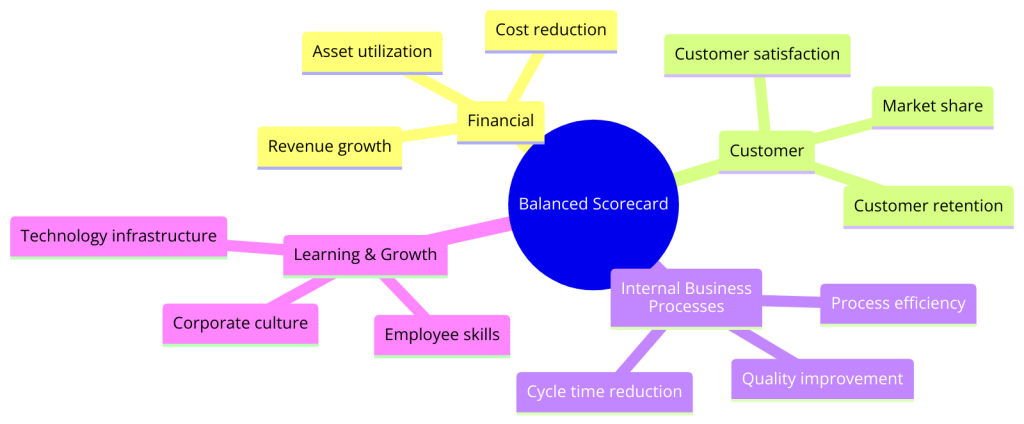

The Balanced Scorecard is a strategic planning and management system used by organizations to align business activities with the vision and strategy of the organization, improve internal and external communications, and monitor organizational performance against strategic goals. It was originated by Dr. Robert S. Kaplan and Dr. David P. Norton in the early 1990s.

The Balanced Scorecard aims to provide a more comprehensive view of organizational performance beyond traditional financial measures by incorporating these additional perspectives. It serves as a framework for translating an organization’s strategic objectives into a coherent set of performance measures, providing a more balanced view of how well the organization is achieving its long-term goals.

The Balanced Scorecard suggests that an organization is viewed from four perspectives and to develop metrics, collect data, and analyze it relative to each of these perspectives:

Financial Perspective

The Financial Perspective is one of the four pillars of the Balanced Scorecard, a strategic management tool that translates an organization’s mission and vision into a comprehensive set of performance metrics. The Financial Perspective focuses on the financial objectives of an organization and measures the economic consequences of actions taken in the other three perspectives (Customer, Internal Business Processes, and Learning and Growth).

The primary purpose of the Financial Perspective is to ensure that the company’s strategy, implementation, and execution contribute to bottom-line improvement. Traditional financial metrics like revenue growth, cost reduction, cash flow, and return on investment (ROI) are common in this perspective, but they are often complemented by more forward-looking indicators that can predict future financial performance.

Key Components of the Financial Perspective:

- Revenue Growth and Mix: This involves looking at the overall growth of revenue and analyzing the mix of revenue sources to ensure a diversified and sustainable income stream.

- Cost Management: This includes measures for controlling and reducing costs, improving operational efficiencies, and optimizing the use of resources.

- Asset Utilization: This involves metrics that assess how effectively the organization uses its assets to generate revenue. Examples include return on assets (ROA) and return on equity (ROE).

- Investment Strategy: This focuses on how capital investments support the organization’s long-term strategy. Metrics might include the payback period, internal rate of return (IRR), or the economic value added (EVA).

Importance:

The Financial Perspective is critical because it clearly shows whether the company’s strategy and operations contribute to bottom-line improvement. It ensures that strategic initiatives are financially viable and align with shareholder expectations. However, relying solely on financial measures can be misleading, as they often reflect past actions and decisions. This limitation is why the Balanced Scorecard includes non-financial perspectives to provide a more comprehensive view of the organization’s performance.

Integration with Other Perspectives:

The Financial Perspective is closely linked with the other perspectives of the Balanced Scorecard. For example:

- Customer Perspective: Satisfied and loyal customers often lead to better financial outcomes through repeat business and referrals, which can increase revenue and reduce marketing and sales costs.

- Internal Business Processes Perspective: Efficient and effective processes can lower operational costs, improve quality, reduce cycle times, and enhance productivity, all of which can positively impact the financial bottom line.

- Learning and Growth Perspective: Investments in employee development, organizational culture, and information systems can lead to innovations and improvements that drive long-term financial performance.

By integrating the Financial Perspective with the other perspectives, organizations can ensure a balanced approach to strategy execution that supports sustainable financial success.

Customer Perspective

The Customer Perspective is one of the four dimensions of the Balanced Scorecard. It is a strategic management tool that helps organizations translate their vision and strategy into action across four key areas: Financial, Customer, Internal Business Processes, and Learning and Growth. The Customer Perspective focuses on identifying and measuring the value delivered to customers, which is crucial for achieving financial success and sustainable growth.

Key Objectives of the Customer Perspective:

- Customer Satisfaction: Understanding and measuring how well the organization meets the expectations and needs of its customers. This can involve customer satisfaction scores, service quality assessments, and customer feedback.

