If you thought Fintech was hot, then “Buy Now, Pay Later” is the sun! Fintech is fusion combustion that shows no signs of cooling down any time later. Users love it because it’s so convenient to use it over a traditional lending product, and Merchants enjoy it too because it helps them boost their top lines. And that has attracted Venture Capitalists, like Bees to Honey.

Klarna, Affirm, Revolut, LazyPay. And yet there is one name that we have heard a lot of in recent days. AfterPay!

Interestingly, AfterPay was a little late to the party, being relatively younger than most other biggies in the space. The company was started in 2014, by Nick Molnar and Anthony Eisen, in Sydney, Australia. Afterpay provides four months of interest-free installments to consumers at checkout.

Afterpay’s simple one-click approach to breaking big-ticket items into smaller, easier-to-pay monthly installments has garnered over 16.2 million (FY21) users over the globe. And thanks to the network effects in play, they have attracted over 88,200 merchants over the globe, with 63,100 from the APAC region alone.

In comparison, most other BNPL players had started operating in the mid-2000s. Some of them have tie-ups with over 250,000 merchants. And yet, Block (erstwhile Square) acquired AfterPay for a whopping $29 Billion. What ticks? What is so special about Afterpay’s business model? But before we try answering that, let us understand the BNPL space a little better, shall we?

About BNPL (Buy Now Pay Later)

Lending is as old as commerce itself. So what then makes BNPL such a vast market? Because BNPL is tech first, lending next. Another distinction is that BNPL players do not position themselves as lending tech companies but instead payments. And going by most of their offerings, which happen to be interest-free, they are sticking to that strategy.

Now there are, in essence, two kinds of BNPL products. One is when you can defer the payment of the bill amount by about 15 to 45 days, at the end of which you will have to pay the total amount. Or the other kind, which is where you can split your bill amount into 3 or 4 equal installments spread over that many months.

So, how do BNPL products like Afterpay make money without interest fees? Simply, by charging the merchants a percentage of the total basket value. Typically this fee varies from 15-30%, unlike traditional credit card networks charging 1-5%. Why then do merchants prefer BNPL? The consumer acceptance of BNPL is one for sure. But also the spectacular growth of the industry compared to traditional carded transactions, which by industry estimates are plateauing.

Also, there is this element of Endowment bias (placing higher emotional value to objects users own) that BNPL brings in, resulting in a lower return by users. And returns have been the biggest bane for e-commerce giants, even the likes of Amazon. And this becomes an issue for sellers who list on platforms because not only is the return shipment cost passed on to them, but the examination, repair, and repackaging end up being additional costs.

And if you’ve watched the iconic movie Never Been Kissed, you’d be able to relate to why this could be a significant issue for online merchants!

What is unique about Afterpay’s business model?

Afterpay offers a simple platform for consumers and merchants. Afterpay provides a customer-centric product that has resonated with consumers because it has turned the traditional model of credit on its head. Merchants benefit significantly by being part of the Afterpay ecosystem, as it delivers them value, reduced risk, and has deeper engagement with customers.

The Afterpay service is offered as an option by participating merchants online and/or in-store. Customers who choose to purchase products using Afterpay receive the purchased products upfront and repay the purchase price (or order value) in four installments (every two weeks) to Afterpay. Afterpay pays the merchant for the purchased product(s) upfront, minus our fee.

Afterpay has become an important source of new customers for retailers. Millions of customers come to Afterpay to determine where to shop and Afterpay provides leads to its retail partners. Many retailers would not have access to such a large pool of core millennial customers otherwise.

How does Afterpay make money?

When AfterPay started operation in 2014, the global BNPL market had several players, like Affirm and Klarna, and even PayPal offering their BNPL payment option to their merchants at checkout. However, there were no such players in the Australian market.

How is the European Klarna championing “Buy Now Pay Later”?

Which meant it was a wide-open field for the enterprising duo, Molnar and Eisen, to exploit. The pair worked with TouchCorp, a specialist in developing payment tech solutions, to launch a BNPL product for Australian merchants.

The first merchant that AfterPay onboarded happened to be IceOnline, one of Australia’s biggest online jewelers, and also Molnar’s previous startup venture. Using Molnar’s impressive persuasion skills, they kept onboarding one key merchant after the other.

They grew 140% Year over Year to 300+ merchants in 2016 and decided to go public with a A$25 million IPO! It is essential for a public company to show the numbers. Afterpay’s business model is completely free for customers who pay on time – helping people spend responsibly without incurring interest, fees, or extended debt. So how did, and how does Afterpay continue to make money?

Afterpay makes money through Afterpay Income (including merchant income, affiliate fees, and interchange earned from the US virtual one-time use card) and Other Income (primarily Late Fees and advertising.)

