Before we dive deep into the SWOT analysis, let’s get the business overview of Hilton. Hilton Worldwide Holdings Inc. (commonly referred to as Hilton) is a leading global hospitality company managing a diverse portfolio of hotel brands and services.

Founded in 1919 by Conrad Hilton, the company has become one of the largest hotel chains in the world. As of 20222, Hilton has 7,165 properties comprising 1,127,430 rooms in 123 countries and territories.

Business Segments:

- Owned and Leased Hotels: Hilton owns, leases, or has stakes in several hotels under various brand names. These properties generate revenue through room rentals, food and beverage sales, and other ancillary services. As of December 31, 2022, the segment included 52 hotels totaling 17,612 rooms.

- Management and Franchise: Hilton also manages and franchises hotels on behalf of third-party owners. The company earns revenue through management, franchise, and incentive fees based on hotel performance in this segment. As of December 31, 2022, the segment includes 778 managed hotels and 6,255 franchised hotels consisting of 1,096,115 total rooms.

Hilton’s diversified portfolio comprises various brands catering to different market segments, from luxury to economy. Some of the key Hilton brands include:

- Luxury Brands: Waldorf Astoria Hotels & Resorts, Conrad Hotels & Resorts, and LXR Hotels & Resorts.

- Upper Upscale Brands: Hilton Hotels & Resorts, Curio Collection by Hilton, and Tapestry Collection by Hilton.

- Upscale Brands: DoubleTree by Hilton, Embassy Suites by Hilton, and Hilton Garden Inn.

- Upper Midscale Brands: Hampton by Hilton, Tru by Hilton, and Homewood Suites by Hilton.

- Midscale Brands: Home2 Suites by Hilton and Motto by Hilton.

Besides hotel operations, Hilton has a customer loyalty program called Hilton Honors, which offers members exclusive benefits and rewards, such as room upgrades, free Wi-Fi, and points redeemed for hotel stays, experiences, or merchandise.

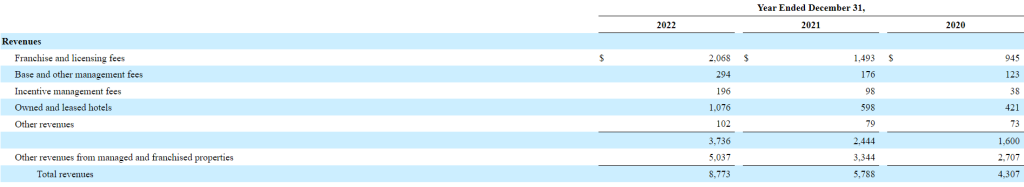

Business Model: Hilton primarily derives its revenues from the following sources:

- Franchise and licensing fees: Represents fees earned in connection with the licensing of one of the brands and fees from licensing agreements to use our IP.

- Base and incentive management fees: Represents fees earned in connection with the management of hotels. Hilton’s fees generally consist of a base fee, typically based on a percentage of the hotel’s monthly gross revenue, and an incentive fee, generally based on a percentage of the hotel’s operating profits.

- Owned and leased hotels: Represents revenues derived from the operations of consolidated owned and leased hotels, including hotel room sales, accommodations sold in conjunction with other services, food and beverage sales, and other ancillary goods and services.

- Other revenues: Represents revenues generated by the incidental support of hotel operations for owned, leased, managed, and franchised hotels, including our purchasing operations and other operating income.

Financial Performance: In 2022, Hilton generated ~$8.7 billion in revenue and $2.1 billion in operating income.

Here is the SWOT analysis for Hilton

A SWOT analysis is a strategic planning tool used to evaluate the Strengths, Weaknesses, Opportunities, and Threats of a business, project, or individual. It involves identifying the internal and external factors that can affect a venture’s success or failure and analyzing them to develop a strategic plan. In this article, we do a SWOT Analysis of Hilton.

By the way, here is a course that will help you stand out in the world of strategy. The Strategic Thinking program for CxO by Cambridge Judge Business School maps your competitive advantage and teaches advanced techniques to formulate, evaluate, and execute winning strategies. Generate winning strategies and learn how to renew them in times of crisis for a competitive advantage.

