Ever since the pandemic struck, significant shifts have occurred across many parts of our lives. We moved from classes to online classes, from meetings to online meetings, from workouts to online workouts, and from dating to online dating.

And all of these online have been facilitated primarily through video communication apps. If there is one app that tops the chart in this category, it’s ZOOM. If you meet someone on the street who hasn’t heard of Zoom yet, congratulations! You’ve just met a monk! Would you mind asking him/her how to attain zen? And please pass on the answer to me. Thanks!

But this article is not about ZEN; it’s about ZOOM and, more importantly, how does Zoom make money? What is the business model of Zoom? Let’s dive in.

A little bit of history

Zoom was founded in 2011 by a former Cisco Vice President, Eric Yuan. Along with 40 engineers, he left Cisco to start a new company called Saasbee Inc. Since the video communication market was already saturated, they had trouble finding investors. They raised their first seed money of $3 million from WebEx software founder Subrah Iyer and venture capitalists Matt Ocko, TSVC, and Bill Tai.

Influenced by Thacher Hurd’s children’s book Zoom City, the company changed its name to Zoom in May 2012. By September 2012, they launched a beta version of the app, hosting up to 15 video participants. Stanford University was the first customer they signed in November 2012. Finally, the service was launched in January 2013, and by the end of the first month, Zoom had 40,000 users, which went up to 1 million by May 2013.

From hereon, the company went on to form various B2B collaborations, gaining more market share. In January 2017, it achieved unicorn status after a series D funding from Sequoia Capital. It also improved its product-enabling features like multiple screens and device meetings, HD and wireless screen sharing, and calendar integration with Microsoft Outlook, Google Calendar, and iCal.

On April 18, 2019, the company became a public company via an initial public offering. Opening at US$36 per share, the share price increased over 72% on the first trading day. The company was valued at US$16 billion by the end of its first day of trading. As of September 1, Zoom had a market capitalization of $88 billion, compared to roughly $30 billion at the onset of the pandemic. Market Differentiation: Zoom’s Growth Strategy

By April 2020, Zoom Video Communications had 300 million daily meeting participants worldwide. Only six months before that, at the end of 2019, this number stood at 10 million meeting participants, and just 20 days before that, the number was 200 Million. 50% growth in 20 days. Wow!!

The Freemium Business Model of Zoom

Zoom runs on a freemium model. It is a business model that offers basic features to a user at no cost and charges a premium for advanced features. The term freemium is attributed to Jarid Lukin of Alacra, a corporate information and workflow tool provider, who coined it in 2006. The practice, however, dates from the 1980s.

This model is extremely popular among software applications as it has the advantage of acquiring a large set of initial users, especially when there’s no cost associated with trying out an app or a service, as most people are willing to take a new app or service for a spin, giving the company an easy way to acquire potential users and study their usage behavior.

Manier times, even if the user doesn’t upgrade or purchase premium services, the company can still make money by collecting their user information and data, and showing them targeted ads. However, free users may never convert to paid users if the product is not up to the mark. Too many features can prevent users from upgrading to a premium version.

Users generally provide features within the premium services, including extra storage, more flexibility or time allowed on the app, and customizations. Users are also offered additional personalized or customer service associated with an account. To learn the Freemium model in detail and how Canva is leveraging the freemium model, check out this story.

Sometimes, free trial and freemium are confused as the same. Typically free trials are time-bound and allow a user to test a few parts of a product or service. Meanwhile, users in the freemium model get to access the entire application indefinitely.

How each Product helps Zoom make money

To understand how Zoom makes money, let us know its products first. If you were to ask a Zoom employee what they provide, their standard answer would be,

We provide a unified communications platform that delivers happiness and fundamentally changes how people interact, connecting them through frictionless and secure video, phone, chat, and content sharing.

They achieve these through a plethora of products: Zoom Meetings, Zoom Phone, Zoom Chat, Zoom Rooms, Zoom Conference Room Connector, Zoom Video Webinars, Zoom Developer Platform, and Zoom App Marketplace.

