Before we deep dive into the SWOT analysis, let’s get the business overview of Tesla. Tesla, Inc. is an American electric vehicle and clean energy company founded in 2003 by entrepreneur and business magnate Elon Musk. The company is named after the renowned inventor and electrical engineer Nikola Tesla.

Tesla designs and manufactures a range of electric vehicles, including the Model S, Model X, Model 3, Model Y, and Cybertruck. The company is also involved in the production of renewable energy products, such as solar panels, energy storage systems, and solar roofs.

Tesla’s electric vehicles are known for their long-range, high-performance, and advanced technology features. They have gained a significant market share in the electric vehicle industry and are considered one of the leading companies in the field. Additionally, Tesla’s energy products have helped to promote the adoption of clean and renewable energy sources.

Tesla’s mission is to accelerate the world’s transition to sustainable energy. The company is committed to reducing the world’s dependence on fossil fuels and mitigating the effects of climate change.

How does Tesla make money: Business Model & Supply Chain Analysis

Here is the SWOT analysis for Tesla

A SWOT analysis is a strategic planning tool used to evaluate the Strengths, Weaknesses, Opportunities, and Threats of a business, project, or individual. It involves identifying the internal and external factors that can affect a venture’s success or failure and analyzing them to develop a strategic plan. In this article, we do a SWOT Analysis of Tesla.

SWOT Analysis: Meaning, Importance, and Examples

Strengths

Tesla has several strengths that have contributed to its success in the electric vehicle and clean energy markets, including:

- Innovative Technology: Tesla is known for its advanced electric vehicle technology, including its batteries, electric motors, and self-driving capabilities. The company invests heavily in research and development and continually improves its technology to stay ahead of competitors.

- Strong Brand: Tesla has built a strong brand around its innovative technology and commitment to sustainability. The company’s brand is associated with luxury, performance, and environmental responsibility, which has helped it attract a loyal customer base.

