The first time I came to know about India’s very own mobile payment solution, Paytm, in 2015, I was in total awe of the technology. How easy it was to transfer money. Asking just the phone number. Nothing else. No hassle of sharing bank details. In 2018, when I went to Paris to do an MBA, I was back to my student life of splitting bills. We used an application called Splitwise to split bills among friends. It was so easy. I was again in awe of the product.

Now combine the two technologies. That is Venmo and what I got is awe*awe when I first learned about it. Although it’s a product only for U.S.-based users, it made me curious to know how Venmo works? What is Venmo’s business model? It costs nothing for its users, so how does Venmo make money? This Strategy Story finds answers to all these questions.

What is Venmo, and how does it work?

Founded in 2009 and owned by Paypal since 2013, Venmo is a U.S.-based mobile payments company that was aimed at friends and family who wish to split bills, e.g., for movies, dinner, rent, or event tickets. A user (the U.S. based only) can transfer/receive funds to/from another user (U.S. based) simply via their Venmo mobile phone application.

[icon name=”lightbulb”] Paypal owns another venture called Honey. Honey is a free browser extension that saves money online. It’s free then how does Honey make money?

Venmo was founded by Andrew Kortina and Iqram Magdon-Ismail, who met as freshman roommates at the University of Pennsylvania. While the duo was helping a friend start a yogurt shop, they realized the pain point in the traditional POS (point of sales) system. After facing a few other inconveniences, they began working on sending money through mobile phones. Their original prototype sent money through text messages, but they eventually transitioned to a smartphone app.

A year after the launch in 2010, Venmo raised $1.2 Mn. Braintree acquired Venmo in 2012 for $26.2Mn. Later in 2013, Paypal acquired Braintree for a whopping $800 Mn. By 2016 Paypal announced that all Paypal merchants could accept payments via Venmo for a small fee for each transaction. Until then, an application used primarily by people to split bills or cost of gits with friends has been turned into a business. People could link their bank account, debit card, or credit card to transfer money to any merchant.

We have understood what Venmo is. We have learned its history and how it has evolved over the years. It would also be interesting to know how does Venmo work? Using Venmo is a three-step process (obviously after downloading the application and login):

- Add your bank account, credit card, or debit card to send money to another Venmo user. You can also use this bank account to receive money from another Venmo User.

- Verify Your Bank Account. There are two ways you can verify your bank account in Venmo: Either by Instant Verification (through your online banking and password) or micro transfers where Venmo withdraws two small amounts and asks you to verify the amount number.

- Transfer Funds to your Venmo app or transfer funds from the Venmo app back to your account.

What makes Venmo’s business model so unique?

Venmo has over 65 million active accounts as of 2021. Venmo’s business model has two types of customers. It charges different types of interchange and withdrawal fees, interest on cash, fees for cashing checks, and affiliate commissions on its cashback program.

The first type of users is individuals like you and me who are just looking for a convenient way to transfer money through mobile or split bills with friends. Venmo calls it a personal profile. Venmo claims that it’s more than just payment, as you can express yourself in each payment by sharing an inside joke, adding emojis and animated stickers, or just keeping it simple. It’s up to you.

The second type of user is a business user. Venmo calls it’s a business profile. A user can switch from personal profile to business profile and track business transactions separately from personal ones. A business profile also allows users to manage bookkeeping and get customer insights to help them plan and sell better. Businesses can also use Venmo for touch-free payments via is Q.R. code.

