Be proactive with your strategy – an excellent prescription for any successful business, and that is what any profitable retail company embraces. And so does Reliance Industries with its digitized and new-age business model of JioMart.

What is good for India is suitable for Reliance. Every action and ambition is shaped on this strong fundamental belief by Reliance Industries Limited, a Fortune 500 company and the largest private-sector corporation in India. Reliance Retail is now embarking on a journey to transform traditional retail through its JioMart Digital Commerce Platform.

JioMart, also known as DESH KI NAYI DUKAAN, is Reliance Retail’s new e-commerce initiative that was launched in 2020 with an aim to integrate digital and physical retail stores to help Indian consumers with unlimited choices, superior value proposition, and unmatched shopping experience by digitally enabling and empowering merchant partners.

JioMart is leading the digital transformation of Reliance Indstries along with platforms like JioMeet, JioHaptik, JioPOSlite, JioGames, JioUPI and JioHealthHub, which were key enablers of work from home, learn from home, health from home and shop from home during the COVID-19 crisis

Reliance Retail and WhatsApp have entered into a commercial partnership agreement to further accelerate Reliance Retail’s Digital Commerce business on the JioMart platform using WhatsApp and to support small businesses on WhatsApp.

The entire ecosystem works closely to ensure that customers can access the nearest Kirana stores that can provide products and services to the homes by seamless transaction with Jiomart using WhatsApp. The JioMart platform is scaling high with more active users, more traffic, and more orders.

Unique Value Proposition & Business Model of JioMart

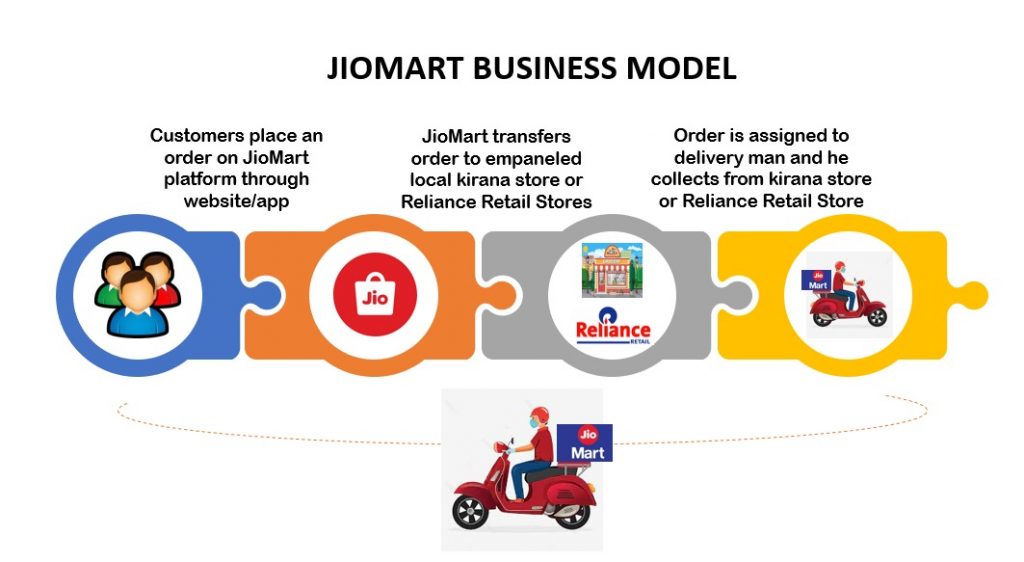

RIL offers local merchants and kiranas an O2O (online-to-offline) marketplace through JioMart, wherein local vendors and small Kirana stores will take orders through WhatsApp and the order will be delivered within 24 hours to the customers.

Currently, Reliance Retail stores are delivering the orders on the JioMart, but it is working on a hybrid model whereby its retail stores, as well as local Kirana stores, will be included for order fulfillment for quicker delivery.

The JioMart also works as a traditional e-commerce website where a user places an online order through the website or app, and the product is delivered in a specified time period.

JioMart is building a robust tech platform by uniting a trio of KIRANAS, CUSTOMERS, and PRODUCERS. JioMart business model focuses on providing omni-channel experience to consumers who can place orders through alternative ways including Whatsapp which will be served by merchant partners.

JioMart is aimed at changing the entire customer journey in ways that even consumers who are not comfortable with digital channels become comfortable with JioMart. JioMart acts as a centralised procurement and delivery platform between manufacturers and merchant partners.