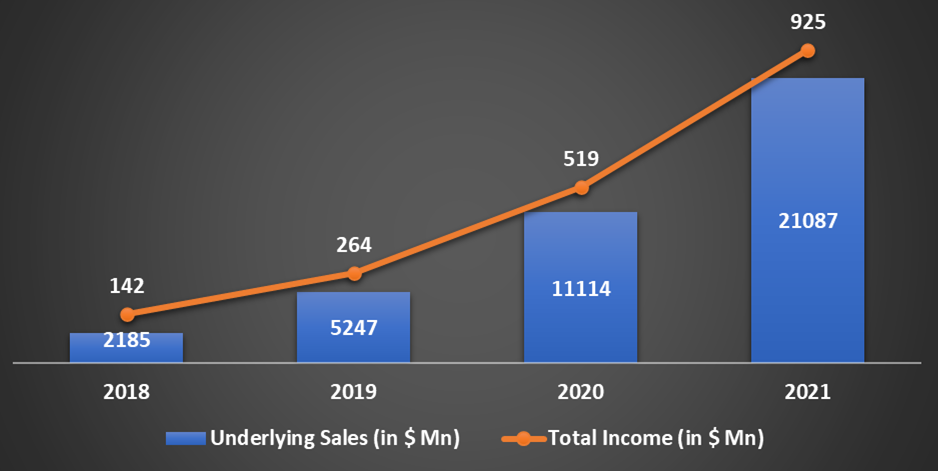

In the year ended 30 June 2021, Afterpay Income increased by 90% on the prior year to $822.3 million. Afterpay Income as a percentage of Afterpay Underlying Sales was 3.9% in the year, in line with the prior year.

Late Fees increased to $87.3 million from $68.8 million in the prior year. However, Late Fees have decreased as a percentage of Underlying Sales and now represent less than 10% of Afterpay Total Income. Let’s understand each revenue stream in detail to see how Afterpay makes money.

Merchant fees

Afterpay does not charge a payment processing fee to merchants, because payment processing is only one component of our overall service. Instead, Afterpay charges

merchants for a range of services. It is Afterpay that incurs the cost of processing payments via the switch-to-acquirer model. As with other merchants, the costs incurred by Afterpay vary according to the type of card used by the customer.

For every transaction that AfterPay processes on behalf of the merchant, they take a flat fee of $0.3 along with a variable pay of 4-6% from the merchant, depending on the volumes the merchant brings in to AfterPay. The higher the volumes, the lower this will cost the merchant. This is in comparison to 1.3-5% Merchant Discount Rates or MDR that typical card Networks like Visa and MasterCard charge.

So what then attracts Merchants to AfterPay? First and foremost, the risk of default is borne by AfterPay and not the merchant. Then there is also the hypothesis, and numerous studies are done to prove it, that BNPL at checkout increases the cart conversion and the ticket sizes of the purchase by 10-20%.

And lastly, consumers who have used a BNPL product are less likely to return the product and more likely to repeat their purchases with the merchant.

Late payment

While there isn’t an interest charged for converting your cart amount into installments, that makes the product offering by AfterPay, in essence, an interest-free loan, right? Yes. And interests in credit lines are how typical lenders make money from consumers, so what about AfterPay?

The majority of Afterpay’s income is derived from merchants, rather than customers. If a customer misses a payment, they won’t be able to use Afterpay until the payments are up-to-date. Late payment fees are charged but are fixed, capped, and do not accumulate over time

They are exploiting what one of the bigger revenue drivers for the credit industry is—late payment fees. Now, in Australia and New Zealand, AfterPay charges $10 as late payment fees; the second a customer misses their payment as mentioned in their invoice at the time of purchase. An additional $7 is charged every week until the customer repays their outstanding. Further, the customer will be barred from further borrowing across any AfterPay merchants until they pay their dues in full.

For order values between $40- $272, the max late payment fee is capped at 25%, and for order values above that, it is capped at $68. That makes the late fees roughly 20-25% in 3 months. So the Annualised percentage rate or APR would be in the range of 80-100% for AfterPay. Compared to traditional credit cards, 36-48% looks pretty steep!

Now, these are what all BNPL players are doing. But AfterPay also has a third source of income which I found when I was going through their last financial report (thank god for being a public listed company)

Advertising fees

AfterPay introduced an in-app advertising model on their Android and iOS apps, where their partner merchants could promote their ongoing deals. Ànd, the merchants, pay per click that the millions of users who have downloaded Afterpay on their mobiles clock on if they find a deal to their liking.

Pretty neat model, considering the chances of these consumers opting for BNPL at checkout is relatively high, which means that AfterPay makes money not only at the top of the funnel but at the end too!