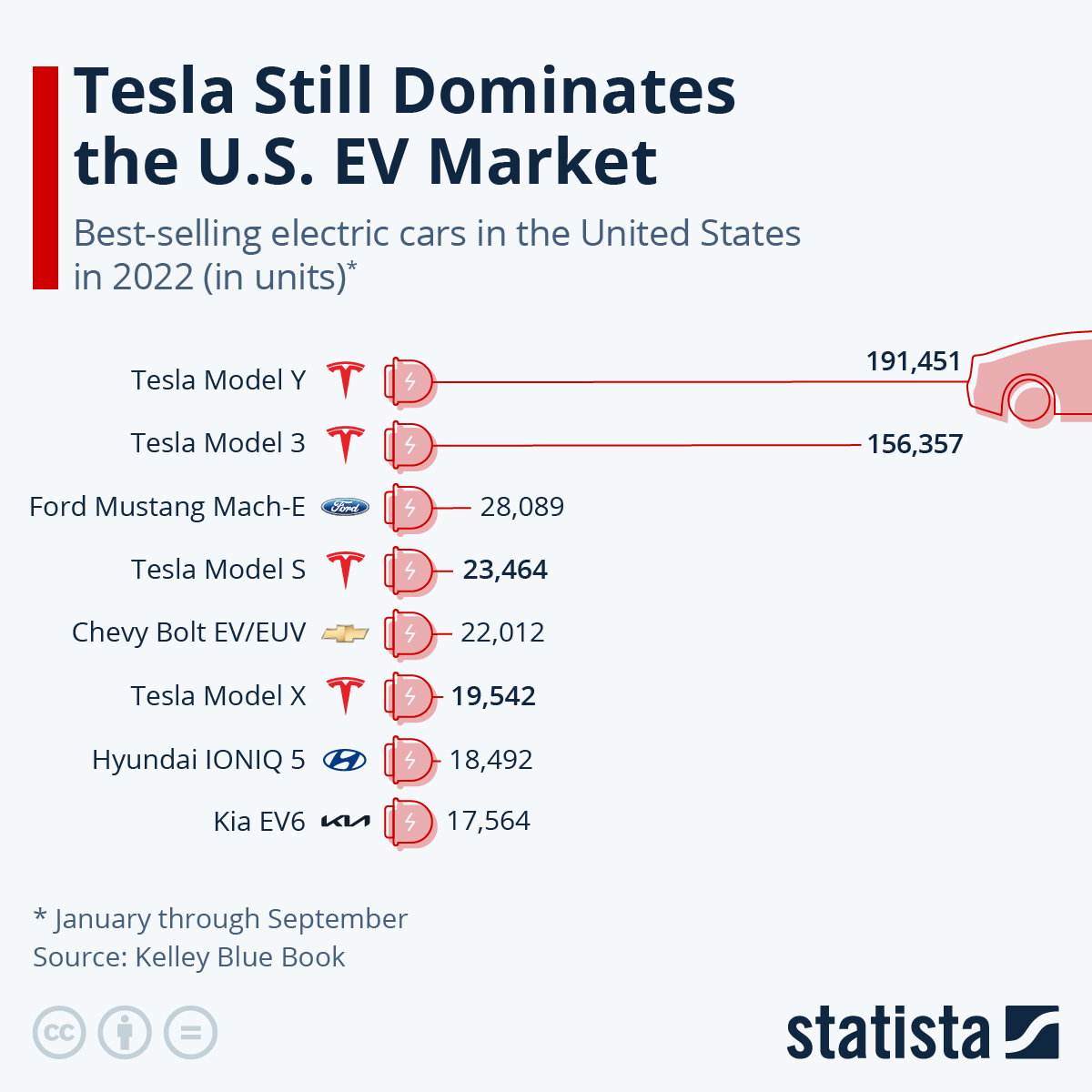

- Market Leader: Tesla is the market leader in the electric vehicle industry, with a significant market share and a strong global presence. The company has a large and growing customer base, and its products are highly sought after.

- Vertical Integration: Tesla has vertically integrated its supply chain, which means that it controls every aspect of its production process, from designing and manufacturing to sales and distribution. This has allowed the company to reduce costs and increase efficiency.

- Sustainable Energy Products: Besides electric vehicles, Tesla produces a range of sustainable energy products, including solar panels and energy storage systems. This diversification has helped the company expand its business and reduce its dependence on the electric vehicle market.

- Strong Leadership: Tesla has a visionary and charismatic leader in Elon Musk, who has been instrumental in the company’s success. Musk has a strong track record of innovation and is highly respected in the tech industry.

You will find more infographics at Statista

You will find more infographics at Statista

Weaknesses

Despite its many strengths, Tesla also has several weaknesses that could impact its future success, including:

- Dependence on a Single Market: Tesla heavily depends on the electric vehicle market, which is still a relatively small portion of the overall automotive market. This makes the company vulnerable to market fluctuations and changes in consumer preferences.

- Production Challenges: Tesla has previously struggled with production, mainly its Model 3 sedan. The company has faced difficulties scaling production to meet demand, leading to delays and reduced profitability.

- High Costs: Tesla’s electric vehicles are expensive compared to traditional gasoline-powered vehicles, which limits their appeal to mainstream consumers. The company’s focus on luxury and performance makes its products less accessible to a broader audience.

- Reliance on Government Incentives: Tesla has benefited from government incentives, such as tax credits and subsidies, which have helped to drive demand for its products. However, these incentives are subject to change, which could impact the company’s future growth.

- Limited Manufacturing Experience: Tesla is a relatively new player in the automotive industry and has limited manufacturing experience compared to more established competitors. This could make it difficult for the company to compete on cost and efficiency.

Opportunities

Tesla has several opportunities to capitalize on in the future, including:

- Growing Electric Vehicle Market: The electric vehicle market is expected to grow significantly in the coming years, driven by government incentives, environmental regulations, and changing consumer preferences. This presents a significant opportunity for Tesla to expand its market share and increase sales.

- Expansion into New Markets: Tesla has a strong global presence in developed markets, but there are still many untapped markets for its products, particularly in developing countries. The company can expand its sales and distribution networks in these markets and reach new customers.

- Diversification into New Products: Tesla has already diversified into renewable energy products like solar panels and energy storage systems. The company has the opportunity to continue diversifying its product offerings and explore new markets, such as electric airplanes or boats.

- Technological Advancements: Tesla is known for its innovative technology and has the opportunity to continue pushing the boundaries of electric vehicles and renewable energy technology. The company could develop new battery technologies, improve its self-driving capabilities, or create new energy-efficient products.

- Partnerships and Collaborations: Tesla has the opportunity to form partnerships and collaborations with other companies in the automotive and renewable energy industries. These partnerships could help the company expand its reach, access new markets, and share knowledge and resources.

- Increasing Awareness of Climate Change: As more people become aware of the impacts of climate change, there is growing demand for sustainable products and solutions. Tesla has the opportunity to position itself as a leader in the sustainability movement and attract environmentally conscious consumers.

Threats

Tesla faces several threats that could impact its future success, including:

- Competition: Tesla faces increasing competition from traditional automakers and new entrants to the electric vehicle market. These competitors may have established brands, larger resources, and lower costs, which could make it more difficult for Tesla to maintain its market share.

- Economic Conditions: Tesla’s sales and profitability could be impacted by changes in economic conditions, such as recessions or changes in interest rates. These conditions could reduce consumer demand for its products and impact the company’s financial performance.

- Regulatory Environment: Regulation changes or government incentives could impact Tesla’s sales and profitability. For example, tax credits or emission standards changes could impact demand for electric vehicles.

- Supply Chain Disruptions: Tesla’s supply chain is complex and relies on a network of suppliers and partners. Disruptions to this supply chain, such as shortages of raw materials or components, could impact the company’s production and profitability.

- Cybersecurity Risks: Tesla’s products and services rely heavily on software and technology, which makes the company vulnerable to cybersecurity risks. Cyberattacks or data breaches could damage the company’s reputation and impact sales.

- Geopolitical Risks: Tesla’s operations and supply chain are global, which exposes the company to geopolitical risks such as trade disputes, political instability, or changes in regulations in different countries. These risks could impact the company’s production, sales, and profitability.