The purchase of a car is the most important financial investment most people ever make. Approaching it with painstaking preparation and educated methodology can save time. Whether buying your first car or finding a more dependable model to upgrade, the decisions one makes along the path may determine financial life for quite some time.

Knowing how to outsmart the market by understanding the best possible financing strategy and analyzing which purchasing channels are available sets you up for success and protects you from losing your hard-earned money.

The Power of Automotive Commercials in the Digital Age: Leveraging Digital Marketing

Exploring Online Auctions

The Internet has transformed how cars are bought and sold, but a real chance to save money seems most apparent with online auctions. Such a platform brings together buyers and sellers worldwide, increasing the competition and eventually driving the prices down. You can research various vehicles, compare bids, and even place your bid in live auctions—all in the comfort of your home.

First, before bidding on an online auction, be sure it is a renowned and quite transparent website. It would also help to find comprehensive vehicle history, multiple photos, and as many available inspection reports as possible.

Reading reviews or checking the platform’s track record will give you peace of mind. This way, you get a vehicle at much better prices than the traditional listings through dealerships just by being cautious and showing due diligence. The global reach of online auctions also gives you access to unique models unavailable in your local market.

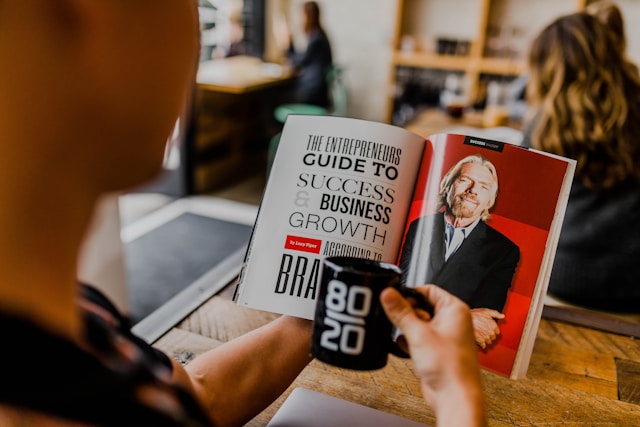

Platforms like abetter.bid car auctions give buyers access to an extensive range of vehicles at competitive prices. By leveraging modern technology and transparent bidding procedures, online auctions can help you make more informed decisions and secure a better deal than you would through conventional means.

Establishing a Realistic Budget and Sticking to It

It may sound so simple, but one of the best ways to save money when buying a car is to set a budget and keep within the limits. Start by clearly ascertaining your financial standing. Calculate your monthly income, existing debts, and projected expenses. From that, come up with a realistic budget for the car, considering not only the upfront cost but also long-term costs, such as insurance premiums, maintenance, fuel, and potential repairs.

Break down the cost of ownership: Remember, buying a car does not stop at the dealership or auction house. Consider extended warranties if appropriate, calculate the cost of regular servicing intervals, and factor in the vehicle’s fuel efficiency. Having a complete picture of the total financial commitment ensures that you choose a car you can afford on purchase day and over the years to come. This predefined budget keeps you from overspending and keeps your finances in order.

Comparing Different Financing Options

Another critical element in saving money involves being selective about how you finance the purchase. Though it may be challenging for most people, the best way is to pay cash upfront. If taking a loan is unavoidable, do your shopping on interest rates and terms. In addition to the banks and credit unions, check out the various manufacturer-backed financing deals that offer qualified buyers lower interest rates or promotional terms.

A slightly reduced interest rate can add significant savings throughout your loan. By the same token, shaving even a couple of years off of the term of a loan—when possible—can equate to saving you money on interest, even though those monthly payments are higher. Settle on a balance that works with your financial situation and goals. Read all the fine print before you finalize to fully understand what you are getting into: conditions and possible fees and penalties for your loan.

Being Mindful of Operating Costs and Insurance

In addition to the purchase price, the ongoing expenses associated with owning a car will impact your bottom line. Insurance premiums can differ depending on the car’s make, model, and age. To compare coverage options and find the best rates, consider checking out affordable car insurance before you finalize your purchase. Get quotes before you finalize your purchase. Choosing a model rated for safety and reliability often means paying lower premiums.

Another factor affecting long-term savings is fuel efficiency. Over several years, a more fuel-efficient car can save you a fortune in gasoline costs. Similarly, routine maintenance costs should be weighed very carefully. Some brands and models are known for requiring high-priced parts or seeking service from specialized shops. Spending more on a car that is economical to maintain can yield much more significant cost savings over several years.

How AI is Changing the Landscape of Car Insurance Customer Service

Conclusion

Saving money on buying a car is a continuing process from before you make a sale until long afterward when you drive away on your new wheels. You put yourself ahead of the game financially as you conduct thorough market research, set a reasonable estimate for your budget, or consider pre-owned car sales or online auctions. Negotiation, carefully selected financing, and the use of technology all combine for the best possible value.