Necessity is the mother of Invention, well Innovation too. Have you ever got stranded waiting for a ride and wishing for a ride to make you reach your destination? Not long ago, we all encountered situations where we have hoped for a ride for ourselves or desperately looked for a ride for our beloved ones standing beside a road. Distance between the places felt so far, and time was so limited.

Ordinary people take the problem as a part of their life and try to live with it. It is those extraordinary who find an opportunity in the problem.

Travis Kalanick, a founder of RedSwoosh, a peer-to-peer file-sharing technology company, later sold the same to Akamai Technologies for $19Millionn, and Garrett Camp, who sold his company StumbleUpon to eBay for $75Million., had something innovative in mind to solve this problem.

In 2008, Travis and Garrett got stranded in Paris on a winter evening waiting for their taxi where they were attending an annual tech conference, LeWeb. It was the moment they got inspired to build a platform where one could request a ride using a phone.

Global mobility as a service market is expected to reach a market capitalization of about US $9.5 trillion by 2030.

Beginning of a Ride: UberCabs

At the beginning of 2010, Garrett Camp tested the concept of Ride-hailing in New York City, and later in May, Uber Cab was launched in San Francisco.

The advancement of Smartphone technology was the primary driver for this product. A rider requests a service with the push of a button. The GPS location of the smartphone provides the location to be picked by the rider. The cost gets deducted automatically from the credit card details provided by the rider.

The beginning of Uber’s business journey was not easy, as they had to face fierce objections from local city administration backed by regional transportation agencies. Uber faced one common hurdle in almost every city they ventured into.

In October 2010, San Francisco Municipal Corporation Transportation Agency and California Public Utility Commission ordered “Cease-and-Desist” to the UberCab, for operating without a taxi license. This led to the change in the company’s name from “UberCabs” to “Uber” and buying the Uber.Com domain name from Universal Music Group for 2% of the company shares. Sadly for UMG, it sold its 2% back to Uber for $1 million (now worth $1.2 billion) just a couple of years after the initial deal.

Gradually, the company evolved itself as a mobility service provider by connecting the user who needs a ride and the service provider.

By 2019, the company successfully established its presence in 69 countries, providing 7 billion trips per year. Uber had acquired ~70% of the ride-hailing market share in the USA. The company went public on 9th May 2019, which was one of the highly anticipated IPOs of the year with a valuation of US$120 Billion by Wall Street Investors. But Uber’s IPO went down 8% on the first day of trading itself and made history the most significant first-day dollar loss in IPO history in the United States.

How does Uber work?

The simplicity of the product makes the user experience enriching. Just open the application, set the location for pickup, select the type of ride, get the ride and pay for the ride with a push of a button.

Uber’s algorithm gets to work as soon as the one requests the ride. It identifies the available driver nearest to the pickup location.

Uber stores the status of each driver if the driver is occupied with the ride or driving without passengers. The available data is used to predict the supply-demand and set the price for the ride.

Uber technology leverages telematics to drive the driver’s driving behavior. It utilizes the phone’s gyroscope, accelerometer, and GPS to determine the driving behavior.

What is Unique about Uber’s business model?

Headquartered in San Francisco, California, Uber evolved to be a technology company by providing several services with technology as its strong backbone. Uber addresses a massive opportunity in powering movement from point A to point B. Let’s understand Value Proposition in Uber’s Platform Business Model

Liquidity Network Effect: Uber offers a massive, efficient, and intelligent network consisting of tens of millions of Drivers, consumers, restaurants, shippers, carriers, and dockless e-bikes and e-scooters, as well as underlying data, technology, and shared infrastructure. Uber’s strategy is to create such an extensive network that leads to a liquidity network effect.

Large driver supply–> Lower wait times and fares–> More riders–> Higher earning potential for drivers–> More drivers. And the cycle repeats.

Cutting Edge Technology: Uber has built proprietary marketplace, routing, and payments technologies. Through its real-time algorithmic decision engine, Uber matches supply and demand for its Mobility, Uber Eats, and Uber Freight offerings.

Operational Excellence: Uber is global but is regional in attitude, with operations in 85+ countries. Uber’s regional on-the-ground operations teams rapidly launch and scale products, support Drivers, consumers, and restaurants, and build and enhance relationships with cities and regulators.

Product Innovation: Uber’s expertise in product innovation allows it to set the standard for powering movement on-demand, provide platform users with a contextual, intuitive interface, and continually evolve features and functionality.

Data is the natural fuel for revenue generation of Uber. Uber uses the geolocation and demand for the ride for dynamic pricing, called “GeoSurge” by Uber.

Delete Uber Campaign was a result of the Critical Mass Effect. How?

How does Uber make money?

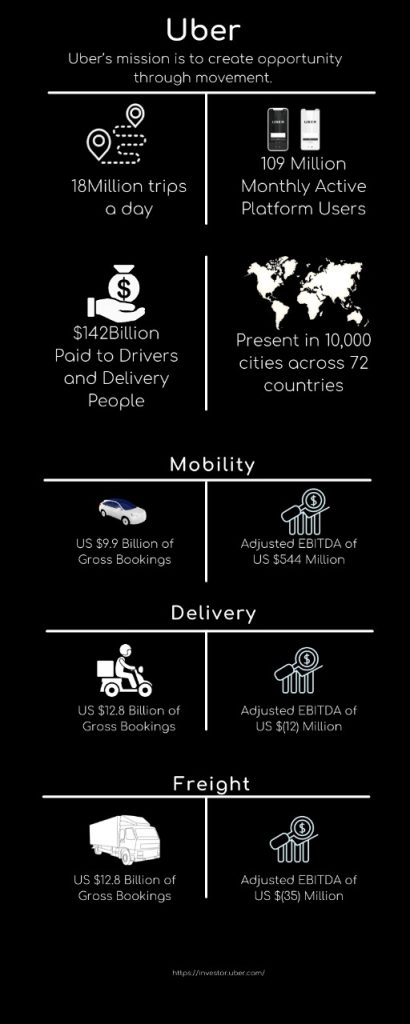

Uber generated $37.2 billion in 2023.