Zoom Meetings

Zoom Meetings is the brand’s most popular product. It provides HD video, voice, chat, and content sharing across mobile devices, desktops, laptops, telephones, and conference room systems. It can support up to 1,000 video participants. It also has features like cloud/local recording with transcripts, video breakout rooms, annotating screen sharing, and other app integration. As of now, it also provides end-to-end encryption.

The Basic version of Zoom Meetings limits usage time to 40 minutes per meeting while limiting participants to 100 attendees. To lift these restrictions, customers will have to pay a monthly subscription fee. Apart from the Basic plan, it provides three other plans: Pro, Business, and Enterprise. The following image shows these in detail:

As we see above, the benefits and features keep on increasing as we move up the tiers.

Zoom also offers optional add-ons. These work in a la carte fashion. The optional add-ins are stand-alone features that a home or business user may specifically require. These are a great way to sell individual features, particularly in price-sensitive markets like India. The following image shows a snippet of the same:

As we can see above, users can buy cloud storage or audio conferencing features individually as per their needs.

Zoom Phone

Zoom Phone is an enterprise cloud phone system that provides robust private branch exchange(PBX) features, such as secure call routing, call queuing, call recordings, etc. It is available stand-alone or as an optional add-on to Zoom Meetings. It also supports Hybrid connectivity, allowing customers to mix native Zoom Phone Calling Plans and third-party voice circuits.

This capability enables customers to enjoy all the benefits and features of Zoom Phone while keeping their existing phone numbers, service provider contracts, and calling rates with their preferred carrier of record.

The above image shows the various plans and pricing of Zoom Phone for the US and Canada region. Since this is not their flagship product and hence is not used to attract new users, we see no free/basic plan.

Zoom Events and Webinar

This is a relatively new product in their bouquet. It’s a platform that is tailor-made for hosting online webinars and events. It helps the user monetize an event through paid registration and has CRM and marketing automation integrations that enable the user to reach wider audiences.

Post-event audience engagement reports are also a feature that comes along with this product. The following image shows the two different plans that are available for this product:

Zoom Rooms

Zoom Rooms is a conference room system that transforms any room into a collaboration space that is easy to use, simple to deploy, and effortless to manage. It brings one click to join meetings, wireless multi-sharing, interactive whiteboard, and intuitive room controls for a frictionless and secure Zoom Meeting experience.

It has a scheduling display feature that helps meet the needs of the agile office by delivering simple, on-the-fly room booking and room utilization management through a calendaring system. The Digital Signage feature leverages displays to project image, video, and URL content playlists in and out of conference rooms.

The role-based admins can easily manage unlimited Digital Signage content and displays through the Zoom Admin Portal and remotely control the content displayed across screens for corporate communications, internal marketing, branding, and more. The following image shows the pricing of this product:

Zoom also partners with various manufacturers to provide the customer with the necessary hardware tools. It would be a fair assumption that these providers pay a percentage of every hardware sale to Zoom. In return, Zoom would make sure to promote its products to the company’s customers.

