Aflac (American Family Life Assurance Company) is an American insurance company. The Company’s principal business is supplemental health and life insurance products to provide customers with the best value in supplemental insurance products in the United States (U.S.) and Japan.

In the U.S., Aflac underwrites a wide range of insurance policies. Still, it is perhaps more known for its payroll deduction insurance coverage, which pays cash benefits when a policyholder has a covered accident or illness. The Parent Company and its subsidiaries provide financial protection to more than 50 million people worldwide.

Aflac’s strategy for growth in the U.S. and Japan has remained straightforward and consistent for many years. The Company develops relevant supplemental insurance products and sells them through expanded distribution channels. To help promote its insurance products, the company’s marketing campaigns feature the Aflac Duck.

In 1999, the Company had been running commercials for nearly a decade, but its brand awareness was hovering at about 10%. An innovative marketing campaign with something unique and memorable to build brand awareness was needed. The Aflac Duck’s first commercial in the U.S., “Park Bench,” aired on January 1, 2000, taught consumers how to pronounce “Aflac.”

The Aflac Duck made its international debut in Japan in 2003. In the two decades since his U.S. debut, the Aflac Duck has become one of the most familiar advertising icons in the world, appearing in many commercials and countless print ads in both the U.S. and Japan. Today, the Aflac Duck is a helpmate who increases brand knowledge and connection.

In this strategy story, we analyzed the business model of Aflac and understood what it does and how it works.

What does Aflac do? How is the business model of Aflac structured?

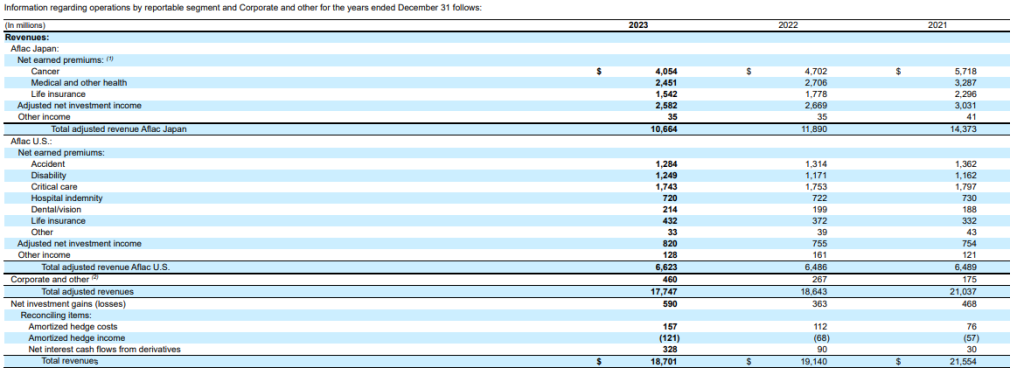

The business model of Aflac relies on the insurance premiums and investments. The business model of Aflac consists of two reporting segments: Aflac Japan and Aflac U.S.

- The primary insurance subsidiary in the Aflac Japan segment is Aflac Life Insurance Japan Ltd.

- Aflac U.S. includes the insurance subsidiaries American Family Life Assurance Company of Columbus (Aflac); Continental American Insurance Company (CAIC), branded as Aflac Group Insurance (AGI); American Family Life Assurance Company of New York (Aflac New York); and Tier One Insurance Company (TOIC); as well as Argus Dental & Vision, Inc. (Argus).

AFLAC JAPAN

With Japan’s aging population and rising healthcare costs, supplemental healthcare insurance products remain attractive. However, due to the aging population and decline in the birth rate, new opportunities for customer demographics are not as readily available. Japan’s existing and potential customers seek easily understood, cost-effective products that can be accessed through technology-enabled devices.

Aflac Japan is the principal contributor to the Parent Company’s consolidated earnings and the largest insurer in Japan regarding cancer and medical (third sector insurance products) policies in force.

As of December 31, 2023, Aflac Japan exceeded 22 million individual policies in force in Japan. Aflac Japan continued to be the number one seller of cancer insurance policies in Japan throughout 2021, with more than 14 million cancer policies in force as of December 31, 2023.

Insurance Products

Aflac Japan’s third-sector insurance products are supplemental products designed to help consumers pay for medical and nonmedical costs that are not reimbursed under Japan’s national health insurance system. Changes in Japan’s economy and an aging population have put increasing pressure on Japan’s national health care system.

As a result, more costs have been shifted to Japanese consumers, who have become increasingly interested in insurance products that help them manage those costs. In addition, since 2020, the pandemic has accelerated digitization and significantly heightened customer awareness of potential financial and healthcare burdens.

Aflac Japan has responded to this consumer need by enhancing existing and developing new products, such as a nursing care product introduced in 2021. The focus at Aflac Japan remains on maintaining leadership in third-sector insurance products that are less interest rate sensitive and have solid and stable margins.

Cancer Insurance: Aflac Japan pioneered the cancer insurance market in Japan in 1974 and remains the number one cancer insurance provider in Japan today. Aflac Japan’s cancer insurance products provide a lump-sum benefit upon initial diagnosis of cancer and fixed daily benefits for subsequent hospitalization and outpatient treatments due to cancer, as well as cancer-related surgical and convalescent care benefits.

Medical and Other Health Insurance

Medical Insurance: Aflac Japan’s medical insurance products provide benefits for hospitalization, surgeries, and outpatient treatment of various illnesses, as well as lump sum benefits related to three critical illnesses: cancer, heart attack, and stroke.

Nursing Care Insurance: Aflac Japan’s Nursing Care Insurance covers out-of-pocket costs incurred when receiving public nursing care services.

Income Support Insurance: Aflac Japan’s Income Support Insurance provides fixed-benefit amounts if a policyholder cannot work due to a significant illness or injury.