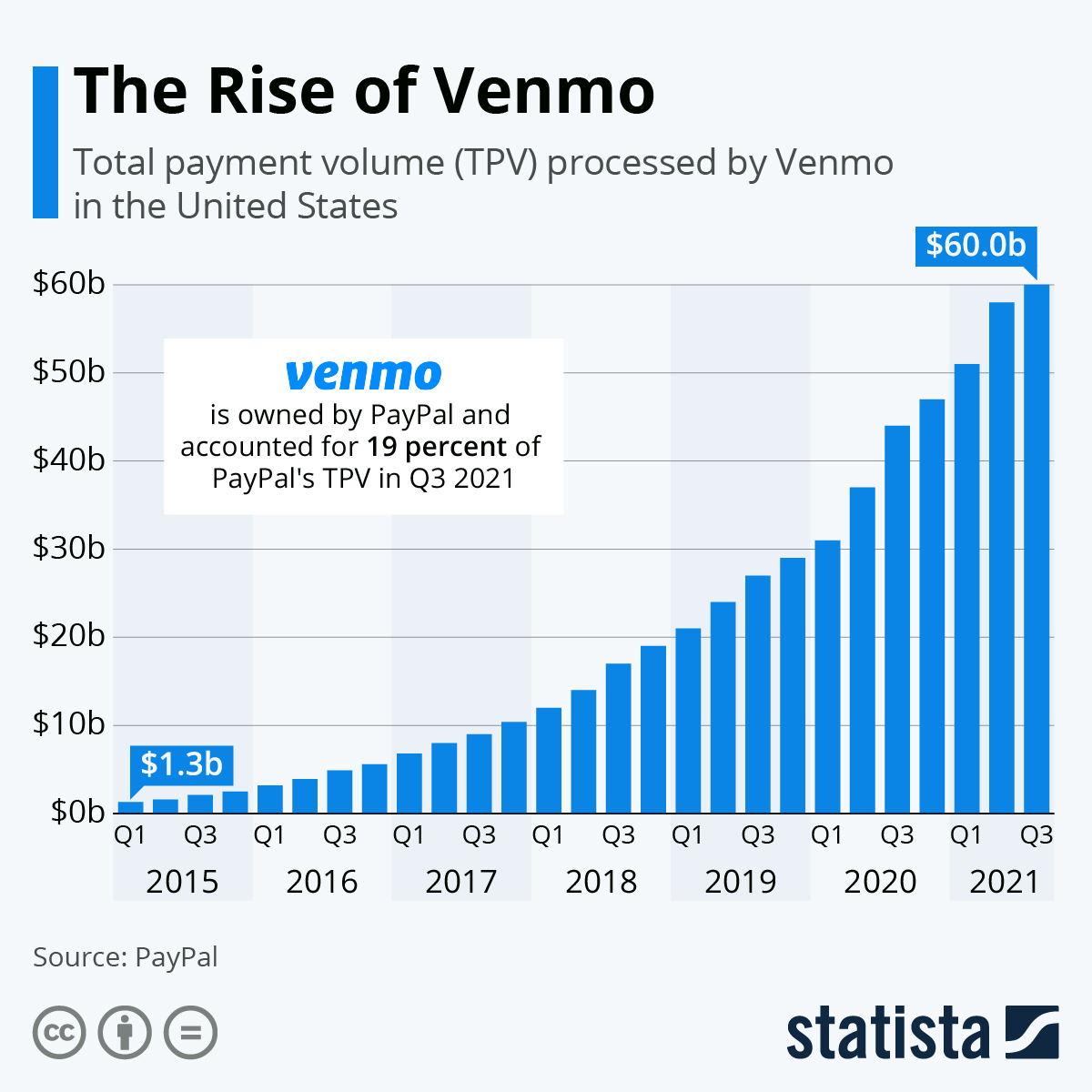

The following chart by Statista shows blockbuster growth of Venmo over the past few years, as young Americans, in particular, enjoy the simplicity of splitting bills or sending money to friends with the touch of a finger. In the three months ended September 30, the total payment volume processed by Venmo amounted to $60 billion, up from less than $5 billion five years ago.

You will find more infographics at Statista

You will find more infographics at Statista

Venmo has the edge over its competitors like Google Pay, Apple Pay, and Zelle. Not only for its payment solutions, but Venmo is also famous among millennials for its split bill features. According to emarketer’s forecasts, Venmo is expected to dominate the U.S. market in 2021 with a 57.5% share of P2P payment users, followed by Zelle (35.6%) and Square’s Cash App (30.8%).

One of the unique features that Venmo has is that when a user makes a transaction, the transaction details (minus the payment amount) are shared on the user’s news feed and to the user’s network of friends and contacts, similar to a social media feed. Venmo claims that the social experience is one of the core appeals of the app, but users can choose not to.

