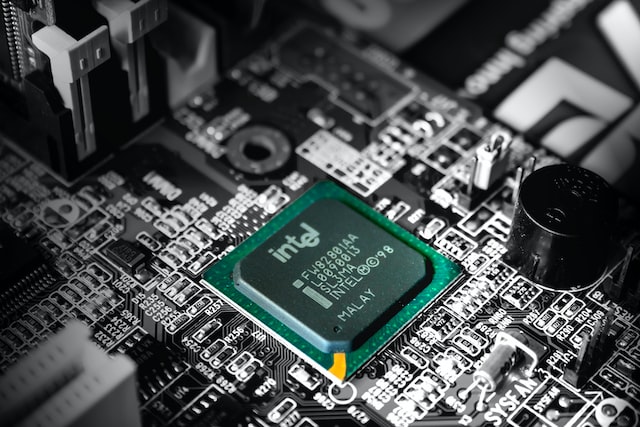

Before we dive deep into the PESTEL analysis, let’s get the business overview of Intel. Intel Corporation is an American multinational corporation and technology company headquartered in Santa Clara, California. The company was founded in 1968 by Gordon Moore and Robert Noyce and has been a cornerstone in developing semiconductor technology. It is a leader in the manufacture of microprocessors, the central unit of many types of computers.

Core Business Segments: Intel’s business can be categorized into several key segments:

- Client Computing Group (CCG): This is typically the largest revenue generator for Intel and focuses on processors and platforms for laptops, desktops, and tablets.

- Data Center Group (DCG): This segment deals with hardware and software solutions for data centers, which include powerful processors and chips that are optimized for enterprise-level tasks, cloud computing, and network infrastructure.

- Internet of Things (IoT): This unit works on making processors and platforms that will power connected devices.

- Non-Volatile Memory Solutions Group: This segment produces memory and storage products, including NAND flash memory and 3D XPoint memory.

- Programmable Solutions Group: This unit specializes in field-programmable gate arrays (FPGAs), which are chips that can be programmed for specific tasks after they’ve been manufactured.

- Intel Labs: This is the research arm of Intel, responsible for exploring cutting-edge technologies that may be commercially viable.

- Other technologies: Includes various other smaller segments, including software products and other initiatives like autonomous driving through its Mobileye subsidiary.

Manufacturing: Intel has been one of the few semiconductor companies designing and manufacturing their own chips. However, it has been increasingly exploring external foundries for some of its products.

Financial Performance 2022: Full-year revenue was $63.1 billion, down 20% YoY. Net income was $7.6 bn, down 65%.

Here is the PESTEL analysis of Intel

A PESTEL analysis is a strategic management framework used to examine the external macro-environmental factors that can impact an organization or industry. The acronym PESTEL stands for:

- Political factors: Relate to government policies, regulations, political stability, and other political forces that may impact the business environment.

- Economic factors: Deal with economic conditions and trends affecting an organization’s operations, profitability, and growth.

- Sociocultural factors: Relate to social and cultural aspects that may influence consumer preferences, lifestyles, demographics, and market trends.

- Technological factors: Deal with developing and applying new technologies, innovations, and trends that can impact an industry or organization.

- Environmental factors: Relate to ecological and environmental concerns that may affect an organization’s operations and decision-making.

- Legal factors: Refer to the laws and regulations that govern businesses and industries.

In this article, we will do a PESTEL Analysis of Intel.

PESTEL Analysis Framework: Explained with Examples

Political

- Trade Policies: Trade policies can significantly impact Intel’s operations, especially considering it is a global company. For instance, the U.S.-China trade tensions have posed challenges for Intel through tariffs and restricted access to one of the largest markets for semiconductor products.

- Regulation and Compliance: As a technology company dealing with advanced manufacturing and export of semiconductor technology, Intel is subject to various regulations in the U.S. and globally. These can include export restrictions, particularly with nations with strained U.S. relations or countries under U.S. sanctions.

- Political Stability: Political stability in countries where Intel has operations or key suppliers can affect its business. For instance, instability could disrupt manufacturing operations or the supply chain, leading to delays and additional costs.

- Intellectual Property Rights: Political factors also extend to international laws and agreements around intellectual property. While developed nations like the U.S. have strong IP laws, this isn’t everywhere. Weak IP protection in some countries could expose Intel to counterfeit production or technology theft risks.

