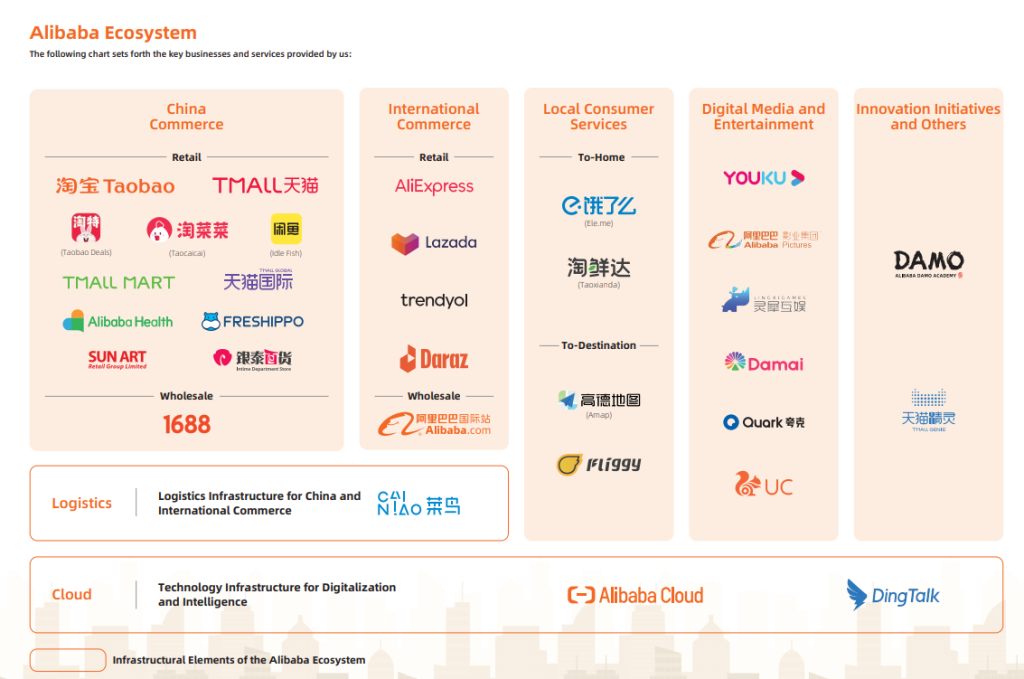

Before we dive deep into the SWOT analysis, let’s get the business overview of Alibaba. Alibaba Group is a Chinese multinational conglomerate specializing in e-commerce, technology, and other sectors. The company was founded by a group of 18 people led by Jack Ma in 1999, and it has grown exponentially since then. Here’s an overview of its primary businesses:

- Alibaba.com: This is the company’s original business. It’s a business-to-business (B2B) marketplace that connects manufacturers and wholesale sellers in China to businesses worldwide.

- Taobao: Launched in 2003, Taobao is a consumer-to-consumer (C2C) online marketplace similar to eBay in the United States. Individuals can buy and sell a broad range of goods.

- Tmall: Tmall is a platform for businesses to sell brand-name goods to consumers in Mainland China, Hong Kong, Macau, and Taiwan. It was introduced as a business-to-consumer (B2C) platform in 2008.

- AliExpress: AliExpress is a retail marketplace targeting consumers worldwide. It allows small businesses in China to sell to customers worldwide.

- Alipay: Alipay is a popular digital payment platform in China, similar to PayPal. It was launched by Alibaba but was spun off as a part of Ant Financial (later rebranded as Ant Group), which is an affiliate of the Alibaba Group.

- Alibaba Cloud: Alibaba Cloud provides a comprehensive suite of global cloud computing services to power international customers and Alibaba Group’s e-commerce ecosystem.

- Ant Group: Ant Group is a financial technology company that operates Alipay, the world’s largest mobile and online payments platform, and Yu’e Bao, the world’s largest money-market fund. It also provides financial services for small businesses. Although Ant Group is affiliated with Alibaba, it’s a separate entity.

- Cainiao Network: Cainiao is a logistics company launched by Alibaba. It operates a logistics information platform that provides real-time information access for buyers and sellers.

Financial Performance 2023: Our total revenue increased by 2% from RMB853,062 million in fiscal year 2022 to RMB868,687 million in fiscal year 2023, and further increased by 8% to RMB941,168 million (US$130,350 million) in fiscal year 2024. Our net income increased by 39% from RMB47,079 million in fiscal year 2022 to RMB65,573 million in fiscal year 2023, and increased by 9% to RMB71,332 million (US$9,879 million) in fiscal year 2024.

Here is the SWOT analysis of Alibaba

A SWOT analysis is a strategic planning tool used to evaluate the Strengths, Weaknesses, Opportunities, and Threats of a business, project, or individual. It involves identifying the internal and external factors that can affect a venture’s success or failure and analyzing them to develop a strategic plan. In this article, we do a SWOT Analysis of Alibaba.

SWOT Analysis: Meaning, Importance, and Examples

Strengths

- Economies of Scale: As one of the largest e-commerce companies in the world, Alibaba benefits from economies of scale, which enable it to reduce costs and improve efficiency. This scale also allows Alibaba to negotiate better deals with suppliers and deliver goods at lower costs.

- Diverse Business Portfolio: Alibaba’s portfolio covers e-commerce, cloud computing, digital media and entertainment, and other initiatives. This diversification reduces the company’s dependence on a single business and allows it to benefit from various growth opportunities in different sectors.

