In July’21, Zomato’s IPO raised Rs 9,375 crore. It was one of the most talked-about events as it became the first Indian startup to go public, that too after COVID when many things became uncertain. This means that Zomato was doing something right, and I decided to read more about its business model, which eventually made me write this article.

Earlier I used to think that Zomato was just about food delivery and restaurant listing. But, I forgot it’s a “FoodTech,” which means it has access to a large amount of data that it has been using in exciting ways and will continue to do so.

In this article, I will try to give a bird’ eye view of Zomato and cover a bit of everything about its business model to its future business plans, how does Zomato make money, and its mind-blowing marketing strategies.

The Growth Story of Zomato

As of 31st March 2021, Zomato is present in 24 countries outside of India. According to their RHP, the company has decided to focus only on the Indian market going forward, considering the market potential.

Zomato has over 1.4 million listed restaurants and 12,000 restaurant partners. Moreover, it has over 6500 restaurant partners for Zomato Gold. In December 2020, it had around 162,000 active delivery drivers and 3,50,000 active restaurant listings on its platform in India

To fuel its rapid expansion, Zomato acquired several startups around the world. In 2014 itself, it acquired four startups overseas. It was part of its strategy to enter markets with low competition in this space of restaurant discovery, make money here, and then tap the markets having competition.

What Strategies made people “Swiggy Karo, Fir Jo Chahe Karo”

One of its most significant acquisitions has been Uber Eats India business, which helped the company get a competitive advantage from its rival Swiggy and one rival less for the company to deal with. Its latest acquisition has been Fitso, a full-stack sports facilities provider and discovery startup, which hints at its foray into the nutrition segment.

Business Model Canvas of Zomato

Customer Segments:

Broadly, we can say that there are three customer segments in Zomato’s business model:

- Local restaurants: Zomato helps restaurants enhance visibility to their target audience, provides opportunities for targeted advertisements, customer service & engagement, as well as track their performance using its analytical tools.

- Users: Can be divided into two categories for Zomato – one who want food delivered to their homes quickly and others who want to go out (they can look for places according to the distance, budget, cuisines and even reserve a table).

- Reviewers: Also known as content contributors of Zomato, these are the people who help others make their choice by providing ratings and reviewing restaurants basis various parameters.

Key Partners:

Restaurants, delivery personnel, and food bloggers (by actively providing reviews on Zomato) are the critical partners in Zomato’s business model. It has tied up with various other companies as well that help in various aspects. A few of the notable partners are:

- London & Partners (helped Zomato in finding the location for office setup, market research, advise on legal matters, assistance in staff and management recruitment, etc.),

- Uber Taxi (this partnership increases convenience for customers who are eating out by enabling them to book an Uber ride to the restaurant they want to dine at from their app itself)

- Electronic payment companies like Visa, PayPal, etc.

In August 2021, a year after the launch of Swiggy Money (a digital wallet that Swiggy made in association with ICICI Bank), Zomato incorporated – Zomato Payments Private Limited (ZPPL), its wholly-owned subsidiary, to provide payment aggregator services and payment gateway services for its users following the RBI guidelines.

Value Proposition

Zomato follows the QAAA model, which consists of:

- Improving the quality of food: Through Hyperpure (talked about in detail later) and Food Hygiene rating, it helps its partner restaurants maintain high-quality standards.

- Boosting accessibility for customers: Starting with metro cities, Zomato has expanded to tier 2 and 3 cities and continues to increase its reach.

- Focusing on affordability: Zomato aims to make food affordable for its consumers without compromising on profits for partner restaurants.

- Driving the force of assortment: Zomato wants to help customers make an informed choice by providing a wide array of information in a structured manner.

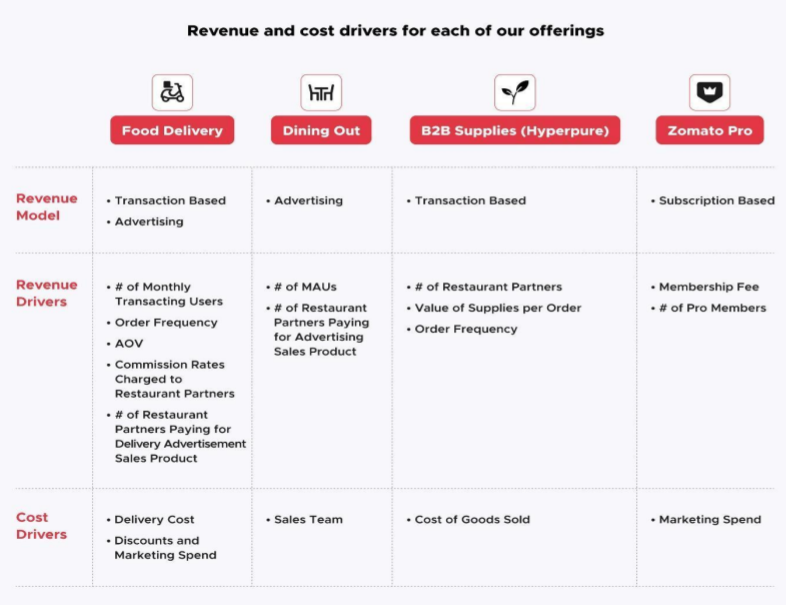

Revenue Model: How does Zomato make money?

