Before we dive deep into the PESTEL analysis, let’s get the business overview of Afterpay. Afterpay is an Australian financial technology company specializing in “buy now, pay later” services. Founded in 2014 by Nick Molnar and Anthony Eisen, Afterpay allows customers to purchase goods and services immediately but pay for them in four installments over six weeks without incurring interest. Merchants receive payment upfront, less a commission, and any fees charged by Afterpay.

Business Model: Afterpay’s business model revolves around the “buy now, pay later” concept, which has gained significant traction both in Australia and internationally. The company’s revenue streams are primarily from two sources:

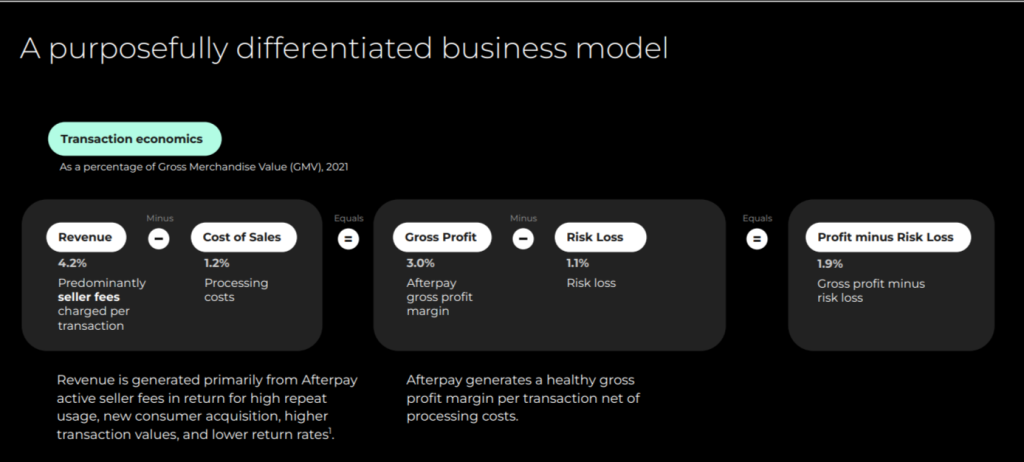

- Merchant Fees: Afterpay charges retailers a fee for each transaction processed through its platform. This fee is a percentage of the transaction value and includes a fixed amount. The idea is to give merchants a way to boost sales by offering a flexible payment method to customers. Merchants are paid upfront, and they don’t have to manage the risk associated with the installment payments as Afterpay takes on that risk.

- Late Fees: Customers who fail to make timely payments are charged late fees. However, Afterpay does not charge interest on the installments, making it a more attractive option for consumers compared to traditional credit cards.

Target Market: Afterpay primarily targets millennial and Gen Z consumers, who are more comfortable with online shopping and digital payment systems but may be averse to traditional credit products

Acquisition by Square: In 2021, Square (now Block), a financial services and mobile payment company founded by Jack Dorsey and Jim McKelvey, announced its intention to acquire Afterpay in an all-stock deal worth approximately $29 billion.

What attracted Square to Afterpay’s business model?

Financial Performance 2022: Afterpay contributed $US811 ($1.18 billion) million of revenue and $US588 million of gross profit to Block over the full calendar year in 2022.

Here is the PESTEL analysis of Afterpay

A PESTEL analysis is a strategic management framework used to examine the external macro-environmental factors that can impact an organization or industry. The acronym PESTEL stands for:

- Political factors: Relate to government policies, regulations, political stability, and other political forces that may impact the business environment.

- Economic factors: Deal with economic conditions and trends affecting an organization’s operations, profitability, and growth.

- Sociocultural factors: Relate to social and cultural aspects that may influence consumer preferences, lifestyles, demographics, and market trends.

- Technological factors: Deal with developing and applying new technologies, innovations, and trends that can impact an industry or organization.

- Environmental factors: Relate to ecological and environmental concerns that may affect an organization’s operations and decision-making.

- Legal factors: Refer to the laws and regulations that govern businesses and industries.

In this article, we will do a PESTEL Analysis of Afterpay.

PESTEL Analysis Framework: Explained with Examples

Political

- Regulatory Framework: The “buy now, pay later” industry is scrutinized by governments to ensure it operates ethically and transparently. Changes in regulatory policy could impact how Afterpay does business, including how it communicates with customers and manages debt collection.

- Political Stability: Afterpay operates in several countries, including Australia, the United States, and the United Kingdom. Political stability in these nations is crucial for business continuity. Unstable political environments could lead to economic volatility, impacting consumer confidence and, thus, revenues.

- Trade Policies: As an international company, Afterpay is affected by trade relations between countries. Tariffs, trade wars, or restrictions can influence its cost structure and international expansion strategy.

- Government Support and Initiatives: Governments increasingly support fintech innovations through various incentives, grants, or favorable policies. Positive government attitudes toward fintech could benefit Afterpay.

- Data Protection and Privacy Laws: Political decisions surrounding data protection laws like GDPR in Europe or CCPA in California have implications on how Afterpay handles consumer data.

Economic

- Interest Rates: The level of interest rates in a particular country could impact consumer willingness to use credit services. Lower interest rates could make traditional credit options more attractive than Afterpay’s interest-free approach.

- Inflation: Higher inflation could affect consumer purchasing power, reducing the number of transactions processed through Afterpay.