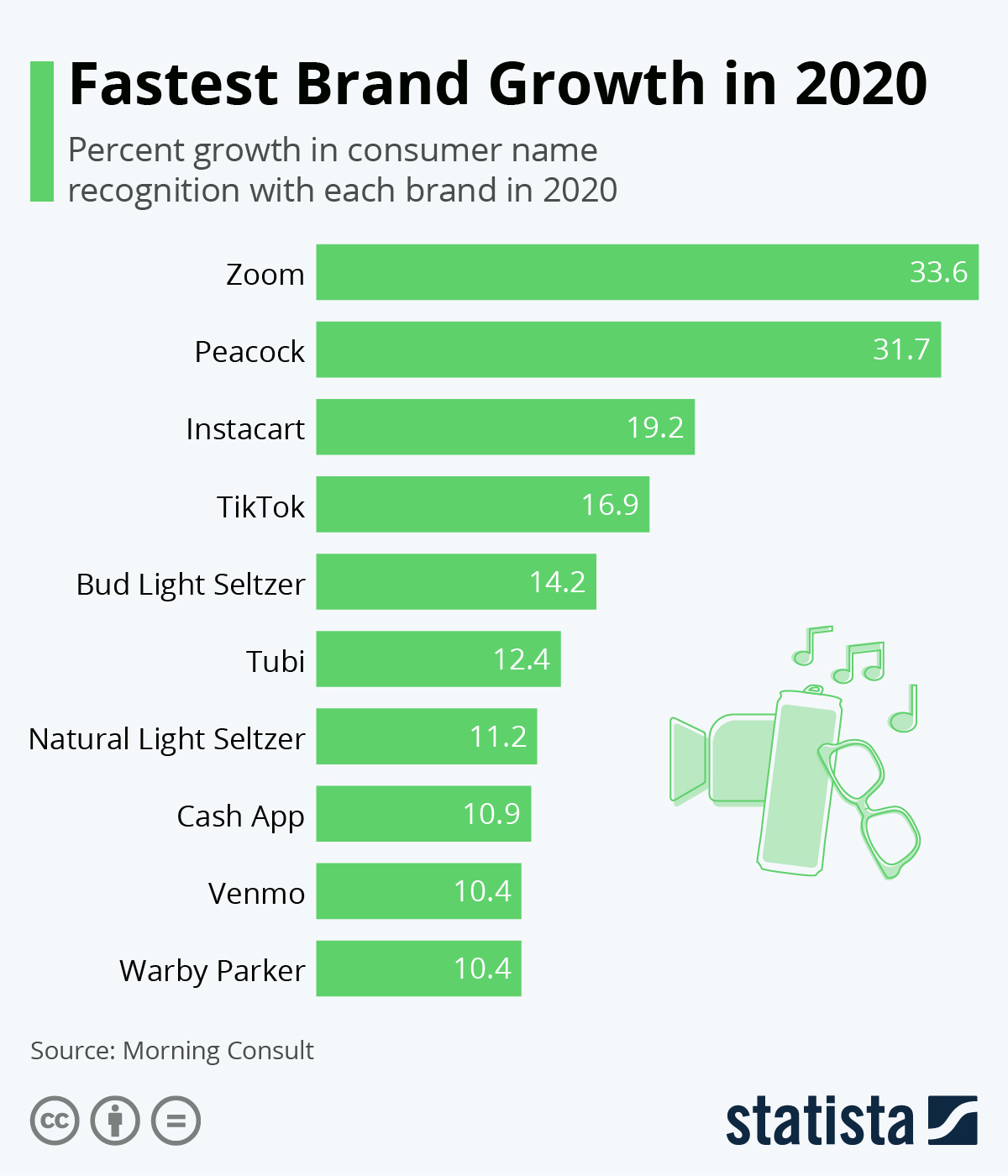

According to Morning Consult’s Fastest Growing Brands of 2020 report, video communications company Zoom saw the largest growth in brand recognition over the course of the year with nearly 34 percent.

You will find more infographics at Statista

You will find more infographics at Statista

How much money has zoom made

According to Crunchbase, Zoom has raised a total of $146M in funding over seven rounds. Their last funding round was raised on April 19, 2019. It was from a Post-IPO Equity round. It was funded by 18 investors.

The most recent investors are Base Partners and Kauffman Fellows Fund. A total of $100M has been raised so far in a single venture fund, Zoom Apps Fund. This was announced on April 20, 2021, and has raised a total of $100M. It has made 14 investments. It has had one exit so far, which was monday.com. It has acquired two organizations. Kites was its most recent acquisition, which happened on June 29, 2021.

As the following chart shows, Zoom saw its revenue skyrocket throughout the fiscal year ended January 31, 2021. Following a 169-percent revenue increase in the first quarter, year-over-year revenue growth accelerated to 355, 367, and 369 percent, respectively, in the second, third, and fourth quarter.

For the twelve months ended January 31, Zoom’s revenue amounted to $2.65 billion, up from just $623 million the previous year. The video conferencing company ended the year with a net profit of $671 million, up from just $22 million in fiscal 2020. As of September 1, Zoom had a market capitalization of $88 billion, compared to roughly $30 billion at the onset of the pandemic.