SWOT Analysis: Meaning, Importance, and Examples

Strengths

- Strong Brand Portfolio: Hilton has a diverse portfolio of well-recognized hotel brands catering to various market segments, from luxury to economy. This diversification allows the company to target different customer groups and reduces its reliance on a single brand or market segment.

- Global Presence: With a presence in over 100 countries and territories, Hilton has established a vast international network that attracts both business and leisure travelers. This global footprint helps the company maintain a stable revenue stream and reduces the impact of regional economic fluctuations.

- Hilton Honors Loyalty Program: The Hilton Honors program has a large and loyal member base, offering exclusive benefits and rewards to its members. This loyalty program enhances customer retention, generates repeat business, and encourages direct bookings through Hilton’s channels.

- Focus on Innovation and Technology: Hilton has proactively adopted and implemented new technologies to enhance guest experiences, streamline operations, and reduce costs. Examples include the Hilton Honors app, digital key, and connected room features, which provide guests with greater convenience and personalized experiences.

- Strategic Partnerships and Alliances: Hilton has forged strategic partnerships with airlines, car rental companies, and credit card issuers, among others, to enhance the value proposition for its guests and provide additional revenue streams.

- Corporate Social Responsibility (CSR): Hilton is firmly committed to sustainability and social responsibility. The company has implemented various initiatives, such as reducing its environmental footprint, investing in local communities, and promoting diversity and inclusion. These efforts help improve Hilton’s brand image and reputation.

Weaknesses

- Limited Ownership of Properties: Hilton primarily operates through management and franchise agreements, meaning it owns relatively few properties compared to its competitors. This lack of property ownership may limit the company’s control over hotel operations and potentially impact brand standards.

- Vulnerability to Economic Cycles: Like other players in the hospitality industry, Hilton is susceptible to fluctuations in economic cycles, which can affect travel demand and, consequently, its revenues. Economic downturns, recessions, or regional crises can lead to reduced demand for hotel accommodations and lower room rates.

- Competition from Alternative Accommodations: The rise of alternative accommodation providers, such as Airbnb and VRBO, has increased competition in the hospitality industry. These platforms often offer lower prices and unique experiences that may attract customers away from traditional hotel chains, including Hilton.

- Dependence on Franchisees: Hilton’s growth strategy relies heavily on franchising (~90%), which means the company’s success is partly dependent on the performance of its franchisees. If franchisees fail to maintain quality and service standards or face financial difficulties, it could negatively impact Hilton’s brand reputation and overall performance.

- Currency Fluctuations: With a significant presence in international markets, Hilton is exposed to currency fluctuations that can impact its financial performance. Exchange rate volatility can lead to revenue and profit margin fluctuations, particularly for operations outside the United States.

- Regulatory and Legal Risks: As a global hospitality company, Hilton must navigate various regulatory environments and comply with local laws and regulations. Any changes in these regulations or non-compliance could result in financial penalties, operational disruptions, and damage to the company’s reputation.

- Data Security and Privacy Concerns: The hospitality industry has been targeted by cyberattacks in recent years, and Hilton is no exception. Data breaches or failure to adequately protect customer information could result in financial losses, legal liabilities, and reputational damage.

- Workforce Challenges: The hospitality industry often faces employee retention, training, and satisfaction challenges. High employee turnover rates can lead to increased costs and reduced service quality. Additionally, Hilton must ensure compliance with labor laws and regulations across different jurisdictions.

By the way, to communicate our strategy effectively within the team, we all need a robust collaboration platform. Miro is the leading visual collaboration platform. Build anything together on Miro. It’s free and as easy to use as a whiteboard, but endlessly more powerful. Do use the Miro platform for strong communication within your team.

Opportunities

- Expansion in Emerging Markets: As economic growth continues in emerging markets, such as Asia-Pacific, Africa, and Latin America, the demand for hotel accommodations is expected to rise. Hilton can capitalize on this growth by expanding its presence in these regions, targeting leisure and business travelers.

