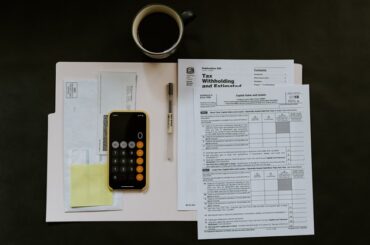

Balance Sheet is one of the three financial statements apart from Profit and Loss Statement and Cashflow, which is used to assess a company’s performance and financial position. It helps in the evaluation of the overall financial position of a company and its ability to pay for its operating needs.

Let us look at some of the most important terms which will help you read the Balance Sheet which will help you read a business like a “PRO”.

Accounts Payable

Amount of money owed by you/ your company to external suppliers. In other words, it includes all of the expenses that a business has incurred but has not yet paid.

Accounts receivable

Amounts of money owed to you/ your company by your customers. In other words, it includes all of the sales a company has made but has not yet collected payments.

Accrued expenses

An expense already incurred but not yet paid for.

Accumulated Depreciation

The sum of depreciation expense over the years of using the asset. The carrying amount of fixed assets in the balance sheet is the difference between the cost of the asset and the total accumulated depreciation.

CAPEX

Capital expenditure or capital expense is the money an organization or a company spends to buy, maintain, or improve its fixed assets, such as buildings, vehicles, or equipment.

Book Value

The Book Value is the original value of an asset, less any accumulated Depreciation.

Working Capital

Capital a business uses in its day-to-day operations. It’s the difference between current assets and current liabilities. It provides an indication of liquidity and the business’s ability to meet its short-term needs.

Equity

The monetary value of a property or business that you own and is beyond any debt. Depending on the type of business, Equity may be referred to as net assets, shareholder’s capital, or proprietor’s net worth.

Long-term Liabilities

Amounts owed for debts that will not become due for at least one year.

Current Liabilities

Liability which is either expected to be settled in a companies normal operating cycle or held primarily to be traded or due to be paid within 12 months from the balance sheet date.