Kirana Delight Model

With the philosophy “CUSTOMER AAPKA, SUPPORT HAMARA”, JioMart enables digitisation of merchants through Jio PoS at the backend and JioMart app at the frontend. These not so digital savvy merchants are empowered to stay connected and transact with their customers.

This partnership model helps Kiranas grow its business and earnings by addressing limited product range, space, and delivery challenges.

Another unique solution provided by JioMart is transforming existing Kirana Stores in less than 48 hours into refreshed self-serviced stores, thereby transforming the customer’s entire shopping experience.

Customer Delight

JioMart allows its users to choose from more than 50,000 products, including fresh fruits and vegetables, groceries and snacks, beverages, home & household essentials, beauty and hygiene and baby care, fashion wear, medicines, jewelry from your favorite brands – Good Life, Cadbury, Aashirvaad, Cadbury, Daawat, Tata, Saffola, Amul, Everest, Haldiram, Britannia, McCain, Real, Dabur, Kellogg’s, Weikfield, Heritage, Nestle, Himalaya, Johnson & Johnson and many more.

Customers can access JioMart through website, native apps on Android and iOS, with full

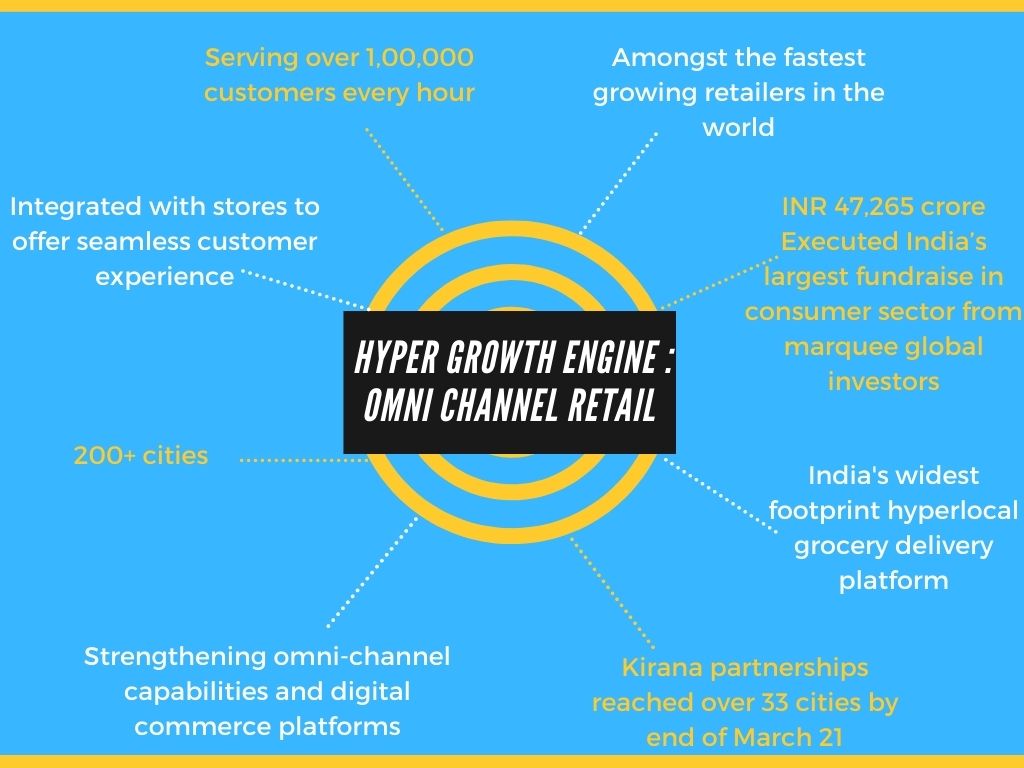

integration into MyJio. The platform has expanded into selling apparels and electronics in some parts of the country. JioMart has scaled up rapidly, with more traffic, active users and orders. Kirana partnerships are being expanded, reaching over 33 cities by the end of March 2021.

BEST FEATURES

- Free Home Delivery

- No minimum order

- Great Value & Attractive prices. Save more for a day and save for 365 days a year

- Easy to use platform with voice integration and barcode scanner

Producer Delight

While continuing to grow its organised retail platform, Reliance Retail is working to integrate producers/manufacturers, supply chain, small merchants and consumers in a seamless digital ecosystem that will benefit all elements of the retail chain.

