Tesla designs, develops, manufactures, sells, and leases high-performance fully electric vehicles, energy generation & storage systems and offers services related to its products.

Tesla generally sells products directly to customers through its website and retail locations. Tesla also continues to grow its customer-facing infrastructure through a global network of vehicle service centers, Mobile Service technicians, body shops, Supercharger stations, and Destination Chargers to accelerate the widespread adoption of its products.

Tesla emphasizes performance, attractive styling, and the safety of its users and workforce in the design and manufacture of its products and is continuing to develop full self-driving technology for improved safety.

Tesla also strives to lower the cost of ownership for its customers through continuous efforts to reduce manufacturing costs and offer financial and other services tailored to its products.

Tesla’s mission is to accelerate the world’s transition to sustainable energy, engineering expertise, a vertically integrated business model, and a focus on user experience that differentiates it from other companies.

The business model of Tesla is built around selling and leasing in two industries: Automotive and Energy Generation & Storage. As strategy enthusiasts, we decided to break down the business model of Tesla and learn how Tesla makes money. We will also look at the supply chain strategy of Tesla.

- In 2022, Tesla produced 1,369,611 consumer vehicles. Tesla is currently focused on increasing vehicle production, capacity, and delivery capabilities, improving and developing battery technologies, improving our FSD capabilities, increasing the affordability and efficiency of our vehicles, bringing new products to market, and expanding our global infrastructure.

- In 2022, Tesla deployed 6.5 GWh of energy storage products and 348 megawatts of solar energy systems. Tesla is currently focused on ramping production of energy storage products, improving our Solar Roof installation capability and efficiency, and increasing the market share of retrofit and new build solar energy systems.

With Tesla, Elon Musk Isn’t Just making Electric Cars

How does Tesla make money? What is the business model of Tesla?

Products & Services

Automotive

The automotive segment includes the design, development, manufacturing, sales, and leasing of electric vehicles, as well as sales of automotive regulatory credits.

Additionally, the automotive segment comprises services and other services, including non-warranty after-sales vehicle services, sales of used vehicles, retail merchandise, sales by its acquired subsidiaries to third-party customers, and vehicle insurance revenue.

In Automotive, Tesla has four products: Model 3, Model Y, Model S, and Model X. Tesla has also announced specialized consumer electric vehicles in Cybertruck and the new Tesla Roadster, and a commercial electric vehicle in Tesla Semi.

Tesla plans to continue leveraging developments in its proprietary Full Self-Driving (“FSD”), battery cell, and other technologies.

Energy

In Energy Generation & Storage, Tesla has two offerings: Energy Storage Products & Solar Energy Offerings. The energy generation and storage segment includes the design, manufacture, installation, sales, and leasing of solar energy generation and energy storage products and related services and sales of solar energy systems incentives.

Energy Storage Products: Powerwall and Megapack are Tesla’s lithium-ion battery energy storage products. Powerwall is designed to store energy at home or in small commercial facilities. Megapack is an energy storage solution for commercial, industrial, utility, and energy generation customers, multiple of which may be grouped to form larger installations of gigawatt hours (“GWh”) or greater capacity.

Tesla also continues to develop software capabilities for remotely controlling and dispatching its energy storage systems across a wide range of markets and applications, including through its real-time energy control and optimization platforms.

Solar Energy Offerings: Tesla sells retrofit solar energy systems to customers and channel partners. Tesla purchases most components for its retrofit solar energy systems from multiple sources to ensure competitive pricing and adequate supply.

Tesla sells its Solar Roof, which combines premium glass roof tiles with energy generation, directly to customers and through channel customers. Tesla continues improving its installation capability and efficiency through collaboration with real estate developers and builders on new homes.

What is Tesla’s Zero Dollar Budget Marketing Strategy?

How does Tesla make money?

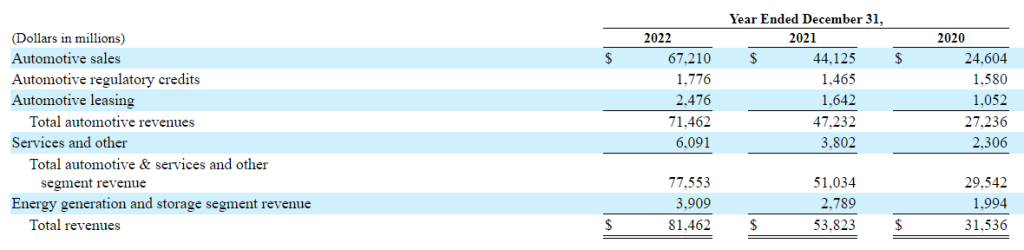

In 2022, Tesla made $81.46 billion, representing an increase of $27.64 billion compared to the prior year. Tesla makes money from three business segments: Sales and Services, which includes Automotive and Energy generation & storage sales, Automotive leasing, and Energy generation and storage leasing. Let’s understand each revenue segment in detail.

1. Sales & Services

Tesla generated 96% of revenue in 2022 in this segment, which comprises five sub-segments: Automotive Sales without a Resale Value Guarantee; Automotive Sales with a Resale Value Guarantee or a Buyback Option; Automotive regulatory credits; Energy generation & storage sales; and Services & Others.

1.1 Automotive Sales without Resale Value Guarantee:

Automotive sales revenue includes revenues related to deliveries of new vehicles and pay-per-use charges, including access to Tesla’s Supercharger network, internet connectivity, Full Self Driving (“FSD”) features, and over-the-air software updates. Automotive sales without a resale value guarantee are Tesla’s most significant revenue stream at 82%.

1.2 Automotive Sales with a Resale Value Guarantee or a Buyback Option

Tesla offers resale value guarantees or similar buyback terms to certain international customers who purchase and finance their vehicles through one of its specified commercial banking partners. Tesla also provides resale value guarantees in connection with automotive sales to certain leasing partners.