Mainly, Uber makes money by charging commissions from drivers on trips they receive on Uber’s platform. 20% of the trip revenue is considered trip commission, and the remaining 80% is entitled to the driver.

Uber uses a dynamic pricing model, where the price per trip depends on the surge in demand and the number of driver availability. The pricing algorithm normalizes the prices once there is an increase in the availability of the drivers.

Services offered are customized for that particular region or city. For riders looking for a very economical ride in an Indian town, Uber Auto is more affordable than UberGo, which is not available in regions where Auto-rickshaws are not available. Uber’s business model has four segments on which it works and makes money: Mobility, Delivery, Freight, and Advanced Technology.

1. Mobility:

The product includes connecting the rider to the ride providing drivers with various vehicles such as different segments of cars, auto-rickshaws, motorbikes, vans, and taxis. The part also includes Uber for Business (U4B), Financial partnerships, transit, and vehicle solutions. Uber made $19.8 billion in 2023 in the segment, a 41% YoY growth.

UberGO/X/XL/WAV: It’s a ride-hailing service, providing affordable private rides connecting the ride to the driver. The classification of the offer is based on the types of vehicle available, so the cost per ride differ based on the type of vehicle. UberGO provides basic variants of cars to make the cost of the ride more economical. The UberX offers standard, economy class cars where it can fit four rides. Whereas, UberXL differs for the size of the vehicle to fit in a maximum of six people or additional room for luggage at an affordable price. WAV provides the vehicle with wheelchair accessibility.

Uber Rental: Rent a car for as many hours as the user needs between 1 hour to 12hours, with the flexibility of adding or removing the required stops. This service is targeted to the Persona who wants to use it to move to multiple locations by dedicating the car for themselves for a predefined number of hours at an affordable price.

Uber Pool: This is the most economical way of traveling by hopping onto an uber service car accompanied by other riders. So with this service, a rider agrees for the driver to pick other riders and drive them to their location while dropping off the rider to the requested destination. With this cost of the ride drops to the lowest compared to other services as the cost of the ride is being shared among other riders as well.

Uber Green: The service is targeted at those who want to reduce their carbon footprint. It provides hybrid or electric vehicles for hailing, with an additional cost compared to UberX.

Uber Transit: Provides access to the user for multi-mode transportation. Users can get information on multiple modes of traveling to reach the destination, including public transit. With this, Uber wants to position itself as a One-Stop solution for traveling with a vision to provide optimized traveling options to the user.

2. Delivery Segment:

The delivery offer lets users search for local restaurants, order meals, and either pick up at the restaurant or have the meal delivered. With this offer, Uber has expanded its service beyond mobility and provided drivers an opportunity for additional earnings during non-peak mobility hours.

The delivery offer also brings the drivers who are not mobility drivers or do not have access to qualified mobility vehicles onto the platform. With this, there is a new eco-system of players on-boarded to the platform utilizing the existing strength and capabilities of the connecting people need of movement of items and thus generate the revenue.

Uber made $12.2 bn in 2023 in the segment, a 12% growth YoY.

3. Freight:

The freight industry is highly fragmented due to its low entry barrier, resulting in more chaos. Shippers need to spend hours or days finding a truck and driver for shipment while most of the discussions are conducted over the phone. It is equally difficult for carriers to find a shipper that works for their business and negotiate the price. This finally leads to the higher non-revenue and “dead-head” miles.

Freight offering on Uber, carrier, and shippers is available on the platform. Carriers get transparent pricing upfront—an ability to carry out a shipment with a touch of a button.

Overall, Uber wants to be a one-stop for all mobility as a service by building a shared economy, as said by Uber CEO Travis Kalanick Interview with Charlie Rose. Uber made over a $5.2bn in the segment in 2023.

4. Advanced Technology Group (ATG):

The ATG is Research and Development under Uber, responsible for developing Autonomous vehicle and ridesharing technologies. But Uber sold its ambitious Autonomous driving unit to Aurora. Uber Elevate, formerly known as Uber Air, touted as an “Urban aviation ridesharing product” to ease the traffic congestion on the ground, got sold to Joby aviation. Uber made $100 Mn in 2020 in ATG and other technology programs.

The journey ahead for Uber:

The low entry barrier for new entrants, lobbying by local taxi operators and service providers to the local governing bodies, bargaining power of drivers, demanding to consider them as employees instead of independent contractors are some of the forces impacting the growth of the company.

Uber, which came up with this innovative solution of getting a ride with the push of a button, eased the ride-hailing problem not long before Lyft launched its service, followed by many local and regional players around the globe.

The ambitious ATG with Autonomous vehicle development and Uber Elevate was a tipping point for all the players to develop autonomous vehicles.

The recent events of selling off the entities make us understand that the focus of Uber is more towards accelerating the generation of profit rather than pursuing the ambitious products and services for the future.

But for any organization to sustain for the long term, focusing on Innovation for the future product offerings is as important as profitability.

Uber is a source of enormous data that could develop new data-driven products.