- Government Subsidies and Tax Incentives: Intel benefits from various subsidies, grants, and tax breaks given by governments, especially in the U.S., to promote technological advancements and research & development. Changes in these incentives due to political shifts can affect the company’s strategic planning.

- National Security Concerns: As a provider of technology that could be used in critical infrastructure, Intel may face restrictions or scrutiny based on national security concerns. This could result in limitations on who they can sell to or what kinds of technologies can be exported.

Economic

- Global Economic Conditions: Intel’s performance is tied to global economic health. During economic downturns, consumer and business spending on technology products can decline, affecting Intel’s sales. Conversely, in periods of economic growth, spending on technology generally increases, benefiting companies like Intel.

- Currency Fluctuations: As a global company, Intel does business in multiple currencies. Fluctuations in exchange rates can impact Intel’s financials, particularly its revenue and profit margins. For example, a strong U.S. dollar could make Intel’s products more expensive in foreign markets, reducing demand.

- Interest Rates: Interest rates can affect Intel in various ways. Low-interest rates can facilitate borrowing for investments in R&D and expansion, whereas high interest rates can increase the cost of borrowing. Additionally, interest rates can influence consumer spending; higher rates might deter spending on technology upgrades or new systems.

- Inflation: Inflation rates impact the costs of raw materials and labor, which, in turn, can affect Intel’s manufacturing costs. High inflation could increase production costs, potentially forcing the company to either absorb these costs or pass them on to customers, which could affect competitiveness.

- Competition and Market Saturation: Economic factors also encompass market dynamics like competition and market saturation. Increased competition, particularly from companies like AMD, NVIDIA, and ARM-based chip manufacturers, puts pressure on prices and profit margins. The saturation level in key markets like personal computers also impacts Intel economically.

- Supply Chain Economics: Intel relies on a complex global supply chain, including raw materials, components, and manufacturing equipment. Economic instability in countries part of this supply chain can disrupt production and increase costs.

- Investment in R&D: Intel’s future competitiveness depends on its investment in research and development. The company’s ability to invest in R&D is influenced by its financial performance, which in turn is affected by the overall economic conditions. A healthy economy can support higher levels of R&D investment.

Sociocultural

- Consumer Preferences and Behavior: Consumer demand for products like personal computers, smartphones, and other connected devices indirectly affects Intel, which supplies the microprocessors for these devices. Sociocultural changes, such as an increased focus on remote work or online education, can drive demand for products that use Intel’s components.

- Work Culture and Talent Management: Different regions have varying work cultures and expectations, affecting how Intel manages its human resources globally. The company needs to understand these nuances to attract, retain, and engage talent effectively. Intel’s reputation as an employer also has sociocultural implications, especially given the tech industry’s focus on diversity, equity, and inclusion.

- Ethical and Social Responsibility: Society’s increasing focus on corporate social responsibility, including ethical considerations around technology use, environmental impact, and fair labor practices, can significantly influence public perception of Intel. For instance, ethical sourcing of raw materials is a growing concern in the tech industry.

- Digital Lifestyle and Adoption: As society becomes increasingly digital, the importance of technology in daily life grows. This change can present both opportunities and challenges for Intel. For instance, the growth of the Internet of Things (IoT) and smart homes could open new markets for Intel’s microprocessors, but it also means that consumers may demand higher performance and energy efficiency.

- Education and Skill Levels: The population’s educational background and skill levels can also affect Intel. For example, a well-educated workforce is crucial for R&D and other advanced operations. Additionally, academic standards and the focus on STEM (Science, Technology, Engineering, Mathematics) can affect the talent pool available for recruitment.

Technological

- Pace of Technological Change: The rapid pace of technological advancements is both an opportunity and a challenge for Intel. The company must invest heavily in research and development to stay ahead or keep pace with competitors like AMD, NVIDIA, and ARM-based chip manufacturers.

- Moore’s Law: Named after Intel co-founder Gordon Moore, Moore’s Law predicts that the number of transistors on a chip will double approximately every two years, increasing processing power. However, as transistors reach physical limitations, it’s increasingly challenging for Intel to maintain this pace, necessitating innovations in chip architecture and manufacturing processes.