Despite the revenue streams, AfterPay made a loss of $79Million in the first half of 2021.

Expenses

While the revenue line item grew 89% in FY21, the costs increased by 151%, taking the total loss to $79. The most oversized cost line item?

International Expansion: FY21 was when AfterPay expanded into the UK, and there were understandably a lot of marketing activities and operational costs of setting up in a new geographic area. This roughly cost around $4M and is understandably a one-time line item. And while sales from the UK stood at $$785M, it still contributed to less than 7% of their total revenue.

The other big cost header was their Marketing Expenses. Now AfterPay does a lot of digital paid media advertising to attract new consumers, especially Gen Z, who typically hang out on social media platforms. Then there was also Visual marketing done in-store to reinforce the AfterPay brand with their key merchants.

And lastly, we have the cost of infrastructure and tech. Being a fintech means many regulatory and technological upkeep is a necessary part of the business.

N26 wants to transform the way individuals manage money and change banking for the better. How?

Acquisition of Afterpay by Square (now Block)

On January 12, 2022, the Bank of Spain approved Block’s takeover bid of Afterpay, marking the final hurdle in the acquisition merger. On January 19, 2022, Afterpay suspended trading of its shares on ASX.

On January 20, 2022, the merged entity trading as Block commenced trading on the ASX under the ticker SQ2. On January 31, 2022, Block completed the acquisition of Afterpay, officially making it a subsidiary. Let’s also understand Block’s business model and for what potential synergies it acquired Afterpay.

Block Business Model

In 2009, Square was set up to help merchants expand their business by readily accepting credit cards, a popular payment option in the US. The idea for Square came about when Jim McKelvey couldn’t close a $2000 bathroom glass fitting deal due to his inability to accept card payments. So he partnered up with jack Dorsey, and the duo made it their mission to give every aspiring business owner multiple alternate payment options like accepting credit cards.

It also provides a platform or marketplace for developers to meet the tech needs of sellers and businesses. So, on the one hand, it offers an easy way for payment management for companies and provides a platform for them to implement the latest tech to scale their business. Win-win for sure.

For end-users, it offers a peer-to-peer money transfer facility as well. And this acts as a great customer acquisition channel for them, as customers who already have the square app would also be prone to using it at the merchant’s checkout if the same has been enabled.

Revenue from POS setup

While Square, now renamed to BLOCK, does charge their merchants for the device that can be plugged into their mobile to accept card payments, they do so at a cost. This means they make no profit from the sale of the devices. Then where did they make the revenues to make a hefty $29Billion deal with AfterPay?

Transactional revenue

Block has a classic razor-blade pricing strategy. They charge a flat 2.75% on every transaction processed. And for instant settlement of transactions, there is an additional 1.5%. They also charge all users 1-4% for bitcoin purchases done via their app.

Customer acquisition costs

As with most tech-based companies, the most prominent metrics that most people chase are Monthly active users (MAU), Daily Active Users (DAU), and User base growth. To achieve these, Block spends a lot on targeting ads to their Target Audience and acquiring new customers.

So, now we know that Block is after making the merchant’s life easier by managing the payments side of their business. But where does AfterPay fit in?

Synergies between Afterpay and Block business model

As you can see, Block aims to enable all the different payment modes at the merchants’ end, so why to leave out the Buy Now Pay Later option, which is estimated to have a CAGR of 22.4% from 2021 to 2028. Given that growth prospects, there is no sense in leaving out a pie the size of $90Billion, is it?

Another reason is the ability to tap into the merchant base each company has built over the years. While Block has a presence in the US, Canada, Australia, UK, Ireland, France, and Japan, most of their revenues come from their merchants based out of Us and Canada.

And in AfterPay’s case, we saw how expensive it could get to expand into a new geographical area. Now imagine having to launch a new product line along with that too.

The best part is AfterPay has an excellent reputation amongst merchants in Australia and New Zealand, which Block would love to tap into.

Now when it comes to digital payments, the cash app trails the likes of PayPal and Venmo in the US. At the same time, they have a significant presence, especially in the offline space. And they have been one of the pioneers in bitcoin-based payments too.

There are synergies, as AfterPay is a pure-play in the online area. When it comes to the user base, AfterPay has a record number of GenZ users, while Block too has been chasing that segment. But GenZ, especially in the US, is not too gung-ho on using credit cards, which is the bread and butter for Block. So imagine being able to bring on board all of AfterPay’s customers and converting them into CashApp users in one fell swoop. Not bad for $29Billions, uh?

Now imagine if we could also opt for a BNPL option in our favorite offline store, thanks to this merger?

Or imagine the possibilities of trading on crypto exchanges but being powered by BNPL? Ok, that may not be the most financially savvy advice!