Insurance is one of the largest industries in the world. Property, casualty, and life insurance premiums amount to approximately $5 trillion globally and account for 11% of the gross domestic product in the United States.

Insurance is needed but not liked. With the pandemic, this negative perception of the insurance industry only intensified.

Customers tend to associate insurance providers with adverse events such as illnesses or accidents that compel them to submit a claim. Customers don’t like that large corporations are making money out of their misery. The very nature makes the industry not very likable.

What if I tell you that there is one company that does not make any money and uses all the extra premium they earn for the good of society. In traditional insurance, it can take days to process the claim. But this company has a word record of processing a claim in 3 seconds!!

Founded in 2015, Lemonade is on a mission to harness technology and social impact to be the world’s most loved insurance company. How did it all start? What are the critical components of Lemonade’s business model? Through this story, we will deep dive into each aspect of Lemonade’s business model.

What is Lemonade? How did it all start?

Lemonade was founded by Daniel Schreiber (former president of Powermat Technologies) and Shai Wininger (co-founder of Fiverr) in April 2015. Dan Ariely joined in 2017 as the Chief Behavioral Officer.

Lemonade is rebuilding insurance from the ground up on a digital substrate and an innovative business model. By leveraging technology, data, artificial intelligence, contemporary design, and behavioral economics, Lemonade is making insurance more delightful, affordable, precise, and socially impactful.

Lemonade’s chatbot, AI Maya, just takes 2 minutes to get covered with renters’ or homeowners’ insurance. Lemonade hopes to offer a similar experience for other insurance products over time.

This breezy experience belies the extraordinary technology that enables it: a state-of-the-art platform that spans marketing to underwriting, customer care to claims processing, and finance to regulation.

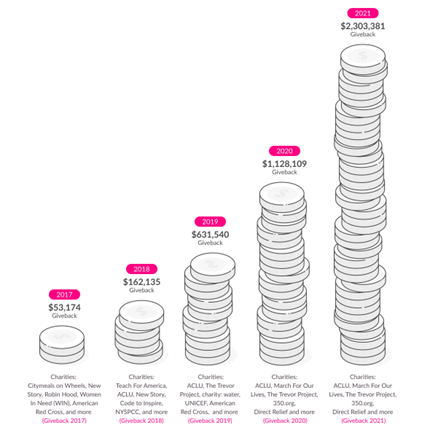

Lemonade was built differently. Instead of profiting from unclaimed premiums, Lemonade takes a flat fee (25%) out of premium as profit and donates whatever money may be left, after paying claims and expenses, to charities (this is called the Lemonade Giveback).

Before going public in Jul ’20, Lemonade had raised $480 Mn in 5 different rounds. As we have built the basics of Lemonade, let’s try to understand the various dimensions of its business model.

What is the business model of Lemonade?

Lemonade’s business model is based on reinsurance. Reinsurance is insurance that an insurance company purchases from another insurance company to insulate itself (at least in part) from the risk of the event of a significant claim. Some of the biggest reinsurers in the world are reinsuring Lemonade. Names like Swiss Re, Munich Re, and Hannover Re are just part of the list.

Lemonade is reimagining the underlying business model to minimize volatility while maximizing trust and social impact. At Lemonade, excess claims are offloaded to reinsurers, while extra premiums are usually donated to non-profits as part of its annual “Giveback.”

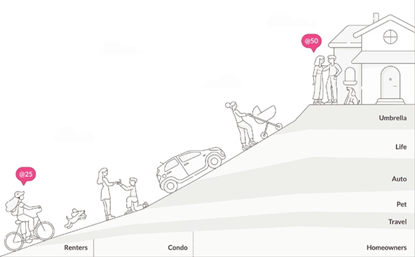

Lemonade is mainly focusing on younger and first-time insurance buyers. As these customers progress through predictable lifecycle events, their insurance usually needs to grow to encompass more and higher-value products:

- renters regularly acquire more property and frequently upgrade to successively larger homes;

- home buying often coincides with a growing household and

- a corresponding need for life or pet insurance, and so forth.

These progressions can trigger orders-of-magnitude jumps in insurance premiums. The result is a business with highly recurring and naturally growing revenue streams as Lemonade is approaching consumers years before they are ripe for legacy providers. Approximately 65% of Lemonade’s customers are under the age of 35.