How does Venmo make money?

Venmo doesn’t charge for basic services like:

- Sending money from a linked bank account, debit card, or your Venmo balance.

- Receiving/withdrawing money into your Venmo account or using our standard transfer to your bank account.

- Venmo also has NO monthly or annual fees.

But Venmo generated $450 million in revenue in 2020. PayPal projects it will make $900 million in 2021 and $2.4 billion by 2023 by 123 Mn users. That is a lot of money Venmo is making. Then how does Venmo make money? There are some fees for premium features and other services through which Venmo makes money. These fees are explained through different use cases.

Spending and sending money: While there is no fee for sending money via account or debit card, there is a 3% transaction fee for using a credit card.

Adding money to account: No fee when you add money to your Venmo account or receive money from Venmo users or a merchant sends you a refund. There’s a seller transaction fee when you receive a payment sent to your business profile, or the sender identifies that as for goods and services.

Transfer money from Venmo Account- Typically, there is no fee for transferring money to your account if you choose the usual route, which transfers cash in 1-3 days. But if you would like to Fastrack the process, there is a fee.

Buying or selling cryptocurrencies– There’s a fee for buying or selling cryptocurrencies. There is a minimum fee. Fees after the minimum are a percentage of the purchase or sale amount.

Venmo also earns revenue by providing other value-added services, including income earned through partnerships, merchant and consumer credit products, referral fees, subscription fees, gateway services, and other services Venmo provides to merchants and consumers.

[icon name=”lightbulb”] Klarna’s “Buy Now Pay Later” is not a new concept. If there is no fee, no interest, how does Klarna make money?

What’s new in Venmo’s business model?

Venmo, in Oct’2020, launched a credit card powered by Visa, which gives customers automatic cash back on every eligible purchase, a personalized rewards experience, and the ability to manage the card directly in the Venmo app. The card unlocks new ways for Venmo’s community of more than 60 million customers to shop, share or split purchases, and earn cashback – everywhere Visa credit cards are accepted.

In April 2021, Venmo announced the launch of crypto on Venmo for its customers to trade cryptocurrency directly within the Venmo app. As per Paypal, the launch of the feature furthers PayPal’s commitment to educating its customers on the potential of digital currencies as they continue to grow and drive understanding and utility of cryptocurrencies on a mass scale.

Paypal, the owner of Venmo, has partnered up with Amazon to make Venmo a payment option for U.S. Amazon customers starting 2022, as per its Earnings report. The announcement is a significant step in PayPal’s ongoing efforts to turn its popular person-to-person payment service into a broader payment solution. Numerous popular retailers in the U.S. accept Venmo payments. Customers can also apply for a Venmo credit card and keep track of their purchases within the Venmo app.

Venmo looks like a great application with great features. $1.3 Trillion worth of transactions are happening in the U.S. through the digital medium. Venmo has not even captured 20% of the U.S. market, let alone the global markets. Venmo, for now, is available only for U.S.-based users. The day it starts to operate globally like its parent company, the sky is the limit.

-AMAZONPOLLY-ONLYWORDS-START-

Also, check out our most loved stories below

Why did Michelin, a tire company, decide to rate restaurants?

Is ‘Michelin Star’ by the same Michelin that sells tires, yes, it is! But Why? How a tire company evaluations became most coveted in the culinary industry?

Starbucks prices products on value not cost. Why?

In value-based pricing, products are priced based on the perceived value instead of cost. Starbucks has mastered the art of value-based pricing. How?

Nike doesn’t sell shoes. It sells an idea!!

Nike has built one of the most powerful brands in the world through its benefit-based marketing strategy. What is this strategy and how Nike has used it?

Domino’s is not a pizza delivery company. What is it then?

How did one step towards digital transformation completely change the brand perception of Domino’s from a pizza delivery company to a technology company?

Why does Tesla’s Zero Dollar Budget Marketing Strategy work?

Touted as the most valuable car company in the world, Tesla firmly sticks to its zero-dollar marketing. Then what is Tesla’s marketing strategy?

-AMAZONPOLLY-ONLYWORDS-END-