1. Delivery charges:

Based on the number of orders, Zomato charges the partner restaurants a commission, which is divided between the company and the delivery partners.

In FY 2019, the company made four times more on delivery than it did the previous year. These charges formed around 75% of the total revenue for the company in that year, which makes delivery charges the largest source of income for the company.

According to the company, in India, the number of customers ordering food every month on their platform in FY 2021 touched 6.8 million customers with three times the average frequency.

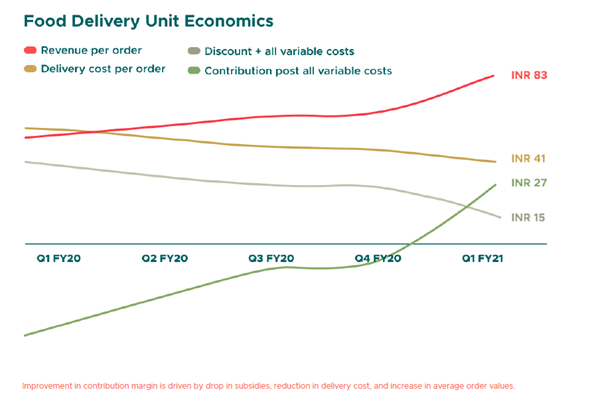

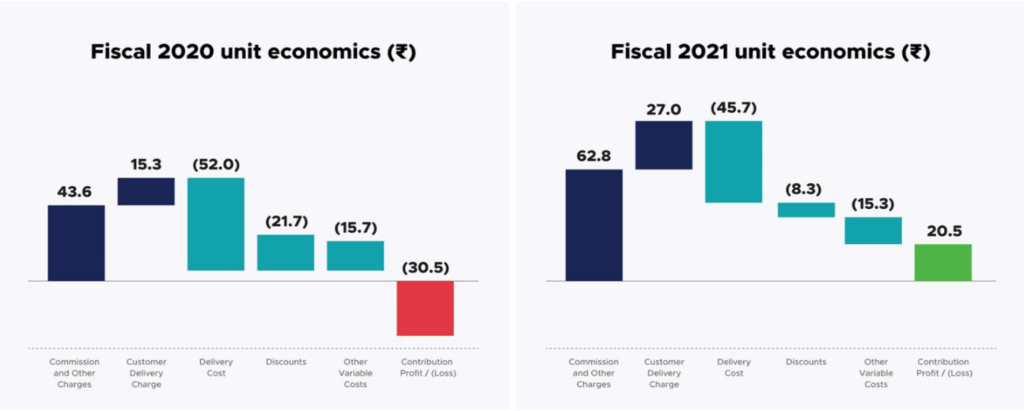

Contribution per order rose from -47 Rs/order in Q1 FY20 to +27 Rs/order in Q1FY21 (as shown in the below diagram)

2. Zomato Pro:

Earlier known by the name Zomato Gold, it was based on a freemium model where customers who paid a certain fee enjoyed premium services while dining at partner restaurants like offers on food and beverages.

Zomato introduced a new membership service in August, an ‘invite-only upgrade of Zomato Pro’s named Zomato Pro Plus. CEO Deepinder Goyal assured that Zomato would bear the entire cost of this service, and delivery partners won’t lose income on the same.

3. Event Organization:

Zomaland event of Zomato became quite popular before COVID hit, and it’s an excellent opportunity for partner restaurants to get visibility. Here Zomato earns from both customers (entry fee) and restaurants.

4. Restaurant Advertising:

With 90 billion monthly visits and 1.4 million restaurant listings, Zomato sure is the go-to place for people who want to find where to eat/order from next.

So, to stand out on the platform, the restaurants have to pay a certain sum of money so that their restaurant gets noticed by people visiting the platform. Zomato charges a certain amount of money from restaurants for advertising.

By charging a monthly subscription fee, it even provides restaurants with analytical tools like Zomato order (with the help of which restaurants can manage their offerings to consumers and give discounts accordingly) and Zomato book (managing table reservations more efficiently).