- Customer Retention and Loyalty: Tracking the organization’s ability to retain customers over time, often reflected in customer loyalty rates, repeat purchase rates, and customer lifetime value. High retention rates indicate customer satisfaction, leading to increased revenue and reduced marketing costs.

- Market Share and Acquisition: Measuring the organization’s success in attracting new customers and expanding its presence in targeted market segments. This can involve tracking changes in market share, the effectiveness of marketing campaigns, and the rate of new customer acquisition.

- Customer Value Proposition: Ensuring the organization’s value proposition aligns with customer needs and preferences. This involves understanding what customers value most: price, quality, service, innovation, or something else, and ensuring that the organization delivers on these dimensions.

Importance:

The Customer Perspective is critical because it focuses on the customer, who ultimately judges the company’s products and services. In many industries, especially those with high competition, attracting, satisfying, and retaining customers is a crucial determinant of financial performance. Furthermore, by focusing on customer needs and expectations, organizations can identify new opportunities for growth and innovation.

Integration with Other Perspectives:

- Financial Perspective: Satisfied and loyal customers often lead to better financial outcomes, such as increased revenue from repeat purchases, higher transaction values, and lower costs associated with customer acquisition and retention.

- Internal Business Processes Perspective: To deliver the value that customers expect, organizations need to excel at internal processes such as product development, manufacturing, delivery, and after-sales service. Improvements in these areas can enhance customer satisfaction and loyalty.

- Learning and Growth Perspective: Developing the skills and capabilities of employees, fostering a customer-centric culture, and investing in technology and systems that improve customer interactions are all critical for delivering value to customers. This perspective supports the organization’s ability to innovate and adapt to changing customer needs.

Metrics and Measures:

To manage the customer perspective effectively, organizations typically use a variety of metrics, such as Net Promoter Score (NPS), customer satisfaction indices, customer complaint rates, customer retention rates, and market share growth. These metrics help organizations track their performance from the customer’s viewpoint and identify areas for improvement.

By prioritizing the Customer Perspective within the Balanced Scorecard framework, organizations can ensure that their strategic objectives are aligned with customer needs and expectations, driving both customer and financial success.

Internal Business Processes

The Internal Business Processes perspective is one of the four components of the Balanced Scorecard, a strategic management tool designed to provide a comprehensive framework for translating an organization’s vision and strategy into a coherent set of performance measures. This perspective focuses on the critical internal operations and processes an organization must excel at to meet its customer and financial objectives effectively.

Key Objectives of the Internal Business Processes Perspective:

- Operational Efficiency: This involves measuring and improving the efficiency of internal processes, which can include reducing cycle times, minimizing waste, and optimizing resource utilization. The goal is to deliver products and services faster, cost-effectively, and with higher quality.

- Process Quality: Ensures that internal processes can produce outputs that meet quality standards, leading to higher customer satisfaction and lower costs related to rework or defects.

- Innovation and Product Development: Focuses on the organization’s ability to develop new products and services, improve existing offerings, and bring these to market quickly. This can involve measures related to the number of new product launches, the success rate of new products, and the percentage of revenue from new products.

- Supply Chain Management: Optimizes the flow of materials, information, and finances as they move from supplier to manufacturer to wholesaler to retailer to consumer. Effective supply chain management can reduce costs, improve flexibility, and enhance customer satisfaction.

Importance:

The Internal Business Processes perspective is crucial because it directs attention to the processes that impact customer satisfaction and the organization’s ability to achieve its financial objectives. By focusing on internal processes, organizations can identify inefficiencies and bottlenecks, improve quality, and drive innovation, all contributing to competitive advantage and long-term success.

Integration with Other Perspectives:

- Customer Perspective: Excellence in internal processes directly impacts the quality, cost, and delivery of products and services, affecting customer satisfaction and loyalty. By improving internal processes, organizations can better meet customer needs and expectations.

- Financial Perspective: Efficient and effective internal processes can lead to lower operational costs, higher productivity, and improved profitability. Organizations can enhance their financial performance by reducing waste and improving process efficiency.

- Learning and Growth Perspective: The ability to improve internal processes often depends on the skills, knowledge, and capabilities of employees, as well as the organization’s culture and information systems. Investments in training, technology, and organizational culture can support continuous improvement and innovation in internal processes.

Metrics and Measures:

To manage and improve internal business processes, organizations might use a variety of metrics, such as:

- Cycle Time: The time required to complete a process from start to finish.

- Cost per Unit: The cost associated with producing a single unit of product or service.

- Defect Rates: The frequency of errors or defects in the outputs of a process.

- Process Throughput: The work or products produced within a given period.

- Capacity Utilization: The extent to which an organization’s total production capacity is used.

These metrics help organizations monitor their internal processes’ efficiency and effectiveness, identify improvement areas, and track progress over time.

By focusing on the Internal Business Processes perspective within the Balanced Scorecard framework, organizations can ensure that their internal operations are aligned with strategic objectives, contributing to overall performance and success.