Under these programs, Tesla receives full payment for the vehicle sales price at the time of delivery. The buyer can sell their vehicle back to Tesla during the guarantee period for a pre-determined resale value. Automotive Sales with a Resale Value Guarantee or a Buyback Option contributed 1.75% to Tesla’s top line in 2021.

1.3 Automotive Regulatory Credits

Tesla earns tradable credits in the operation of its automotive business under various regulations related to zero-emission vehicles, greenhouse gas, fuel economy, and clean fuel. Tesla sells these credits to other regulated entities that can use the credits to comply with emission standards and other regulatory requirements. Automotive Regulatory Credits contributed 2.7% to Tesla’s revenue in 2021.

1.4 Energy Generation and Storage Sales

In this segment, Tesla makes money from selling solar energy systems and energy storage systems to residential, small commercial, large commercial, and utility-grade customers, including engineering, design, and system installation. \

Post-installation, residential and small-scale commercial customers receive a proprietary monitoring system that captures and displays historical energy generation data. Energy Generation and Storage Sales contributed 4.2% to Tesla’s revenue in 2021.

1.5 Services and Other Revenue

Services and other revenue consist of non-warranty after-sales vehicle services, sales of used vehicles, retail merchandise, sales by its acquired subsidiaries to third-party customers, and vehicle insurance revenue. Services and Other Revenue contributed 7% to Tesla’s revenue in 2021.

2. Automotive Leasing Revenue

2.1 Direct Vehicle Operating Leasing Program

Qualifying customers can lease a vehicle directly from Tesla for up to 48 months. At the end of the lease term, customers must return the vehicles to Tesla or may opt to purchase the vehicles for a pre-determined residual value. Direct Vehicle Operating Leasing Program contributed 2.3% to Tesla’s revenue in 2021.

2.2 Direct Sales-Type Leasing Program

Depending on the specific program, customers may or may not have a right to return the vehicle to Tesla during or at the end of the lease term. If the customer does not have a right to return, the customer will take title to the vehicle at the end of the lease term after making all contractual payments. Direct Sales-Type Leasing Program contributed 0.7% to Tesla’s revenue in 2021.

3. Energy Generation and Storage Leasing

For revenue arrangements where Tesla is the lessor under operating lease agreements for energy generation and storage products, Tesla records lease revenue from minimum lease payments, including upfront rebates and incentives earned from such systems. Energy Generation and Storage Leasing contributed 1% to Tesla’s revenue in 2021.

Supply Chain strategy of Tesla

Tesla’s products use thousands of purchased parts that are sourced from hundreds of suppliers across the world. Tesla has developed close relationships with vendors of critical parts such as battery cells, electronics, and complex vehicle assemblies.

Specific components purchased from these suppliers are shared or are similar across many product lines, allowing Tesla to take advantage of pricing efficiencies from economies of scale.

As is the case for most automotive companies, the supply chain strategy of Tesla focuses on sourcing components and systems from single suppliers. Where multiple sources are available for specific vital components, Tesla works towards qualifying multiple suppliers to minimize production risks due to supply disruptions. The following list will give you a brief idea of Tesla’s suppliers.

As part of its supply chain strategy, Tesla also mitigates risk by maintaining safety stock for critical parts and assemblies and die banks for components with lengthy procurement lead times.

Tesla’s products use various raw materials, including aluminum, steel, cobalt, lithium, nickel, and copper. Pricing for these materials is governed by market conditions and may fluctuate due to factors outside Tesla’s control, such as supply and demand and market speculation. Tesla strives to execute long-term supply contracts for such materials at competitive pricing and to have a rock-solid supply chain strategy.

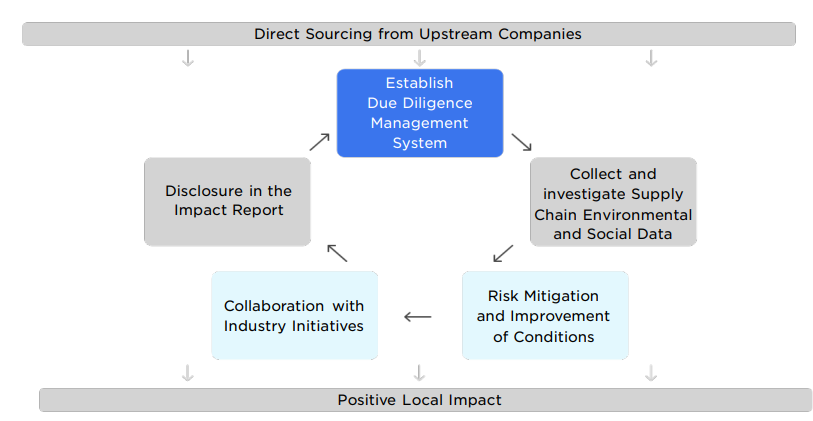

Tesla wishes to make its supply chain and business model sustainable and reduce its carbon footprint. Tesla has plans to incentivize suppliers to provide energy and emissions data. Additionally, Tesla only sources responsibly produced materials. By responsible sourcing, Tesla means to:

- Increase the share of materials it sources directly from suppliers and those closer to its factories (supply chain localization); and

- Continue to source globally to contribute to the improvement of local conditions in its sourcing communities.

Its suppliers must provide evidence of management systems that ensure social, environmental, and sustainability best practices in their operations and demonstrate a commitment to responsible sourcing in their supply chains.

Tesla has already started identifying which materials and processes in its supply chain are critical emitters so it can prioritize engagement and projects to address these emissions.

Tesla has an advantage of a high level of vertical integration in its business model and direct sourcing relationships, which means it is positioned to manage upstream emissions better than most.