Over the years, Reliance Retail has made excellent investments in developing its end-to-end value chain, which is backwardly integrated for fresh foods enabling quality of a product, supply security, and sourcing efficiencies. This has resulted in win-win partnerships with their producers.

Through the JioMart platform, producers are linked with small kiranas and consumers to create a win-win model for the whole ecosystem by benefitting local kiranas from competitive pricing and warehousing strategies on one side and benefitting customers to get their essentials from a variety of products at a click.

There are competitive strengths of JioMart’s business model that are creating this rewarding model for everyone.

- Robust Value Chain system of collection, processing, and distribution centers across India

- High scale of digital commerce channels and stores network

- Wide and a strong portfolio of its brands across staples, consumer products, and general merchandise

- Hyperlocal digital strategy to serve its customers and merchant partners

- Leveraged retail partnerships for new brand launches, promotions, and activations

As per Statista’s 2021 Global Consumer Survey

Demographic Profile of Customers: JioMart has a user share of 36% and is ranked 4 among top grocery delivery brands in India. 46% of JioMart customers are between the ages of 18 and 29 and Consumers with a high income make up 40% of JioMart customers. 66% of JioMart users live in a family of 4 members or less.

Consumer Lifestyle: Music and Food are important interests of JioMart customers. 44% of JioMart users believe in owning the latest technology while 57% like to stay up to date with new technologies. JioMart users prefer to use the internet on a Smart TV and are more socially active through updates than the average online user.

Acquisition Strategy of Reliance to provide support to JioMart’s business model

RIL expanded its business under strategic partnerships with merchants across the country under its model of JioMart. By the end of the financial year 2021, the digital commerce and merchant partnerships business accounted for about 10% of revenues, significantly stepped up from near zero in the preceding year. Reliance Retail invested in a range of acquisitions to strengthen its capabilities in the supply chain, technology, and product portfolio. Here’s a list of a few:

- NetMeds – With an investment of INR 620 cr, the addition of Netmeds will enhance the company’s ability to provide health care products and services at best price and quality alongwith expanding its digital commerce proposition to include daily essentials.

- Hamleys – This British toy retailer was acquired for about INR 620 cr in an all cash deal. This acquisition will give a global footprint to the group with its network of 167 stores across 18 countries.

- Urban Ladder – With a purchase of this online home décor company for INR 182.12 cr, this acquisition shall widen the bouquet of consumer products offerings increasing the customer engagement and services across its retail offerings.

- Zivame – Acquiring 15% stake, it will broaden its customer base focused to women having 30+ retail stores and a presence in more than 800 partner stores across the country.

- Future Group – Accquiring the Retail & Wholesale Business and the Logistics & Warehousing Business from the Future Group for lumpsum aggregate consideration of INR 24,713 crore makes a strong strategic fit into Reliance retail business accelerating the competitiveness of small merchants.

- Just Dial – With acquisition of controlling stake for a consideration of INR 5710 crores will help to boost the digital ecosystem for merchant partners with Just Dial’s existing database of ~30.4 million listings and its existing consumer traffic of ~ 129.1 million quarterly unique users (as on 31 Mar 2021)

- FYND – Acquisition of majority stake for INR 295 crores, will help to ramp up the sales of offline retailers by directly selling through its offline stores and also enables them to connect with Amazon India & Flipkart.

India’s digital revolution is a key enabler of JioMart’s growth

Since the last few years, India’s online grocery market is continuously rising due to increased smartphone users, consumer awareness, and increased disposable income. Not in just tech-savvy Tier -1 but JioMart also continues to gain traction across regions with Tier II and Tier III cities contributing over half of the orders.

Also, a broad base of India’s population is working, preferring online grocery shopping over traditional shopping of waiting in a queue and hence booming the e-commerce market. In addition, there are also advantages associated with the country’s online grocery market like the vast variety of products, pricing advantages, delivery at home with just a few clicks from their device are adding more fuel to its growth.