5. Zomato Kitchens:

Here, Zomato will connect kitchen partners (a partner who will construct the kitchen according to the design and specifications and in turn Zomato will pay money to operate this place) with restaurant partners (partners who will operate their restaurants in the space which Zomato had asked kitchen partners to construct).

The role of Zomato is to act as an aggregator bringing together both kitchen and restaurant partners. Since it has access to a large amount of data, it knows which location would be optimum for the construction of cloud kitchens.

It might start its cloud kitchens in the future and develop an in-house brand that competes with other restaurants on the platform. This could be a game-changer for Zomato and could turn out to be very profitable for them.

For more clarity on what is a cloud kitchen and its types (can use any)

6. Hyperpure by Zomato:

Launched in 2018 to provide good quality ingredients to partner restaurants, under this program, Zomato collaborates directly with farmers, producers, mills, and processors to monitor the source of each of the ingredients being sold to ensure freshness and quality of the produce. According to its RHP, in March 2021, it supplied ingredients to 9,225 restaurant partners across 6 Indian cities.

Zomato aims to bring more efficiency in the supply chain by using a technology-driven end-to-end platform so that fewer people are involved; high-quality ingredients are supplied and reducing food wastage.

During the first pandemic wave, many restaurants signed up on this platform, but these numbers didn’t grow as such during the second wave. Despite the challenges, investors are optimistic that the platform will increase by ten times in the next 2-3 years.

Cost structure:

Expenses incurred by the company can be broadly categorized into: platform development cost, branding and advertisement cost, credit card processing fees, legal and accounting fees, office maintenance cost, and employee salaries.

Fixing its Unit Economics

Unit economics is the profit made by the company per food order delivered, and positive unit economics is one of the biggest obstacles for any food delivery company in the world. According to its RHP, Zomato has been able to achieve positive unit economics.

This was possible by charging higher delivery charges from customers, decreasing discounts offered on the platform (offering high discounts initially was one of the ways it acquired customers on their platform and made them habituated to use it), decreasing the advertising expenses, and increased commission from restaurants, utilizing its logistics fleet more efficiently and adding new sources of revenue using subscriptions like Zomato Pro.

Content is the king for Zomato:

Zomato’s focus on content (content related to restaurants on its application and website) helps them to attract a large number of customers to their platform organically, and even numbers support this: in FY2021, 68% of new customers were acquired organically without any paid advertisements (source: Zomato RHP).

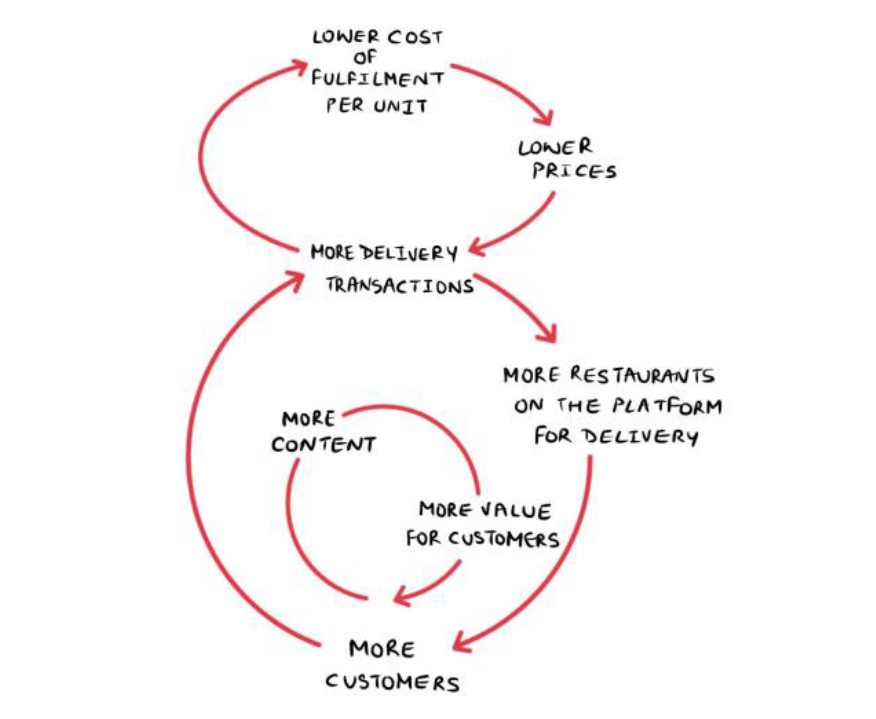

Customers coming to the platform further enhance the richness of this content by adding their ratings, reviews, and photographs of the restaurants and food served there. This creates a virtuous cycle that further feeds into the transaction funnel and creates a strong flywheel effect.

