Before we dive deep into the SWOT analysis, let’slet’s get the business overview of BASF. BASF SE is a German multinational chemical company that operates in various industries, including chemicals, plastics, performance products, crop protection, and oil and gas.

BASF produces a wide range of products for various industries, including automotive, construction, pharmaceuticals, agriculture, and consumer goods. Its product portfolio includes chemicals, plastics, coatings, catalysts, crop protection products, and fine chemicals.

The company strongly focuses on innovation and sustainability, with a significant portion of its research and development budget dedicated to developing new sustainable technologies.

In recent years, BASF has been restructuring its portfolio to focus on its core businesses and divesting non-core assets. The company has also been investing heavily in digitalization and expanding its presence in emerging markets, particularly in Asia.

BASF has companies in 90 countries. BASF operates six Verbund sites and 232 additional production sites worldwide. BASF’s Verbund site in Ludwigshafen, Germany, is the world’sworld’s largest integrated chemical complex owned by a single company.

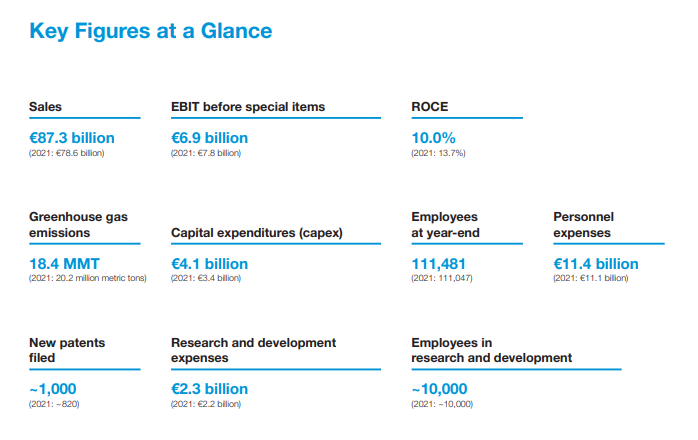

BASF is a publicly traded company with shares listed on several stock exchanges, including the Frankfurt, New York, and London Stock Exchanges. Following are some key figures as of Dec ’22 ’22.

Here is the SWOT analysis for BASF

A SWOT analysis is a strategic planning tool used to evaluate the Strengths, Weaknesses, Opportunities, and Threats of a business, project, or individual. It involves identifying the internal and external factors that can affect a venture’sventure’s success or failure and analyzing them to develop a strategic plan. In this article, we do a SWOT Analysis of BASF.

SWOT Analysis: Meaning, Importance, and Examples

Strengths

- Diversified product portfolio: BASF offers a wide range of products and solutions across different industries, which helps to reduce its dependence on any single product or market. This diversification helps to mitigate risks and stabilize the company’scompany’s revenue streams.

- Intense research and development capabilities: BASF strongly focuses on innovation and invests heavily in research and development. This enables the company to develop new and improved products, stay ahead of its competitors, and address evolving customer needs. BASF has around 10,000 employees and spent €2.3 billion in R&D in 2022.

- Operational efficiency: BASF has a strong track record of operational excellence, which allows it to optimize its production processes and reduce costs. This, in turn, improves the company’scompany’s profitability and helps it to compete more effectively in the market.

- Global presence: BASF operates in over 80 countries, which gives it a global footprint and enables it to serve customers worldwide. This also allows the company to benefit from growth opportunities in different regions and markets.

- Sustainability leadership: BASF’s sustainability approach covers the entire value chain – from the responsible procurement of raw materials and safety and resource efficiency in production to sustainable solutions for its customers. This contributes to the company’s reputation and positions it for long-term success in a world increasingly focused on sustainability.

Weaknesses

- Exposure to cyclical industries: BASF operates in several cyclical industries, such as construction and automotive, which are vulnerable to economic downturns. This can lead to fluctuations in the company’s revenue and profitability.

- Dependence on a few large customers: BASF significantly depends on a few large customers, particularly in the automotive industry. This creates a risk of concentration, as the loss of a significant customer could dramatically impact the company’scompany’s financial performance.

- High capital expenditure requirements: The chemical industry requires substantial capital investment, particularly for research, development, and production facilities. This can lead to high capital expenditure requirements, limiting the company’scompany’s flexibility to pursue other growth opportunities or return capital to shareholders.

- Environmental and regulatory risks: As a chemical company, BASF is exposed to environmental and regulatory risks, including the potential for accidents, pollution, and regulatory fines. This could damage the company’scompany’s reputation and financial performance.

- Competitive market: The chemical industry is highly competitive, with numerous players vying for market share. This could lead to pricing pressure and lower profitability for BASF, particularly in periods of oversupply.

Opportunities

- Expanding in emerging markets: BASF can leverage its global presence to expand into emerging markets such as Asia, Africa, and Latin America, which offer significant growth opportunities due to rising middle-class populations and increased demand for chemicals and materials.

- Developing sustainable solutions: BASF has an opportunity to create sustainable solutions for its customers, which can help address environmental challenges and enhance the company’scompany’s reputation as a leader in sustainability.

- Investing in digitalization: BASF can leverage digitalization to optimize its operations, enhance customer experience, and develop new digital solutions for its customers.

- Investing in research and development: BASF can continue to invest in research and development to develop new products and solutions that address evolving customer needs and challenges.

- Acquisitions and partnerships: BASF can explore opportunities to acquire or partner with other companies to expand its product portfolio, enter new markets, or access new technologies. This can help the company to stay competitive and achieve its growth objectives.

Threats

- Economic volatility: BASF’s business is sensitive to economic conditions, particularly in the automotive and construction industries. Economic fluctuations can reduce demand for the company’s products and services, which could impact its financial performance.

- Intense competition: The chemical industry is highly competitive, with numerous players vying for market share. This could lead to pricing pressure and lower profitability for BASF.

- Environmental regulations: As a chemical company, BASF is exposed to environmental and regulatory risks, including the potential for accidents, pollution, and regulatory fines. Increasing regulations and compliance costs could impact the company’scompany’s financial performance.

- Geopolitical risks: BASF operates in multiple countries, which exposes it to geopolitical risks such as trade barriers, political instability, and changes in regulations or policies that could affect its operations.

- Technological disruption: The chemical industry is undergoing significant technological disruption, particularly in digitalization, artificial intelligence, and biotechnology. Failure to keep up with technological advancements could impact BASF’s competitiveness and growth prospects.