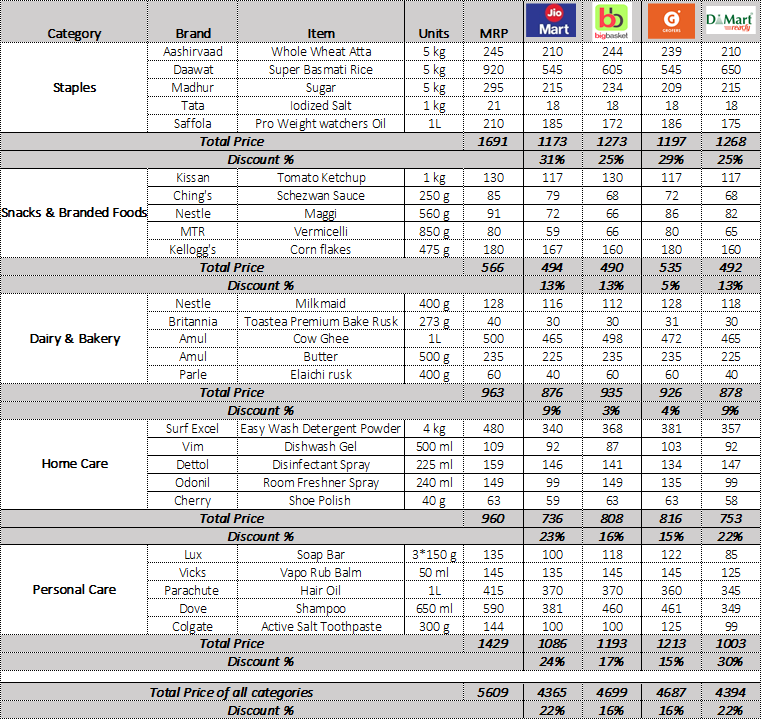

But there are many seasoned players for online grocery stores apart from Jiomart – Bigbasket, Grofers, D-mart ready, and many more. All players have put in millions of dollars to get on the surface. All have adopted diversified strategies with cut-throat competition not only to survive but also thrive.

To get a bird view of pricing and discounts of major players, let’s take a sneak peek: –

With the increase in digital literacy and the Indian government promoting digitalization, the online grocery market will gain momentum. Due to the Covid-19 outbreak, online grocery shopping is more perceived as the convenient option for shopping and the safest due to features of contactless delivery following the social distancing norms.

The NEW NORMAL has impelled every sector to accept and embrace the practical ways that are hygiene and safe. The online grocery platform is also getting in motion due to high internet penetration with competitive data tariffs and affordable smartphones. The digital payment system is adding a feather to this growth.

Thus, factors like smart shopping, time-saving and convenience, and safety measures make online grocery shopping the BEST choice for consumers and JioMart with its inclusive business model is a top contender of that choice.

-AMAZONPOLLY-ONLYWORDS-START-

Also, check out our most loved stories below

Why did Michelin, a tire company, decide to rate restaurants?

Is ‘Michelin Star’ by the same Michelin that sells tires, yes, it is! But Why? How a tire company evaluations became most coveted in the culinary industry?

Bajaj Auto: The Story of an Indian Born Global Brand

Bajaj Auto has evolved tremendously over time from its traditional scooter Chetak to having the trendiest bike Pulsar. It has managed to stay relevant.

Jio’s Offensive Marketing Warfare: From Challenger to Leader

In just 4 years Reliance Jio has become the Indian telecom market leader due to its marketing warfare strategies. What is this strategy and how Jio used it?

Johnnie Walker – The legend that keeps walking!

Johnnie Walker is a 200 years old brand but it is still going strong with its marketing strategies and bold attitude to challenge the conventional norms.

Flipsters: Creating the Butterfly effect in Indian Startup Ecosystem

How is it that ex-Flipkart employees or Flipsters as they call themselves have achieved such massive success in the Indian Startup Ecosystem?

Nike doesn’t sell shoes. It sells an idea!!

Nike has built one of the most powerful brands in the world through its benefit based marketing strategy. What is this strategy and how Nike has used it?

Domino’s is not a pizza delivery company. What is it then?

How one step towards digital transformation completely changed the brand perception of Domino’s from a pizza delivery company to a technology company?

Why Indians love Old Monk? What is the revival plan of the dying brand?

Indians especially armed forces and college students for generations have loved Old Monk. What makes this rum so special? It’s classy, dark yet affordable.

IKEA- The new master of Glocalization in India?

IKEA is a global giant. But for India, the brand modified its business strategies. The adaptation strategy by a global brand is called Glocalization

-AMAZONPOLLY-ONLYWORDS-END-