- Economic Growth: Economic prosperity generally leads to increased consumer spending, benefiting Afterpay. Conversely, economic downturns often lead to reduced consumer spending and potentially higher default rates on repayments.

- Exchange Rates: As an international company, Afterpay is subject to exchange rate fluctuations. Volatile exchange rates can impact the company’s financial performance when converting foreign earnings to its home currency.

- Disposable Income: Higher levels of disposable income among consumers generally lead to more retail spending, which could increase usage of Afterpay’s services.

- Market Maturity: Economic development in target markets can influence the adoption rate of “buy now, pay later” services. Emerging economies with growing middle-class populations can provide expansion opportunities.

Sociocultural

- Generational Attitudes: Millennials and Gen Z are more open to fintech solutions and wary of traditional credit systems due to high-interest rates and hidden charges. Afterpay’s model could be more appealing to these younger cohorts.

- Online Shopping Behavior: The cultural acceptance and prevalence of online shopping directly impact Afterpay’s business model, as the service is often integrated into e-commerce platforms.

- Consumer Trust: Trust in financial systems varies from culture to culture. In some societies, people are more comfortable with traditional banking systems, while in others, there may be a more rapid adoption of fintech solutions like Afterpay.

- Financial Literacy: The level of financial literacy in a population can affect how well consumers understand the pros and cons of “buy now, pay later” systems, which in turn influences the adoption rate and perception of services like Afterpay.

- Social Norms on Debt and Credit: Cultural attitudes toward debt and the use of credit can vary widely. In some societies, a social stigma may be associated with using credit, which could affect the adoption of Afterpay’s services.

- Lifestyle Trends: The popularity of “fast fashion” or impulse buying could encourage using “buy now, pay later” services. Conversely, a cultural shift towards more sustainable and thoughtful consumption could reduce the frequency of impulse purchases, impacting Afterpay’s business.

Technological

- Payment Infrastructure: The state and development of a country’s digital payment infrastructure can significantly impact Afterpay’s operations. Countries with more developed digital payment systems are more likely to provide fertile ground for Afterpay’s services.

- Cybersecurity: As a financial service provider, Afterpay needs to stay ahead of cybersecurity threats. Increased incidents of cyber-attacks or security breaches can not only lead to financial losses but also severely damage the company’s reputation.

- Data Analytics: The use of advanced data analytics can help Afterpay in risk assessment, customer segmentation, and targeted marketing. Machine learning algorithms can also predict consumer behavior and default rates.

- Blockchain and Digital Currencies: The rise of blockchain technology and digital currencies like Bitcoin could impact the fintech landscape. Although this technology has yet to be widely adopted for payment services, it could pose challenges and opportunities for Afterpay.

- API Integrations: The ability to integrate easily with online retailers via APIs (Application Programming Interfaces) can give Afterpay a competitive edge by making it more convenient for merchants to adopt its platform.

- Automation and AI: Advances in automation and Artificial Intelligence can help Afterpay streamline its operations, from customer service to fraud detection, resulting in cost savings and improved efficiency.

- Interoperability: Compatibility with various e-commerce platforms, banks, and financial systems is crucial for Afterpay’s scalability. The more seamlessly it can integrate with other platforms, the more appealing it becomes to both merchants and consumers.

Environmental

- Carbon Footprint: As a technology company, Afterpay relies on data centers, which consume significant amounts of electricity. Its carbon footprint could become a point of scrutiny, particularly as discussions about sustainability gain prominence.

- E-Waste: The life cycle of the operation hardware could also be scrutinized. Management of e-waste is becoming an important consideration for companies in all sectors.

- Sustainable Practices: Consumer and investor sentiment increasingly lean towards sustainable and responsible business practices. Adopting sustainable practices, even as a fintech, could become a competitive advantage for Afterpay.

- Supplier Sustainability: As Afterpay continues to grow, its choice of suppliers for everything from office supplies to cloud services can be viewed through the lens of sustainability. Associations with non-sustainable vendors can negatively impact its reputation.

- Indirect Environmental Impact: While Afterpay’s direct environmental impact might be limited, its role in facilitating consumerism, particularly in industries like fast fashion, could draw attention to its indirect environmental footprint.

- Energy Efficiency: Adopting energy-efficient practices in data centers, offices, and other operational areas could result in cost savings and environmental benefits.

Legal

- Financial Regulations: Different countries have varying rules governing financial institutions and credit-providing entities. Regulatory compliance is crucial for Afterpay, especially as it continues its international expansion.

- Consumer Protection Laws: Laws designed to protect consumers could impact how Afterpay structures its terms of service, fee schedules, and collection practices. Failure to comply could result in penalties and damage to reputation.

- Data Protection and Privacy Laws: With regulations like GDPR in Europe and CCPA in California, Afterpay must ensure it handles customer data in compliance with various international, federal, and state privacy laws.

- Anti-Money Laundering (AML) and Know Your Customer (KYC) Regulations: As a financial service provider, Afterpay must adhere to AML and KYC regulations, which require verifying customer identities and monitoring transactions to prevent illegal activities.

- Cybersecurity Laws: Increasingly stringent cybersecurity laws require companies to protect sensitive data and report data breaches in a specified manner; failure to comply with this could result in significant penalties.

- E-commerce Regulations: As Afterpay often partners with online retailers, it must be aware of and comply with laws regulating e-commerce, such as online disclosures, advertising, and consumer rights related to online transactions.