Profit and Loss Statement is one of the three financial statements apart from Balance sheet and Cashflow, which is used to assess a company’s performance and financial position. It summarizes all the revenues and expenses a company has generated in a given timeframe (month, quarter, year, etc.). Simply put, the statement shows whether a company is making money or not.

Whether you are interested in studying finance, have your own business, love investing in stocks or just want to know more about a companies financial health, Statement of Profit and Loss is the most important set of documents that one needs to assess the sustainability of an organization.

Let us look at some of the most important terms which will help you read the Statement of Profit and Loss which will help you read a business like a “PRO”.

Income Statement

Also known as Profit and Loss Statement, it is an overview of how a business is performing in a particular period. It indicates the source of income and cost of running the business to arrive at the net profit and loss.

Revenue

Also, known as “Topline”, Revenues are what you receive for your products or services. You subtract from it all of your expenses, and what’s left is profit — the “bottom line.”

Cost of Goods Sold (COGS)

Costs incurred in a given period to manufacture and sell the business’s goods. High COGS can be a big reason for a negative Income statement for most companies.

Margin

A profit margin is how much money a company makes. For example, a gross profit of INR 1 cr on sales of INR 10 cr is a 10% profit margin. Companies compare profit margins with other companies to see how they are doing.

Overheads

Expenses incurred in running a business which cannot be directly linked to producing a product or providing a service. These costs are incurred irrespective of whether a company is profitable or not.

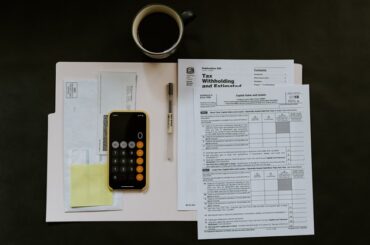

Interest Expenses

The cost incurred by an entity when it borrows funds. It can represent interest payable on borrowings – bonds, loans, convertible debt, or lines of credit.

TSS Tip: Use “interest coverage ratio” to determine how comfortably a company can pay all its outstanding debt. The ratio is calculated by dividing EBIT by interest on debt expenses during a given period of time. A bad interest coverage ratio is any number below 1

Dividend

When a company earns a profit or surplus, it can pay a proportion of the profit as a benefit to shareholders in the form of Dividends. A range of 35% to 55% is considered healthy from an investor’s point of view. A company that is likely to distribute roughly half of its earnings as dividends means that the company is well established and a leader in its industry.

Retained Earnings

Cumulative income that a company has earned and has kept in the business instead of passing to the shareholders as dividends.

EBIT

Calculated as the company’s revenue less its expenses, EBIT is a measure of a company’s ability to produce income on its operations in a given year. EBIT multiples are always higher than EBITDA multiples.

EBIDTA

Similar to EBIT, however, Companies do not subtract their tax liability, interest paid on debt, amortization, or depreciation while calculating EBIDTA. EBITDA can be harder to calculate from the Statement of Profit and Loss. Depreciation and Amortization can be included in several spots on the income statement like COGS or General overhead and might be difficult to read.

TSS Tip: Do check out Cash Flow Statement if you want to have the full depreciation and amortization numbers

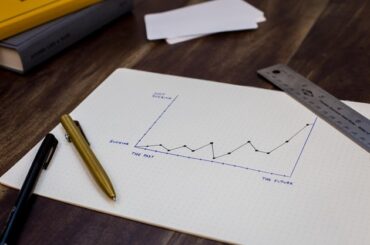

Let us understand the difference between EBIT and EBITDA

Attached below is a Performa Profit and Loss (P&L) Statement:

[embeddoc url=”https://thestrategystory.com/wp-content/uploads/2020/10/Profit-and-Loss-Statement.xlsx” viewer=”microsoft”]