Learning and Growth

The Learning and Growth perspective, also known as the “Organizational Capacity” perspective, is one of the four pillars of the Balanced Scorecard framework. This dimension focuses on the intangible assets of an organization, primarily its people, systems, and organizational procedures. The core idea is that long-term success is achieved through continuous improvement and the capability to innovate and change in alignment with market demands and opportunities.

Key Objectives of the Learning and Growth Perspective:

- Employee Skills and Knowledge: Emphasizes the importance of ongoing employee training and development to ensure the workforce has the necessary skills and knowledge to meet current and future demands. This includes technical skills relevant to specific job functions and soft skills facilitating effective communication, teamwork, and leadership.

- Employee Satisfaction and Retention: Recognizes that employee engagement and morale are critical to productivity and innovation. High employee satisfaction and retention rates indicate a positive organizational culture supporting personal and professional growth.

- Information Systems and Technology: Focuses on the role of technology in enabling efficient and effective business processes. This includes the hardware and software used by the organization and the systems and processes that ensure information is accurately captured, stored, and made accessible to decision-makers.

- Organizational Culture and Alignment: Pertains to creating a culture that supports the organization’s strategic objectives, encourages open communication, and fosters a sense of shared purpose among employees. Alignment ensures that everyone works towards the same goals and understands how their role contributes to the broader strategy.

Importance:

The Learning and Growth perspective is essential for creating the foundation for achieving excellence in the other three Balanced Scorecard perspectives (Financial, Customer, and Internal Business Processes). It recognizes that an organization’s ability to innovate, improve, and meet customer needs over the long term depends on its people, systems, and procedures.

Integration with Other Perspectives:

- Internal Business Processes: A skilled and knowledgeable workforce, supported by efficient information systems, can enhance process efficiencies, drive innovation, and improve quality, directly impacting operational performance.

- Customer Perspective: Engaged and well-trained employees are more likely to deliver superior customer service and contribute to developing products and services that meet evolving customer needs, thus enhancing customer satisfaction and loyalty.

- Financial Perspective: Investments in learning and growth initiatives can lead to long-term financial benefits, such as increased productivity, reduced operational costs, and enhanced revenue growth through innovation and improved customer satisfaction.

Metrics and Measures:

To manage the Learning and Growth perspective, organizations might use metrics such as:

- Employee Training Hours: The average number of training hours per employee, indicating the organization’s commitment to employee development.

- Employee Satisfaction and Engagement Scores: Regular surveys gauge how motivated, engaged, and satisfied employees are with their work and work environment.

- Turnover Rates: Particularly voluntary turnover rates, which can indicate the overall health of the organization’s culture and the effectiveness of its retention strategies.

- Technology ROI: The return on investment for technology initiatives, measuring how effectively technology investments support business objectives and process improvements.

By focusing on the Learning and Growth perspective within the Balanced Scorecard, organizations can invest in the capabilities and systems that will enable them to adapt, grow, and achieve long-term success.

Examples of balanced scorecard

To illustrate the Balanced Scorecard approach, here are examples for each of the four perspectives:

Financial Perspective

- Revenue Growth: Measures the year-over-year increase in income generated from the organization’s activities.

- Cost Reduction: Targets specific areas where operational costs can be minimized without affecting product or service quality.

- Return on Investment (ROI): Calculates the efficiency of various investments in terms of their generated returns.

- Cash Flow Analysis: Evaluate the inflows and outflows of cash, ensuring the organization maintains a healthy liquidity position.

Customer Perspective

- Customer Satisfaction Index: Surveys and feedback tools measure customers’ satisfaction with the products, services, and overall experience.

- Market Share: Assesses the company’s proportion of total sales in its industry, indicating competitive strength.

- Customer Retention Rate: Measures the percentage of customers the company retains over a certain period, reflecting customer loyalty and satisfaction.

- Net Promoter Score (NPS): Gauges customer loyalty by asking how likely customers are to recommend the company to others.

Internal Business Processes Perspective

- Quality Control Metrics: Monitors defect rates, rework levels, and adherence to quality standards.

- Cycle Time: Measures the time required to complete a business process from start to finish, aiming to increase efficiency.

- Process Cost: Analyzes the cost associated with each critical process, identifying opportunities for cost-saving improvements.

- Innovation Pipeline Strength: Evaluates the number and potential of new ideas or projects in development, indicating the organization’s future growth prospects.

Learning and Growth Perspective

- Employee Turnover Rate: Monitors the rate at which employees leave the organization, indicating the overall work environment and employee satisfaction.

- Training Hours per Employee: Measures the investment in employee development, correlating with improved performance and innovation.

- Skill Assessments: Regular assessments to ensure employees have the necessary skills and competencies for their roles and future company needs.

- Employee Engagement Scores: Surveys to gauge employee engagement and identify areas for improvement in the organizational culture.

These examples show how a Balanced Scorecard might be implemented in an organization. The specific metrics can vary significantly depending on the industry, the organization’s strategic goals, and challenges.