Value Proposition

Delightful Experience: Since Lemonade’s primary business comes from Gen Zers, a generation that grew up with a smartphone, Lemonade strongly focuses on making the buying and claiming to process more fun through playful bots.

Aligned Values: Millennials feel more aligned with brands whose values align with their own. Young consumers are becoming distrustful of large institutions. Lemonade wants to play the game differently. If money is left over after paying claims, Lemonade gives back excess funds to non-profits selected by the customers, ensuring that it minimizes any incentive to deny legitimate claims.

Great Prices: Due to highly automated systems, Lemonade can offer insurance premiums more efficiently than the typical incumbent. Prices can be as low as 50% cheaper, a significant advantage when competing with younger, more price-sensitive consumers.

Wedding Insurance, why do you need it more than ever?

Offerings

Renters and Homeowners Insurance: Lemonade offers insurance to renters and homeowners, which covers stolen or damaged property, and also covers personal liability, which protects customers in case of an accident or damage to another person or their property. Customers can purchase extra coverage to protect against accidental loss, damage, and theft worldwide of their jewelry, fine art, and other personal property.

Pet Insurance: Lemonade offers pet insurance that covers diagnostics, procedures, medication, accidents, or illness. Such an offering is allowing Lemonade to be a more likable and preferred insurer among the pet-friendly millennials.

Car: Although it’s typical car insurance with some slightly more features, Lemonade’s car insurance is unique in a different way. For each added Lemonade Car customer, Lemonade plants trees based on drivers’ mileage to help offset carbon emissions.

Life insurance: Lemonade offers life insurance to individuals between 18 and 60 without a medical exam or a lab test. With term life offered by Lemonade, policyholders pay a fixed annual premium for the entire term of the policy.

A Health Insurance Company with a Purpose to Make People Healthier- The Discovery Health

Revenue

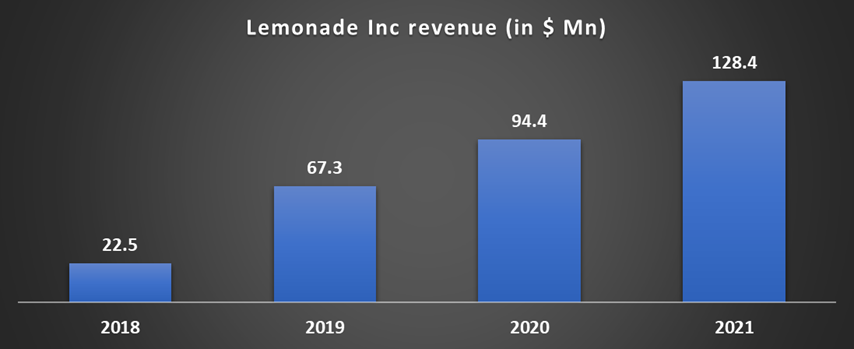

Strong retention rates and a subscription-based model create highly recurring and naturally growing revenue streams, ensuring stability in Lemonade’s top-line results. Lemonade Insurance made $128 Mn in 2021, with a YoY growth rate of 36%. Lemonade primarily has four revenue streams, which are as follows.

- Net Earned Premium: Lemonade works on a reinsurance business model to minimize the risks. Net earned premium is the premium earned from customers less the insurance amount paid to third-party reinsurers. This stream made 60% of the revenue earned by Lemonade in 2021.

- Ceding Commission Income: This is the commission Lemonade earns for giving business to third-party reinsurers. This stream made 35% of the revenue earned by Lemonade in 2021.

- Net Investment Income: The stream represents interest earned from fixed maturity securities, short-term securities, and other investments. This stream made 1.5% of the revenue earned by Lemonade in 2021.

- Commission and Other Income: Commission income consists of commissions earned for policies placed with third-party insurance companies where Lemonade has no exposure to the insured risk. This stream made 3.5% of the revenue earned by Lemonade in 2021.

Conclusion

Undoubtedly, Lemonade has reinvented the insurance industry using machine learning and artificial intelligence to satisfy the consumers and bring efficiencies to the ecosystem. Lemonade has made insurance more delightful, affordable, precise, and socially impactful.

With just $128 Mn revenue in a $5 trillion industry and an innovative business model, Lemonade has the potential to become the world’s most loved insurance company one day.