Marketing Strategy of Zomato

When it comes to its social media presence, Zomato has been very clear about its motive to make such content for its customers, which educates them about the brand and is also very refreshing and fun to watch. This is even evident from the bio company has written for itself on its social media handles, and the company does stand up to its promise of delivering entertainment. It focuses on the emotional benefit part rather than the functional benefits.

Zomato’s social media handles (YouTube, Instagram, Twitter, LinkedIn) are full of exciting campaigns that would be challenging to cover all (honestly, one can even write one complete article on that and we will be writing very soon). Here are some of the campaigns/posts/tweet threads that I enjoyed from Zomato in recent times:

Turning crisis into opportunity: #zomatoloot campaign

Almost a year back, when users criticized Zomato’s butter chicken ad on YouTube, the brand’s marketing team announced the #zomatoloot campaign where users were given a chance to create ads for the brand, and the winner got a sum of 25 lacs. This gave the brand a lot of free publicity and, of course, ads that it could use for the coming weeks. 4113 entries were received as a part of this contest, and the winning ad was:

Winning consumer’s trust during COVID times:

Last year, when the COVID wave hit and people were skeptical about ordering from outside, Zomato ensured that the safety of consumers is their priority, and they are taking steps for the same.

‘On-Time or Free’ (OTOF) campaign:

Taking inspiration from Dominoes, Zomato launched this campaign in December 2019 to guarantee on-time delivery to its customers on its entire menu and not just one food item (as used to happen traditionally).

Never late to the party:

Zomato seldomly misses an opportunity whenever a significant event occurs, be it related to sports, politics, or business.

Platform-specific content:

Zomato adapts its content according to the platform. For example, one can find memes related to office and colleagues on LinkedIn, reels made on ongoing trends on Instagram, replying to other brands on a constant thread in their context on Twitter, Food challenges, and Celebrity Brunches on YouTube, etc.

Zomato’s Twitter account regularly engages with the audience and keeps posting excellent content, which made Twitter award Zomato for the Best brand voice in 2020. Deepinder Goyal, its founder, makes sure that he makes important announcements related to its activities on Twitter.

OOH campaigns:

Before social media became so popular, brands used to spend heavily on billboard advertisements, and so did Zomato. Minimalistic, mostly text, but always grabs attention and brings a smile to your face.

Zomato also uses push notifications in mobile apps, email marketing, SEO, and paid advertisements to gain top-of-the-mind recall for consumers.

Future of Zomato:

In India, with the coming of COVID, the food delivery market saw a growth in the number of orders as people who used to go out to eat preferred to eat at their homes safely. This trend will most probably continue in the future as well.

One of the biggest challenges for any food delivery company is making unit economics per order favorable, which Zomato has achieved recently. Increased demand for food delivery and positive unit economics per order means that Zomato’s profitability is likely to grow.

Apart from food delivery, Hyperpure has been one of the focus areas for the company. Whether Zomato will be able to scale this up and reap profits out of it, is something to watch out for. Recently, cloud kitchens have been gaining traction.

How Rebel Foods business model is taking Kitchen to the clouds

After REBEL foods recently became a unicorn, it will be interesting to see how Zomato scales up its cloud kitchen venture: Zomato kitchens, in its multidimensional business model. Given the enormous access to data that Zomato has, it should try to compete in this segment.

-AMAZONPOLLY-ONLYWORDS-START-

Also, check out our most loved stories below

Why did Michelin, a tire company, decide to rate restaurants?

Is ‘Michelin Star’ by the same Michelin that sells tires, yes, it is! But Why? How a tire company evaluations became most coveted in the culinary industry?

Starbucks prices products on value not cost. Why?

In value-based pricing, products are price based on the perceived value instead of cost. Starbucks has mastered the art of value-based pricing. How?

Nike doesn’t sell shoes. It sells an idea!!

Nike has built one of the most powerful brands in the world through its benefit-based marketing strategy. What is this strategy and how Nike has used it?

Domino’s is not a pizza delivery company. What is it then?

How one step towards digital transformation completely changed the brand perception of Domino’s from a pizza delivery company to a technology company?

Why does Tesla’s Zero Dollar Budget Marketing Strategy work?

Touted as the most valuable car company in the world, Tesla firmly sticks to its zero dollar marketing. Then what is Tesla’s marketing strategy?

Yahoo! The story of strategic mistakes

Yahoo’s story or case study is full of strategic mistakes. From wrong to missed acquisitions, wrong CEOs, the list is endless. No matter how great the product was!!

Apple – A Unique Take on Social Media Strategy

Apple’s social media strategy is extremely unusual. In this piece, we connect Apple’s unique and successful take on social media to its core values.

-AMAZONPOLLY-ONLYWORDS-END-