Before we dive deep into the SWOT analysis, let’s get the business overview of American Airlines. American Airlines Group Inc. (AAL) is a major American airline holding company headquartered in Fort Worth, Texas.

Founded in 1926 as American Airways, it has grown through a series of mergers and acquisitions to become one of the largest airlines in the world. The company operates under its flagship carrier, American Airlines, and several regional carriers, such as American Eagle, independently owned regional airlines.

As of 2021, American Airlines serves an extensive domestic and international network, including destinations across North America, South America, Europe, Asia, and the Caribbean. The company operates out of ten primary hubs, with its largest hub being the Dallas/Fort Worth International Airport (DFW). American Airlines is a founding member of the Oneworld airline alliance, which includes other major carriers like British Airways, Cathay Pacific, and Qantas.

American Airlines offers a variety of travel classes, including Basic Economy, Main Cabin, Premium Economy, Business Class, and First Class, catering to its customers’ different needs and budgets. The airline also has a frequent flyer program, AAdvantage, which allows members to earn miles and redeem them for rewards such as flight upgrades, hotel stays, and car rentals.

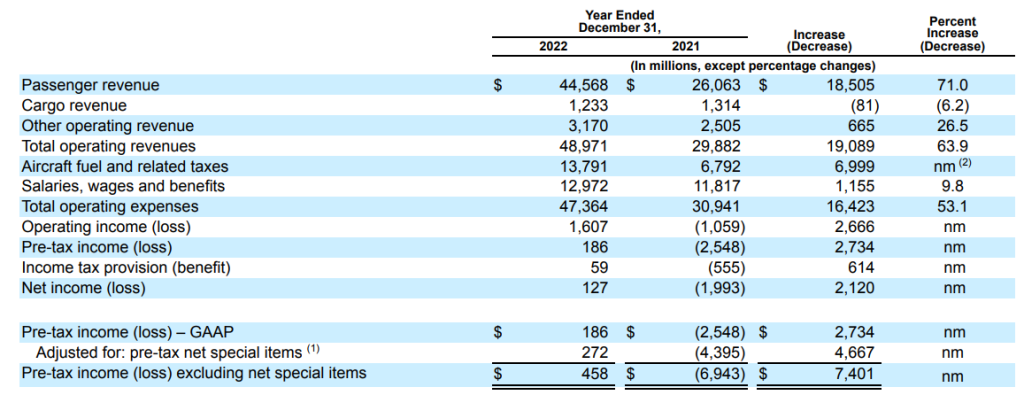

- In 2022, we reported total operating revenues of $49.0 billion, an increase of $19.1 billion, or 63.9%, compared to 2021.

- Pre-tax income and net income were $186 million and $127 million, respectively, in 2022. This compares to the 2021 pre-tax and net losses of $2.5 billion and $2.0 billion, respectively.

Here is the SWOT analysis for American Airlines

A SWOT analysis is a strategic planning tool used to evaluate the Strengths, Weaknesses, Opportunities, and Threats of a business, project, or individual. It involves identifying the internal and external factors that can affect a venture’s success or failure and analyzing them to develop a strategic plan. In this article, we do a SWOT Analysis of American Airlines.

SWOT Analysis: Meaning, Importance, and Examples

Strength

- Extensive route network: American Airlines has an extensive domestic and international network, serving a large number of destinations across North America, South America, Europe, Asia, and the Caribbean. This vast network allows the airline to cater to a diverse customer base and reach many markets, which in turn helps generate significant revenue.

- Strong brand recognition: American Airlines is a well-established brand with a long history in the aviation industry. This strong brand recognition helps the company attract and retain customers and allows the airline to leverage its brand for marketing and partnership opportunities.

- Membership in the oneworld alliance: As a founding member of the oneworld airline alliance, American Airlines can provide its customers with seamless travel experiences through code-sharing agreements, joint ventures, and reciprocal frequent flyer programs with other member airlines. This membership also helps the airline extend its reach and boost its global presence.

- Hub-and-spoke model: American Airlines operates a hub-and-spoke system with ten primary hubs across the United States. This model allows the airline to efficiently consolidate and connect passenger traffic, offering its customers a wide range of connecting flights and minimizing travel time.

- Diverse product offerings: American Airlines offers a variety of travel classes and services, catering to different customer needs and budgets. This product diversification helps the airline appeal to a broader range of customers and generate additional revenue streams.

- AAdvantage loyalty program: The AAdvantage frequent flyer program is one of the industry’s largest and most established loyalty programs. It allows American Airlines to reward and retain its most loyal customers, contributing to a significant portion of its revenue.

Weaknesses

- High debt levels: American Airlines has historically had high levels of debt, which can impact the company’s financial flexibility and ability to invest in growth opportunities. High debt levels also increase the airline’s vulnerability during economic downturns and industry-wide crises, such as the COVID-19 pandemic. American Airlines ended the year with $43 billion in total adjusted debt, down from a peak of over $48 billion in 2021.