- Emerging Technologies: Emerging fields such as artificial intelligence, machine learning, edge computing, and the Internet of Things (IoT) present both opportunities and challenges. Intel must develop chips and technologies to power these new fields, not just traditional computing devices.

- Open Source and Collaboration: The rise of open-source software and collaborative platforms can affect Intel’s strategies. For example, collaboration with open-source software ecosystems can be an essential driver for adopting Intel’s hardware in data centers.

- Cybersecurity: As a technology provider, Intel chips must be secure to maintain consumer trust. Vulnerabilities in microprocessors can have significant repercussions, affecting a wide range of devices and systems that use Intel’s chips. This necessitates continuous focus and investment in cybersecurity measures.

- Supply Chain Technology: Advanced technologies in supply chain management, including analytics, automation, and AI, are crucial for Intel to maintain efficiency in its complex global supply chain. Intel must stay abreast of the latest technologies to optimize its manufacturing and distribution processes.

- Cloud Computing: The transition from on-premises hardware to cloud-based solutions directly impacts Intel’s data center business. The demand for powerful, energy-efficient chips for cloud servers is increasing, which Intel must meet to retain its market share.

- Competitive Technologies: Technologies like quantum computing and ARM architecture are viewed as potential threats to traditional chipmakers like Intel. The company must monitor these technologies and adapt its strategies accordingly.

Environmental

- Energy Consumption and Efficiency: As a semiconductor manufacturer, Intel’s operations require substantial energy usage. There is growing public and regulatory pressure to reduce energy consumption and enhance efficiency. Investing in green technologies and sustainable energy sources could benefit Intel.

- E-Waste Management: Electronic waste is a growing environmental concern. As a supplier of components for a multitude of electronic devices, Intel shares a part of the responsibility for reducing e-waste. Sustainable disposal and recycling of electronic components could become crucial for the company’s image and regulatory compliance.

- Water Usage: Semiconductor manufacturing is water-intensive. As water scarcity becomes increasingly global, efficient water use and recycling will likely become critical factors. Intel must adopt technologies that minimize water use and employ sustainable water management practices.

- Regulatory Compliance: Governments and international organizations are implementing more stringent environmental regulations. Compliance with these regulations can impose additional costs on Intel and catalyze the company’s adoption of more sustainable practices.

- Raw Materials: Intel relies on various raw materials, including metals and chemicals, for its manufacturing processes. Sourcing these materials has environmental implications, including potential habitat destruction and pollution. Ethical and sustainable sourcing practices can help Intel mitigate these environmental impacts.

Legal

- Intellectual Property Laws: Intellectual property (IP) is a cornerstone of Intel’s business. The company holds numerous patents and trademarks that are vital to maintaining its competitive advantage. Keeping these IPs secure and defending against infringements are constant legal challenges. Conversely, Intel also needs to be cautious not to infringe on the IPs of other companies, which could result in lawsuits.

- Anti-Trust and Competition Laws: Intel operates in markets closely monitored for anti-competitive practices. Anti-trust laws in countries like the U.S. and regulatory frameworks in regions like the European Union are important considerations. Failure to adhere to these laws can result in substantial fines and damage to reputation.

- Environmental Regulations: As mentioned in the environmental factors, compliance with environmental laws and regulations is crucial. This includes adhering to emissions standards, waste disposal protocols, and other sustainability benchmarks. Non-compliance could result in fines, legal sanctions, and reputational damage.

- Data Protection and Privacy Laws: Data is critical to Intel’s operations, particularly as the company expands into areas like cloud computing and the Internet of Things (IoT). Laws such as the European Union’s General Data Protection Regulation (GDPR) and California’s Consumer Privacy Act (CCPA) impose stringent data protection requirements that Intel must comply with.

- Cybersecurity Laws: Given the nature of Intel’s products, which are foundational to many computing systems, compliance with cybersecurity laws and standards is crucial. This includes ensuring that its microprocessors are secure and do not pose cybersecurity risks, which could result in legal repercussions.

- Contract Laws: Intel engages in numerous contracts, ranging from supplier agreements to customer contracts. Understanding and complying with contract laws across different jurisdictions is important to minimize legal risks.