The residential brokerage industry is highly fragmented, with numerous active, licensed agents and brokerages, and is evolving rapidly in response to technological advancements, changing customer preferences, and new offerings.

Additionally, traditional real estate agents earn commissions based on a home’s sale price without directly considering customer satisfaction or service quality. Another challenge for these conventional real estate agents is the excessive competition.

Hence, agents spend significant time and money prospecting customers through traditional advertising channels and networking activities, reducing productivity.

To solve all these challenges, Redfin built the first large-scale brokerage-based business model that stands apart in consumers’ minds for delivering a unique and consistent customer experience, where the value is in brokerage and its technologies, not just a personal relationship with one agent.

As strategy enthusiasts, we decided to analyze the business model of Redfin- and understand how Redfin works and makes money. We will also understand who Redfin’s competitors are and what factors Redfin competes on.

What is Redfin? How does Redfin work?

Redfin, founded in 2004, is a technology-powered residential real estate brokerage and is on a mission to redefine real estate in the consumer’s favor.

The way Redfin works is simple. In a commission-driven industry, Redfin puts the customer first. Redfin does this by pairing its agents with its technology to create a faster, better, and less expensive service.

Redfin meets customers through its listings-search website and mobile application, reducing the marketing costs that can keep fees high. Redfin lets homebuyers schedule home tours through mobile.

Redfin uses machine learning to recommend better listings than any customer could find on their own. And Redfin pays lead agents based partly on customer satisfaction, not just commission. Redfin measured its NPS as 50 against the industry average of 38.

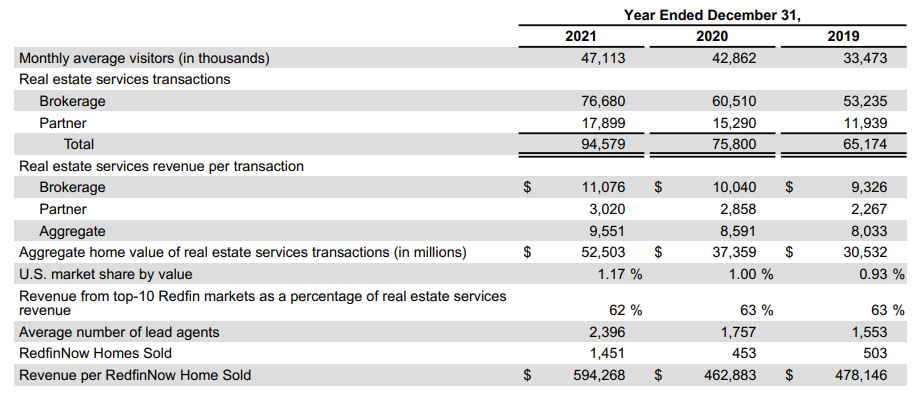

Redfin listings were on the market for 24 days in 2021 compared to the industry average of more than 28 days. Redfin also claims that customers buy and sell the same home at a 53% higher rate than competing brokerages.

Besides selling homes, Redfin also works on other services around real estate, like loan mortgage, title and settlement services, and digital platforms to connect consumers with available apartments and houses for rent. We shall see all services of Redfin in detail in the business model.

How does Redfin make money? What is the business model of Redfin?

Value Proposition

Better Service through technology: Redfin uses a wide range of next-generation technologies to empower customers and increase agents’ productivity. This leads to consistently better customer service at a lower cost.

Redfin uses machine learning and artificial intelligence to answer customers’ most important questions about where to live, how much a home is worth, and when to move.

Redfin leverages cloud computing to perform computationally intensive comparisons of homes at a scale that would otherwise be cost-prohibitive. Redfin also uses three-dimensional scanning cameras that let potential homebuyers walk through the property online.

On-Demand and personalized Service: Homebuyers can schedule home tours quickly as per the lead agent’s availability, location, areas of expertise, and past interactions with that buyer.

Redfin agents learn about the customer before the tour through a system that records homes of interest, different listing recommendations, or an on-the-spot offer.

Redfin agents update this system at every customer tour as Redfin’s endeavor to offer a personalized experience depends on these data inputs.

Customers Save Money: Redfin gives homebuyers a portion of the commissions that it earns. Redfin charges most home sellers a commission of 1% to 1.5%, compared to the 2.5% to 3% typically charged by traditional brokerages. Redfin refunded homebuyers an average of $1,900/transaction in 2021.

Products

The business model of Redfin is designed to combine brokerage, rentals, mortgage, title services, and instant offers to directly purchase a consumer’s home into one solution, sharing information, coordinating deadlines, and streamlining processes so that a consumer’s move is more manageable and often less costly.

As Redfin integrates these services more closely over time, Redfin aims to help consumers move much more efficiently than a combination of stand-alone companies.

Redfin Mortgage underwrites mortgage loans, and after originating each loan, Redfin Mortgage sells the loans to third-party mortgage investors. Redfin Mortgage does not intend to retain or service mortgage loans.

Title Forward offers title and settlement services to offer a completely digital closing, leading to efficiency gains for our brokerage, title, and mortgage businesses.

RedfinNow buys homes directly from homeowners and resells them to homebuyers. Customers who sell through RedfinNow typically get less money for their homes than they would be listing with a real estate agent. However, they get that money faster with less risk and disruption.