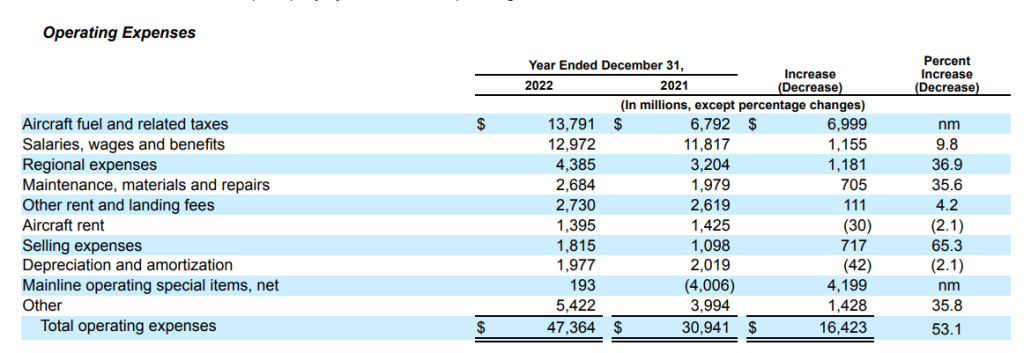

- Dependence on oil prices: The airline industry heavily depends on oil prices, as fuel is a significant operating cost for airlines. Fluctuations in oil prices can considerably impact American Airlines’ operating expenses and profitability, making it vulnerable to market volatility.

- Labor issues: American Airlines has faced labor issues in the past, including disputes with unions and challenges in maintaining labor costs. These issues can lead to operational disruptions, customer dissatisfaction, and potential financial impacts.

- Intense competition: The airline industry is highly competitive, with numerous domestic and international players vying for market share. American Airlines faces fierce competition from legacy carriers and low-cost airlines, which can pressure its pricing power, profitability, and market share.

- Aging aircraft fleet: Although American Airlines has been investing in fleet renewal, the company still operates an older aircraft fleet compared to some of its competitors. This can lead to higher maintenance costs and reduced fuel efficiency, impacting the airline’s operating expenses and environmental footprint.

- Customer service perception: American Airlines has faced some criticism regarding customer service and overall passenger experience in the past. This perception can impact customer loyalty and the airline’s ability to attract new customers, ultimately affecting the company’s brand and reputation.

Opportunities

- Industry recovery from the COVID-19 pandemic: As vaccination rates increase and travel restrictions ease, the airline industry is expected to rebound from the negative impact of the COVID-19 pandemic. American Airlines can benefit from this recovery by expanding its network, increasing capacity, and targeting leisure and business travelers.

- Expansion into emerging markets: Significant growth potential exists in emerging markets such as Asia, Africa, and Latin America. American Airlines can explore opportunities to expand its route network in these regions, tapping into the increasing demand for air travel driven by economic growth and a growing middle class.

- Focus on cost efficiency and operational improvements: By streamlining its operations, optimizing its route network, and investing in more fuel-efficient aircraft, American Airlines can reduce operating costs, improve profitability, and enhance its competitive position in the industry.

- Leveraging technology and digital innovation: By investing in digital technologies, American Airlines can enhance its customer experience, optimize operations, and drive cost savings. This includes areas such as mobile applications, artificial intelligence, and data analytics for personalized marketing and revenue management.

- Strengthening partnerships and alliances: American Airlines can explore opportunities to strengthen its existing partnerships and forge new alliances within the oneworld alliance and with other airlines. These collaborations can help the airline expand its global reach, share costs, and access new markets.

- Focus on sustainability: As environmental concerns become more prominent, airlines are under increasing pressure to reduce their carbon footprint. American Airlines can invest in sustainable aviation technologies, such as more fuel-efficient aircraft, alternative fuels, and carbon offset programs, to enhance its environmental performance and appeal to environmentally conscious travelers.

Threats

- Economic downturns and geopolitical tensions: Economic downturns and geopolitical uncertainties can lead to reduced demand for air travel, impacting American Airlines’ revenue and profitability. The airline industry is susceptible to global economic conditions, and any downturn could negatively affect American Airlines.

- Intense competition: The airline industry is characterized by intense competition, with numerous domestic and international carriers vying for market share. American Airlines faces competition from legacy carriers and low-cost airlines, which can pressure its pricing power, profitability, and market share.

- Fluctuating oil prices: The airline industry heavily depends on oil prices, as fuel is a significant operating cost for airlines. Fluctuations in oil prices can considerably impact American Airlines’ operating expenses and profitability, making it vulnerable to market volatility.

- Regulatory and environmental concerns: Airlines are subject to various regulations, including safety, security, and environmental requirements. Regulation changes or increased scrutiny can lead to higher compliance costs and potential operational disruptions for American Airlines. Furthermore, growing environmental concerns and potential carbon taxes could increase operating costs and pressure the airline to invest in more sustainable practices.

- Labor relations: American Airlines has faced labor disputes and challenges in maintaining labor costs in the past. Any future labor issues could lead to operational disruptions, customer dissatisfaction, and potential financial impacts.

- Health crises and natural disasters: The airline industry is susceptible to the effects of health crises, such as the COVID-19 pandemic and natural disasters, which can significantly disrupt operations, reduce demand for air travel, and affect the financial performance of airlines like American Airlines.

- Cybersecurity and data breaches: With increasing reliance on technology and digital platforms, airlines face the risk of cyberattacks and data breaches, which could compromise sensitive customer information and result in financial losses, reputational damage, and potential regulatory penalties for American Airlines.