- Growth in the Mid-Scale and Budget Segment: The mid-scale and budget segments of the hospitality market have experienced significant growth in recent years, driven by cost-conscious travelers. Hilton can further develop and expand its brands in these segments to capture a larger share of this growing market.

- Strategic Acquisitions and Partnerships: Hilton can explore opportunities for strategic acquisitions or partnerships to strengthen its brand portfolio, expand its global footprint, and enhance its technological capabilities. Collaborating with or acquiring smaller, innovative hotel chains can help Hilton maintain its competitive edge.

- Leveraging Technology and Personalization: Investing in technology and data analytics can help Hilton enhance guest experiences, streamline operations, and optimize revenue management. Personalizing guest experiences through AI-powered recommendations, targeted marketing, and customized services can foster customer loyalty and drive repeat business.

- Focus on Sustainability: As consumer awareness of environmental and social issues grows, Hilton can further develop and promote its sustainability initiatives. Implementing eco-friendly practices and investing in local communities can help the company differentiate itself from competitors and appeal to environmentally conscious travelers.

- Expansion of the Hilton Honors Program: Enhancing the Hilton Honors loyalty program by offering more attractive benefits, unique experiences, and personalized rewards can help Hilton retain and attract new customers. Additionally, partnerships with complementary businesses can further enhance the value proposition for program members.

- Health and Wellness Tourism: The health and wellness tourism segment is a growing trend in the travel industry. Hilton can capitalize on this opportunity by incorporating wellness-focused amenities, services, and experiences into its properties or launching a new brand dedicated to health and wellness.

- Adaptation to the “Work from Anywhere” Trend: As remote work becomes more prevalent, Hilton can cater to the needs of digital nomads and remote workers by offering flexible workspaces, long-term stay packages, and reliable internet connections at its properties. This can help the company capture a new market segment and increase occupancy rates.

Threats

- Economic Uncertainty: The hospitality industry is sensitive to economic cycles, and any downturn or recession can lead to reduced travel demand, impacting hotel occupancy and room rates. Economic uncertainties can negatively affect Hilton’s revenues and profitability.

- Intense Competition: Hilton faces fierce competition from other established hotel chains, such as Marriott, IHG, and Hyatt, and alternative accommodation providers like Airbnb and VRBO. This competition can lead to price wars, reduced market share, and pressure on profit margins.

- Regulatory and Legal Challenges: Hilton must comply with various laws and regulations in multiple jurisdictions as a global company. Changes in these regulations, such as those related to employment, taxes, or zoning, could increase operating costs or limit the company’s ability to expand.

- Currency Fluctuations: With a significant international presence, Hilton is exposed to currency exchange rate risks. Volatility in currency markets can lead to fluctuations in the company’s financial performance and affect its overall profitability.

- Natural Disasters and Pandemics: Natural disasters, such as hurricanes, earthquakes, or floods, can damage hotel properties and disrupt operations. Moreover, pandemics, like the COVID-19 outbreak, can severely impact the travel industry, leading to reduced demand, travel restrictions, and potential closures of hotel properties.

- Changing Consumer Preferences: Hilton must adapt its offerings to stay relevant and appealing as consumer preferences and expectations evolve. Failure to do so may result in the company losing market share to competitors that better meet changing customer demands.

- Data Security and Privacy: The hospitality industry increasingly relies on digital systems and customer data, making it vulnerable to cyberattacks and data breaches. Failure to protect customer information adequately can result in financial losses, legal liabilities, and damage to Hilton’s reputation.

- Labor Issues: The hospitality industry often faces employee retention, training, and satisfaction challenges. High employee turnover rates can lead to increased costs and reduced service quality. Additionally, labor disputes, strikes, or changes in labor regulations can negatively impact Hilton’s operations and brand reputation.

- Geopolitical Tensions and Terrorism: Geopolitical tensions and acts of terrorism can impact the travel industry by reducing travel demand or prompting governments to impose travel restrictions. Such events can adversely affect Hilton’s operations, particularly in regions with heightened geopolitical risks.