RentPath offers an end-to-end digital marketing platform that connects consumers with available apartments and houses for rent across all 50 states and the District of Columbia.

Marketing Strategy of Redfin

With potential customers sometimes hopping between websites and different individual real estate agents during a home search—and often deciding against a move—it’s easy for an advertiser to lose track of who closes.

Redfin analyzes billions of interactions from customers and potential customers in its databases. As part of its marketing strategy, Redfin runs over a hundred experiments on its website and mobile tools, with many more on third-party channels to identify the most effective advertising.

Redfin applies this data-driven marketing strategy to decisions about which pages to optimize for search engine traffic, what combination of email messages drives the most sales, and which moments in a TV commercial inspire the most vigorous consumer response.

The goal of this data-driven marketing approach is a formula for cost-effectively driving increased customer awareness through both digital and traditional advertising channels:

- Search engine optimization. Redfin constantly upgrades website content so that top-trafficked search engines rank Redfin for properties, neighborhoods, and regions.

- Targeted-email campaigns. Redfin runs targeted email campaigns to connect with customers. These email campaigns, powered by machine learning, recommend relevant new listings to homebuyers and home sellers.

- Paid-search advertising. Redfin advertises with top-trafficked search engines and modifies campaigns based on results.

- Social media marketing. Redfin purchases targeted ads on social media networks such as Facebook and Twitter to generate traffic and attract new customers. Redfin can pay more for one particular Facebook ad if Redfin has determined that the people who click on it are highly likely to buy a home.

- Traditional media. Redfin markets through traditional media, including TV, radio, and direct mailings.

How does Redfin make money: revenue model

Redfin makes money primarily from commissions and fees charged on each real estate services transaction closed by its lead agents or partner agents, from the sale of homes and subscription-based product offerings for its rental business.

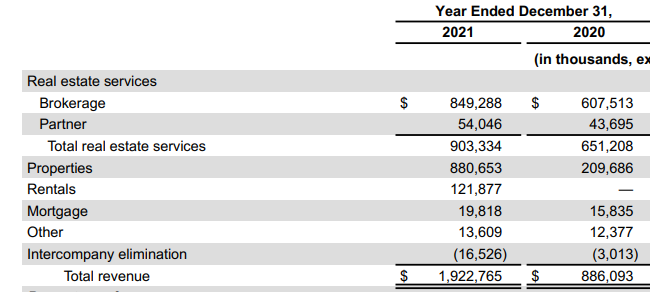

Redfin made $1.922 billion in 2021. Let’s see the different revenue segments through which Redfin makes money.

Real Estate Services Revenue

Brokerage Revenue—Brokerage revenue includes Redfin’s offer and listing services, where the lead agents represent home buyers and sellers. Redfin recognizes commission-based brokerage revenue upon closing of a brokerage transaction.

Partner Revenue—Partner revenue consists of fees paid to Redfin from partner agents or under other referral agreements. Partner revenue is affected by the number of partner transactions closed, home-sale prices, commission rates, and the amount Redfin refunds customers.

Properties Revenue: Properties revenue consists of revenue earned when Redfin sells homes that Redfin bought directly from homeowners. Properties revenue represents the sales price of the home.

Rentals Revenue: Rentals revenue primarily consists of subscription-based product offerings for internet listing services, lead management, and digital marketing solutions.

Mortgage Revenue: Mortgage revenue includes fees earned from mortgage origination services.

Other Revenue: Other services revenue includes fees earned from title settlement services, Walk Score data services, and advertising. Substantially all income from other services is recognized when the service is provided.

In 2021, revenue increased by $1,036.7 million, or 117%, compared with 2020. The increase in brokerage transactions was attributable to higher customer awareness of Redfin and growing customer demand. In contrast, the increase in brokerage revenue per transaction was driven primarily by rising home values.

Redfin Competitors

Redfin’s competitors are other residential real estate brokerages, which include franchise operations affiliated with national or local brands and small independent brokerages. The biggest Redfin competitors are Realtor.com, Zumper, HomeLight, Zillow, and OpenDoor.

Redfin also competes with hybrid residential brokerages, which combine Internet technology and brokerage services, and a growing number of others that operate with non-traditional real estate business models.

Competition is particularly intense in some of the densely populated metropolitan markets Redfin serves. They are dominated by entrenched real estate brokerages and are the primary markets for innovative and well-capitalized new entrants.

Redfin has various competitors for its different products:

- Redfin Mortgage competes with numerous national and local multi-product banks and focused mortgage originators. Redfin competes primarily on service, product selection, interest rates, and origination fees.

- Title Forward competes with numerous national and local companies that typically focus solely on these services. Redfin competes primarily on the timeliness of service and fees.

- RedfinNow competes with real estate companies whose primary service is buying and selling homes and home rental companies that purchase homes and then rent them. Redfin competes primarily on the prices Redfin offers customers to buy their homes.

- RentPath competes with companies that provide an online marketplace for residential rental listings and related digital marketing solutions. Redfin competes primarily on the scope and quality of listings Redfin offer on its digital platforms, value-added digital marketing solutions, traffic generated through our websites and mobile applications, and the breadth of its broader marketing services.