Before we dive deep into the SWOT analysis, let’s get the business overview of AstraZeneca. AstraZeneca is a global, science-led biopharmaceutical company focusing on discovering, developing, and commercializing prescription medicines. Founded in 1999 through the merger of Astra AB of Sweden and Zeneca Group PLC of the UK, it has become one of the world’s foremost pharmaceutical companies.

Therapeutic Areas: AstraZeneca operates in a variety of therapeutic areas, including:

- Oncology

- Cardiovascular, Renal & Metabolism (CVRM)

- Respiratory & Immunology

- Other areas like neuroscience and infection

COVID-19 Vaccine: AstraZeneca has been in the global spotlight due to its development of a COVID-19 vaccine in collaboration with the University of Oxford. This vaccine has been distributed to numerous countries and is vital in global vaccination campaigns.

Here is the SWOT analysis for AstraZeneca

A SWOT analysis is a strategic planning tool used to evaluate the Strengths, Weaknesses, Opportunities, and Threats of a business, project, or individual. It involves identifying the internal and external factors that can affect a venture’s success or failure and analyzing them to develop a strategic plan. In this article, we do a SWOT Analysis of AstraZeneca.

SWOT Analysis: Meaning, Importance, and Examples

Strengths

- Strong Product Pipeline: AstraZeneca has a robust pipeline of drugs in various stages of development, especially in oncology, cardiovascular, renal, metabolism, respiratory, and immunology areas, which promises future growth.

- Global Presence: With operations in numerous countries, AstraZeneca has a diversified geographic footprint that allows for global market penetration and reduces reliance on any single market.

- Research and Development: The company strongly focuses on R&D, investing a significant percentage of its revenue back into research, leading to a high rate of innovation.

- Strategic Partnerships and Collaborations: AstraZeneca actively partners with other pharmaceutical companies, governments, and healthcare providers, enhancing its capabilities and reach.

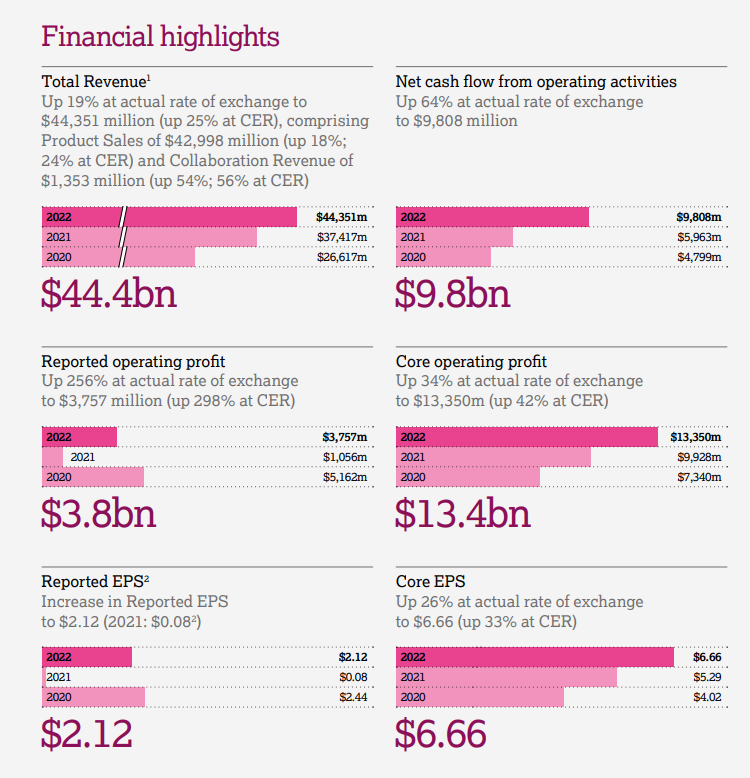

- Financial Performance: Historically, AstraZeneca has demonstrated solid financial performance with a good balance of growth in revenues and profitability.

- Established Brand: It is a well-established brand with a strong reputation for quality in the pharmaceutical industry, contributing to its competitive edge.

- Diverse Product Portfolio: The company offers various medicines, including blockbusters and specialty care medications, that cater to multiple diseases and conditions.

- Effective Corporate Strategy: AstraZeneca’s corporate strategy effectively aligns with changing market dynamics, focusing on areas with high unmet medical needs.

- Leadership in Biologics: AstraZeneca has developed expertise in biologic drugs, which are at the forefront of biomedical research with the potential for delivering cutting-edge therapies.

- COVID-19 Vaccine: The development and distribution of the Oxford-AstraZeneca COVID-19 vaccine have significantly increased the company’s global profile and reputation.

- Patent Portfolio: Owning a wide range of patents protects its investments and provides exclusivity in the market for its key drugs, securing long-term revenue streams.

Weaknesses

- Drug Patent Expirations: The loss of exclusivity on key drug patents can lead to a significant drop in revenue as generic versions become available.

- High Dependence on Key Drugs: A heavy reliance on the sales of a few blockbuster drugs can be risky if those drugs face competition or other market challenges.

- R&D Productivity: Despite a strong pipeline, the actual yield of marketable products compared to the investment in R&D can be low, as is the risk with any company in the pharmaceutical industry.

- Regulatory Challenges: The pharmaceutical industry is heavily regulated, and any changes in regulation or delays in drug approvals can hurt AstraZeneca’s operations and profitability.