You will find more infographics at Statista

You will find more infographics at Statista

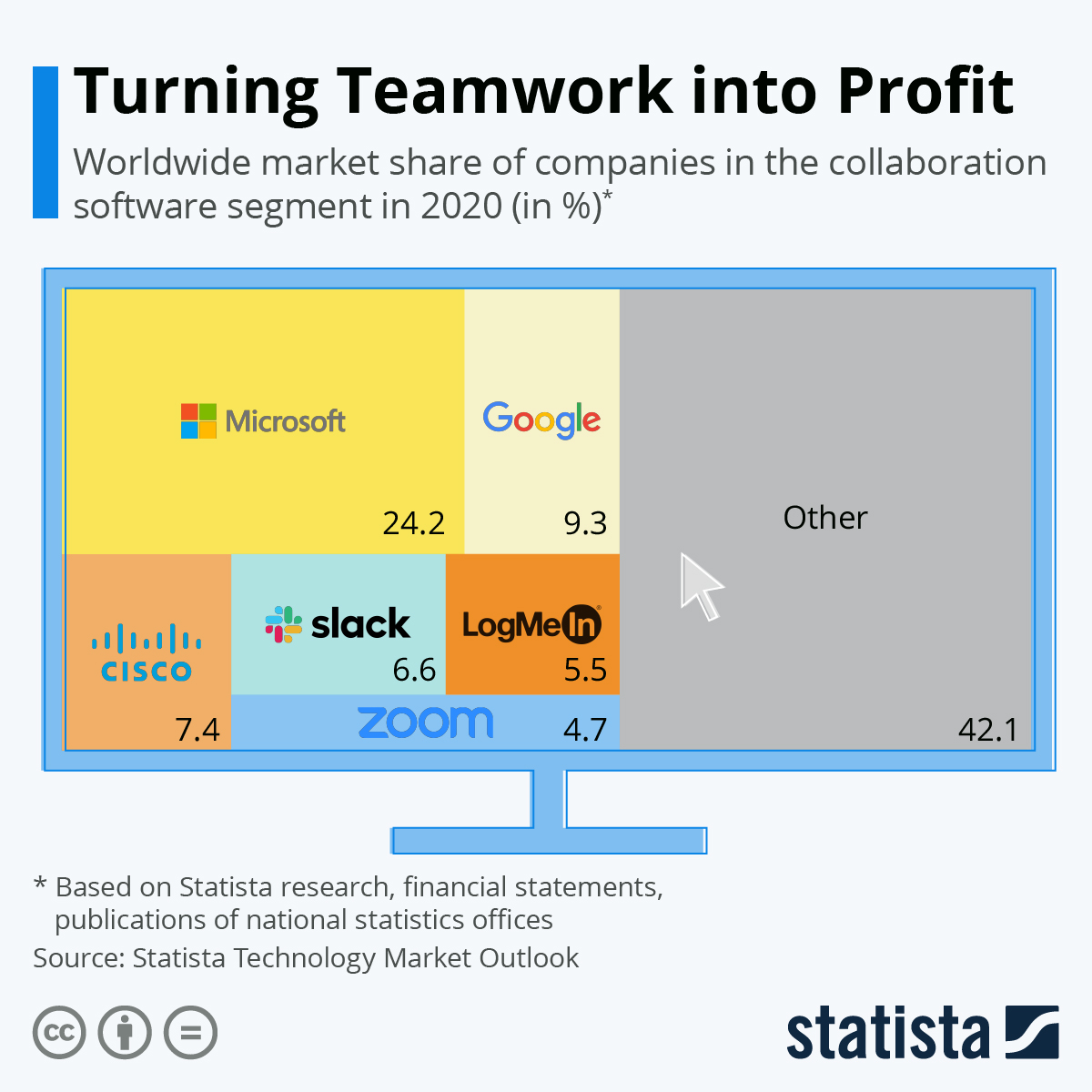

So, now you know how the app you use so often, Zoom, in your day-to-day life to digitize your activities makes money. Even though Zoom Video Communications (Zoom) managed to increase its revenue to over one billion US dollars for the first time, it’s still in a tough spot compared to the collaboration software segments of other big tech players.

As Statista chart shows below, Microsoft still dominates this specific market with almost one-quarter of the total global revenue stemming from the use of its products, while Zoom only had about five percent market share in 2020.

You will find more infographics at Statista

You will find more infographics at Statista

What would be interesting is to see how Zoom would continue to maintain the growth and surpass giants like Microsoft and Google with its video chat application.