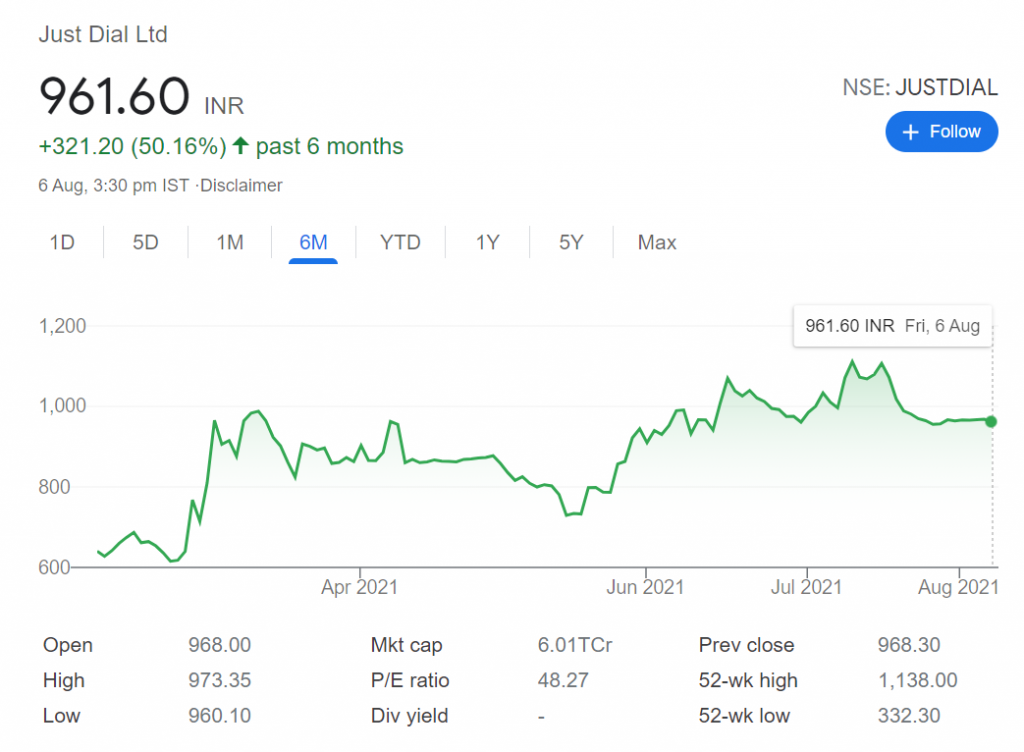

In the last six months, the stock of Just Dial has appreciated 50.16%.

However, all is not well with Just Dial. The high numbers result from Just Dial’s sales strategy, which is persuading its customers to upgrade to paid services. Since this number is not static, it keeps on changing with time.

If the product cannot come up with new features, the users will not find much value in it and stop subscribing to paid services. This results in lead saturation of existing customers, making companies look for new leads and convert them into paying customers.

To prevent going obsolete, Just Dial decided to add more value to their existing customers, and in a bid to do so, they launched Search Plus and JD Omni. Search Plus allowed users to search for local businesses and allowed them to pay the businesses for the service through the platform.

On the other hand, JD Omni was a product focussed on SMEs to help them with inventory management, billing, and other related things. However, users didn’t subscribe to these add-ons much, so it didn’t work as expected. This made Just Dial return to its previous strategy of focussing on B2B services rather than entering the B2C market.

Just Dial, which was once a dominant player in the local search-based market, is now facing hard competition from highly specialized search-based companies who are focussing on a particular vertical and taking market space from Just Dial in that.

The pandemic added more woes for the company as SMEs stopped paying for listing due to cash crunch, and to deal with that, Just Dial started spending more on advertising. This resulted in a dip in revenue during the June quarter last year.

Reliance interest in Just Dial

Since the market space of Just Dial is becoming highly competitive, Reliance acquisition will give Just Dial a competitive edge and open avenues for growth. Just Dial is seeing this as a good opportunity to ease its burdens. But the question arises what is in the deal for Reliance. Why is it interested in infusing so much capital into the listing business?

Reliance itself has been working aggressively to onboard Kirana stores and provide them with various financial services such as inventory management, tax return filing services, and sourcing and procurement support, a concept similar to JD Mart and JD Omni.

Reliance’s strategy is to link these Kirana stores digitally, making a stronghold on B2B services which will become the backbone for their B2C business plans. It includes embedding its e-commerce app JioMart into WhatsApp, allowing 400 million users to order products and services from the messaging app.

Reliance will be leveraging Just Dial’s 25-year old search and listing database of ~30 Mn and the pan India network to accelerate its local commerce and payments play. This deal not only allows Reliance to acquire a strong listing business player at a reasonable price but also opens the doors of B2B market space.

The acquisition will help boost the digital ecosystem for merchant partners of Reliance, through its JioMart Business Model. But how JioMart is revolutionizing the retail industry?

So, Reliance’s acquisition of Just Dial is a win-win game for both the players; at least, that’s what it looks like for now. We will see how it pans out in the future.

-AMAZONPOLLY-ONLYWORDS-START-

Also, check out our most loved stories below

Why did Michelin, a tire company, decide to rate restaurants?

Is ‘Michelin Star’ by the same Michelin that sells tires, yes, it is! But Why? How a tire company evaluations became most coveted in the culinary industry?

Bajaj Auto: The Story of an Indian Born Global Brand

Bajaj Auto has evolved tremendously over time from its traditional scooter Chetak to having the trendiest bike Pulsar. It has managed to stay relevant.

Jio’s Offensive Marketing Warfare: From Challenger to Leader

In just 4 years Reliance Jio has become the Indian telecom market leader due to its marketing warfare strategies. What is this strategy and how Jio used it?

Johnnie Walker – The legend that keeps walking!

Johnnie Walker is a 200 years old brand but it is still going strong with its marketing strategies and bold attitude to challenge the conventional norms.

Flipsters: Creating the Butterfly effect in Indian Startup Ecosystem

How is it that ex-Flipkart employees or Flipsters as they call themselves have achieved such massive success in the Indian Startup Ecosystem?

Nike doesn’t sell shoes. It sells an idea!!

Nike has built one of the most powerful brands in the world through its benefit based marketing strategy. What is this strategy and how Nike has used it?

Domino’s is not a pizza delivery company. What is it then?

How one step towards digital transformation completely changed the brand perception of Domino’s from a pizza delivery company to a technology company?

Why Indians love Old Monk? What is the revival plan of the dying brand?

Indians especially armed forces and college students for generations have loved Old Monk. What makes this rum so special? It’s classy, dark yet affordable.

IKEA- The new master of Glocalization in India?

IKEA is a global giant. But for India, the brand modified its business strategies. The adaptation strategy by a global brand is called Glocalization

-AMAZONPOLLY-ONLYWORDS-END-