- Pricing Pressure: AstraZeneca, like other pharmaceutical companies, faces constant pressure on drug pricing from government healthcare systems and insurance companies, affecting profit margins.

- Legal Risks: Ongoing legal battles or the potential for litigation related to drug patents or clinical trials can be a significant financial and reputational risk.

- Market Access: Gaining market access for new drugs promptly can be challenging due to the complex and varied healthcare systems across the globe.

- Intense Competition: The pharmaceutical industry is highly competitive, with numerous companies competing for market share, which can limit growth and put pressure on pricing.

- Cultural and Organizational Challenges: Integrating acquisitions and managing a global workforce can present cultural and organizational challenges that impact company efficiency and cohesion.

- Limited Presence in Emerging Markets: While AstraZeneca has a global presence, it might not be as strong in some emerging markets, which are seen as the next growth frontier for pharmaceuticals.

Opportunities

- Emerging Markets: Expanding into emerging markets offers the opportunity for AstraZeneca to grow its customer base, especially in regions with rapidly growing demand for healthcare services.

- Product Pipeline Development: Innovating and pushing new drugs through the pipeline can lead to marketable products that address unmet medical needs, particularly in specialized therapeutic areas.

- Strategic Acquisitions and Partnerships: Acquiring smaller biotech firms or forming strategic alliances can enhance AstraZeneca’s R&D capabilities and product portfolio, providing a quick entry to new markets or technologies.

- Biosimilars: Investing in developing biosimilars could open up new revenue streams as patents of biologic drugs expire and demand for cost-effective alternatives rises.

- Personalized Medicine: There’s a growing trend towards personalized medicine. AstraZeneca can invest in this area to create tailored treatments, enhancing drug efficacy and patient outcomes.

- Digital Health Solutions: Integrating digital health solutions and technology in drug development and patient monitoring can improve efficiency and improve health outcomes.

- Healthcare Partnerships: Collaborating with healthcare providers and insurers could enhance market access and patient treatment adherence, thereby increasing sales.

- Expanding Therapeutic Areas: Entering into or expanding presence in therapeutic areas outside of AstraZeneca’s current focus could present new revenue opportunities.

- Patent Cliff Recovery: Developing new drugs to replace those going off-patent can help mitigate the impact of revenue loss due to the expiration of key drug patents.

- Aging Population: As global populations age, there is an increasing demand for healthcare products and services, providing a growing market for AstraZeneca’s products.

- Preventive Treatments and Vaccines: Investing in developing vaccines and preventative treatments could lead to new products, as shown by the success of their COVID-19 vaccine.

- Adherence to Sustainability: Focusing on sustainability and eco-friendly practices can improve brand image and cater to the increasing number of environmentally-conscious consumers.

- Regulatory Approvals: Gaining approval for new drugs in various regions can open up significant new markets, especially if AstraZeneca can navigate the regulatory landscape effectively.

- Advancements in Technology: Leveraging advancements in biotechnology, AI for drug discovery, and data analytics can lead to more efficient R&D processes and a competitive edge.

Threats

- Intense Competition: The pharmaceutical industry is highly competitive, with many companies aiming to develop new drugs and generics that can impact AstraZeneca’s market share and pricing power.

- Generic Penetration: As patents expire, there is a threat from generic drugs, which can significantly undercut AstraZeneca’s pricing and revenue.

- Regulatory Changes: Changes in healthcare regulations, pricing controls, and drug approval processes in key markets can create uncertainty and may hinder business operations or profitability.

- Drug Pricing Pressures: There is global pressure to reduce drug prices from governments, insurance companies, and patient groups, which can affect profit margins.

- Patent Litigations: Legal challenges against drug patents can lead to loss of exclusivity, allowing competitors to enter the market with similar drugs.

- Innovation Challenges: The company must continually innovate to stay ahead, and any slowdown in bringing new drugs to market can be a significant threat to growth.

- Market Access Barriers: Tariffs, trade barriers, or political instability can limit access to crucial markets, affecting sales and growth opportunities.

- Reputation Risks: Negative publicity related to drug side effects, recalls, or legal issues can damage the brand and consumer trust.

- Economic Downturns: Global economic instability can reduce healthcare spending and affect AstraZeneca’s business.

- Exchange Rate Fluctuations: As a global company, AstraZeneca is susceptible to foreign exchange risks that can impact its financial results.

- Cybersecurity Threats: Potential data breaches and cyber-attacks can jeopardize patient data and proprietary information.

- Changing Consumer Preferences: Shifts in how patients and healthcare providers approach treatment, such as a move towards holistic and alternative medicines, can impact demand for certain drugs.

- Healthcare Reforms: Reforms in healthcare systems, particularly in the United States, can result in significant shifts in how drugs are paid for and can affect pharmaceutical companies like AstraZeneca.

- Rising R&D Costs: The increasing cost of research and development can threaten profitability, especially if the R&D does not yield profitable drugs.

- Global Health Crises: Outbreaks of new diseases or pandemics can shift the focus and resources to certain areas, potentially disrupting ongoing projects and affecting revenue streams.

- Intellectual Property Protection: In some countries, intellectual property rights may not be strongly protected or enforced, leading to unauthorized use or copying of AstraZeneca’s products.