Life Insurance

Whole Life: Aflac Japan launched Prepare Smart Whole-Life Insurance in 2018, a whole life insurance product with low cash surrender value, which offers non-smoking policyholders further discounted premiums, and it provides beneficiaries, typically a designated family member, with a predetermined benefit payment upon the death of the insured.

GIFT: GIFT is a term life insurance product that provides a designated family member with a fixed amount of money every month upon a breadwinner’s death or serious disability as family support.

Lemonade Business Model: To Become the most loved insurance company

WAYS and Child Endowment: WAYS is an insurance product with features allowing policyholders to convert a portion of their life insurance to medical, nursing care, or fixed annuity benefits at a predetermined age. Aflac Japan’s child endowment insurance product offers a death benefit until a child reaches age 18.

Distribution Channels

Traditional Sales Channel: This distribution channel includes individual agencies, independent corporate agencies, and affiliated corporate agencies. Aflac Japan was represented by more than 8,000 sales agencies at the end of 2021, with approximately 112,000 licensed sales associates employed by those agencies, including individual agencies.

Banks: Consumers in Japan rely on banks to provide traditional bank services and, as one key source, provide insurance solutions and other services. By the end of 2021, Aflac Japan had agreements with approximately 90% of the total number of banks in Japan to sell its products.

Dai-ichi Life: Aflac Japan’s alliance with Dai-ichi Life was launched in 2001, and approximately 40,000 Dai-ichi Life representatives offered Aflac’s cancer products. \

Japan Post Group: Aflac Japan’s alliance with Japan Post Group was launched in 2008. After the alliance strengthened in 2013, the number of postal outlets of Japan Post selling Aflac Japan’s cancer products increased to more than 20,000.

Daido Life: In 2013, Aflac Japan and Daido Life Insurance entered into an agreement for Daido to sell Aflac Japan’s cancer insurance products specifically to the Hojinkai market, which is an association of small businesses.

AFLAC U.S.

Customer demographics continue to evolve, and new opportunities present themselves in different customer segments, such as the millennial and multicultural markets. Customer expectations and preferences are changing.

Trends indicate existing, and potential customers seek cost-effective solutions that are easily understood and can be accessed through technology-enabled devices. Additionally, income protection and the health needs of retiring baby boomers continue to shape the insurance industry.

Aflac designs its U.S. insurance products to provide supplemental coverage for people with significant medical or primary insurance coverage, as Aflac U.S. insurance policies pay benefits regardless of other insurance. Aflac U.S. products are distributed in the individual and group supplemental insurance markets.

Insurance Products

Cancer Insurance: Aflac U.S.’s cancer insurance products provide a lump-sum benefit upon initial cancer diagnosis and subsequent benefits for treatment received due to cancer. Aflac U.S. offers cancer insurance on an individual basis.

Accident Insurance: Aflac U.S. offers accident coverage on both an individual and group basis. These policies pay cash benefits in the event of a covered injury. The accident portion of the policy includes lump-sum benefits for accidental death, dismemberment, and specific injuries, as well as fixed benefits for hospital confinement.

Disability Insurance: Aflac U.S. offers short-term disability benefits on both an individual and group basis and long-term disability benefits on a group basis. The individual short-term disability product offers an Aflac Value Rider that pays a benefit, fewer claims, for every consecutive five-year term the policy is in force.

Critical Illness Insurance: Aflac U.S. offers coverage for critical illness plans individually and in groups. These policies are designed to pay cash benefits in the event of critical illnesses such as heart attack, stroke, or cancer.

Hospital Indemnity Insurance: Aflac U.S. offers hospital indemnity coverage on both an individual and group basis. Hospital indemnity products provide policyholders fixed dollar benefits triggered by hospitalization due to accident or sickness.

Dental and Vision Insurance: Aflac U.S. offers network dental and vision products on a group basis. Aflac U.S. offers fixed-benefit dental coverage on both an individual and group basis. Aflac U.S. offers Vision Now, an individually issued policy that provides benefits for serious eye health conditions and loss of sight, and coverage for corrective eye materials and exam benefits.

Life: Aflac U.S. offers term- and whole-life policies on both an individual and group basis.

Distribution Channels

Independent Associates/Career Agents: The career agent channel in Aflac U.S. focuses on marketing Aflac to the small business market, defined as employers of between three and 99 employees. U.S. sales associates are independent contractors and are paid commissions and other variable compensation based on first-year and renewal premiums from their sales of insurance products.

How does Oscar Health insurance work: Business Model

Brokers: The broker channel of Aflac U.S. focuses on selling to the mid-and large-case market, which comprises employers with 100 or more employees and typically an average size of 1,000 employees or more. Brokers in the U.S. are independent contractors and are paid commissions based on first-year and renewal premiums from their sales of insurance products.

Consumer Markets: While Aflac U.S. primarily markets its insurance products at the worksite, Aflac U.S. is also expanding its distribution strategy to directly reach consumers outside the traditional worksite through digital lead generation.

Revenue Model

The business model of Aflac earns its revenues principally from insurance premiums and investments. Aflac’s operating expenses primarily consist of insurance benefits provided and reserves established for anticipated future insurance benefits, general business expenses, commissions, and other costs of selling and servicing its products.

Profitability for Aflac’s business model depends principally on its ability to price its insurance products at a level that enables it to earn a margin over the costs associated with providing benefits and administering those products.

For the full year of 2023, total revenues were down 2.3% to $18.7 billion, compared with $19.1 billion for the full year of 2022. Net earnings were $4.7 billion, or $7.78 per diluted share, for the full year of 2023, compared with $4.4 billion, or $6.93 per diluted

share, for the full year of 2022.