- Technology and Data: Alibaba has a robust technological infrastructure that enables it to manage a vast amount of data from its various businesses. It leverages big data analytics and artificial intelligence to understand customer behavior, enhance user experience, and drive its business strategy.

- Strong Brand and Customer Loyalty: Alibaba has built a strong brand, leading to significant customer loyalty. The company’s platforms, like Taobao and Tmall, are among China’s most visited e-commerce websites.

- Payment Infrastructure: With Alipay (under Ant Group), Alibaba has its payment infrastructure, providing a significant advantage in customer convenience and data acquisition.

- Innovative Culture: Alibaba’s corporate culture encourages innovation, which is crucial in the fast-evolving technology and e-commerce landscape.

- Strong Logistics and Supply Chain Network: Through Cainiao Network and collaborations with other logistics providers, Alibaba has a well-established logistics and supply chain network that enables it to deliver goods swiftly and efficiently.

- Geographical Advantage: Alibaba dominates e-commerce in China, the world’s most populous country and second-largest economy. It has an intimate understanding of Chinese consumer behavior, which international competitors might lack.

Weaknesses

- Heavy Dependence on the Chinese Market: Despite its international presence, a substantial portion of Alibaba’s revenues come from China. This reliance makes the company vulnerable to economic and regulatory changes within the country.

- Regulatory Challenges: Alibaba has faced regulatory scrutiny not just in China but also in other countries. For instance, the Ant Group’s planned initial public offering (IPO) was halted by Chinese regulators in 2020. In 2021, China Fined Alibaba $2.8 Billion in Landmark Antitrust Case.

- Counterfeit Products: Alibaba’s platforms have been criticized for the presence of counterfeit and low-quality products, which can harm its reputation and customer trust.

- Data Security and Privacy Concerns: Like other technology companies, Alibaba has to address increasing data security and privacy concerns. Any significant data breach could have severe repercussions on its business.

- Competition: Alibaba faces intense competition in its various business segments from both domestic and global players. Competitors like Tencent, JD.com, Amazon, and Google can challenge the company’s market position.

- Cultural Differences in Global Expansion: As Alibaba expands globally, it faces cultural and regulatory differences that could challenge its growth.

- Corporate Governance Issues: The company’s governance structure has faced criticism for concentrating too much power on its partners and founder. This could lead to conflicts of interest with shareholders.

- Dependence on Small & Medium Businesses: A significant portion of Alibaba’s revenue comes from small and medium businesses. Economic conditions affecting these businesses can indirectly impact Alibaba’s financial performance.

Opportunities

- Global Expansion: Although Alibaba is a dominant player in China, there’s considerable scope for growth in international markets. Expanding its e-commerce, cloud computing, and financial services operations outside China can provide substantial growth opportunities.

- Growth in Cloud Computing: Alibaba Cloud is the leader in China’s cloud market and ranks among the top global cloud service providers. As more businesses undergo digital transformation, the demand for cloud services is expected to increase significantly, providing a substantial growth opportunity.

- New Technology Adoption: Adoption and development of new technologies like artificial intelligence (AI), machine learning (ML), blockchain, and the Internet of Things (IoT) can drive innovation and open up new avenues for growth. For example, AI can enhance customer experience on its e-commerce platforms, and blockchain can enhance transparency and efficiency in its logistics operations.

- Financial Services: There’s a significant opportunity to expand financial services offerings. Ant Group (Alibaba’s affiliate) already has a massive user base for its digital payment service, Alipay. This user base can be leveraged to offer additional financial services.

- Logistics and Supply Chain Management: Further investment in logistics and supply chain management can improve efficiency, reduce costs, and enhance customer satisfaction. Alibaba’s Cainiao Network has the potential to grow and revolutionize logistics in China and beyond.

- Digital Entertainment and Media: The digital entertainment and media sector is another area where Alibaba could expand, leveraging its existing customer base and technological capabilities.

- Rural E-commerce: There’s a significant untapped market in China’s rural areas. Expanding its e-commerce operations into these regions could provide Alibaba with a vast new customer base.

Threats

- Regulatory Challenges: One of the significant threats facing Alibaba is increased scrutiny and regulation from the Chinese government and other countries where it operates. In April 2021, Chinese regulators hit Alibaba with a record antitrust fine. Future regulations can impact the company’s operations and profitability.

- Intense Competition: Alibaba faces strong competition in all of its business segments. In e-commerce, companies like JD.com, Pinduoduo, and Amazon are constant threats. In cloud computing, it competes with global giants like Amazon Web Services, Microsoft Azure, and Google Cloud. Competitive pressure can impact market share and profit margins.

- Economic Conditions: Economic slowdown, especially in China, which generates most of its revenues, can adversely affect Alibaba’s business. The COVID-19 pandemic and the ongoing U.S.-China trade tensions are examples of such threats.

- Data Security and Privacy: Maintaining data security is a significant challenge with increasing cyber threats and privacy concerns. Any significant data breach can harm the company’s reputation and customer trust and lead to regulatory penalties.

- Counterfeit Products: Despite Alibaba’s efforts to eliminate counterfeit goods, they still exist on its platforms. This damages the company’s reputation and causes friction with global brands and regulators.

- Dependency on Third-party Logistics: Although Alibaba has its own logistics network, Cainiao, it also relies on third-party logistics providers for product delivery. Any disruption in these services can impact its business.

- Fluctuating Exchange Rates: Since Alibaba has a global presence, it’s subject to risks associated with fluctuating exchange rates. Currency devaluation or appreciation can impact its financial performance.