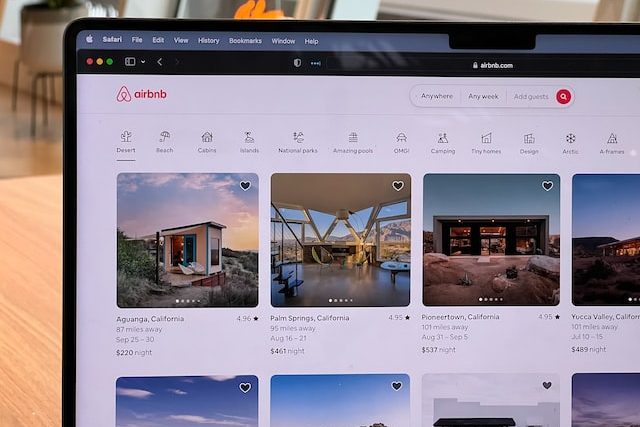

Before we dive deep into the PESTEL analysis, let’s get the business overview of Airbnb. Airbnb, Inc. is an American company that operates an online marketplace for lodging, primarily homestays for vacation rentals and tourism activities. It is based in San Francisco, California. The platform is accessible via a website and mobile app.

Here’s a brief overview of Airbnb’s business model:

- Hosts and Guests: Airbnb’s platform connects hosts and guests. Hosts list their property – a full home, a single room, or even a castle or treehouse – and set rental prices and availability. Guests can search the listings, read reviews from other guests, and book stays. Airbnb acts as an intermediary between hosts and guests, providing a platform for this transaction.

- Revenue: Airbnb’s primary source of revenue is service fees from bookings. It charges guests a service fee for each booking, typically ranging from 6% to 12% but can be as high as 20%. Also, hosts are charged a flat 3% fee for processing payments.

- Experiences: Apart from home-sharing, Airbnb offers “Experiences” where local hosts can offer unique activities like cooking classes, nature walks, or guided tours. Airbnb takes a 20% commission from the price of these experiences.

- Luxe: Airbnb also has a segment called “Airbnb Luxe,” which offers luxury homes with premium services, catering to a high-end market segment.

- Trust and Safety: To ensure the safety and security of its users, Airbnb has several trust and safety measures. This includes a secure payment platform, a host guarantee program, a million-dollar host protection insurance program, and a global customer service team. Users are also able to review each other to build a trustable community.

- Global Presence: As of 2021, Airbnb has a presence in more than 220 countries and regions worldwide and is expanding to more markets.

It’s important to note that Airbnb’s business model has been subject to regulations in different jurisdictions. Some cities have passed laws limiting or banning short-term rentals due to concerns about housing affordability and the character of residential neighborhoods.

Financial Performance 2022: 2022 was another record year for Airbnb. Revenue of $8.4 billion grew 40 percent year over year (46% ex-FX). Net income was $1.9 billion—making 2022 Airbnb’s first profitable full year on a GAAP basis. Adjusted EBITDA was $2.9 billion, while Free Cash Flow was $3.4 billion, growing 49 percent yearly.

How does Airbnb make money | Business Model

Here is the PESTEL analysis of Airbnb

A PESTEL analysis is a strategic management framework used to examine the external macro-environmental factors that can impact an organization or industry. The acronym PESTEL stands for:

- Political factors: Relate to government policies, regulations, political stability, and other political forces that may impact the business environment.

- Economic factors: Deal with economic conditions and trends affecting an organization’s operations, profitability, and growth.

- Sociocultural factors: Relate to social and cultural aspects that may influence consumer preferences, lifestyles, demographics, and market trends.

- Technological factors: Deal with developing and applying new technologies, innovations, and trends that can impact an industry or organization.

- Environmental factors: Relate to ecological and environmental concerns that may affect an organization’s operations and decision-making.

- Legal factors: Refer to the laws and regulations that govern businesses and industries.

In this article, we will do a PESTEL Analysis of Airbnb.

PESTEL Analysis Framework: Explained with Examples

Political

- Government Regulations: Airbnb’s operation is heavily influenced by government regulations and policies, which vary widely from one location to another. In some cities, governments have imposed stringent rules and regulations concerning short-term rentals due to concerns about housing shortages, noise complaints, or the maintenance of neighborhood character. For example, in New York and San Francisco, regulations limit the number of days a property can be rented out in a year.

- Taxation Policies: Airbnb hosts are subject to local and national tax laws. The taxation policies can have a substantial impact on Airbnb’s operation and its attractiveness to potential hosts. For example, in some jurisdictions, Airbnb has to collect a hotel or tourist tax on each booking and remit this to the local tax authority.

- Political Stability: The political stability of a region can significantly affect Airbnb’s operations. For instance, in regions with political unrest, conflict, or frequent changes in government policy, Airbnb might find it difficult to operate.

- International Trade Policies: As a global company, Airbnb could be affected by international trade policies, such as tariffs or restrictions on services trade, though this is less common than for goods-based businesses.

- Government Support: In some areas, governments may provide support to the tourism industry, which could indirectly benefit Airbnb. For instance, a campaign to promote tourism in a particular city or country could lead to increased demand for Airbnb rentals.

- Data Protection and Privacy Laws: Political decisions around data protection and privacy can impact how Airbnb operates. For example, the European General Data Protection Regulation (GDPR) places certain obligations on companies like Airbnb in terms of how they handle the personal data of EU citizens.

Economic

- Economic Conditions: The general health of the economy plays a significant role in Airbnb’s business. In a strong economy, consumers tend to have more disposable income and are more likely to spend on travel and accommodations. Conversely, during economic downturns or recessions, consumers tend to cut back on discretionary spending, including travel.

- Exchange Rates: Airbnb operates in many currencies as a global company. Changes in currency exchange rates can affect both hosts and guests. For example, if a country’s currency depreciates against the dollar, its hosts may receive less income in their local currency. Similarly, guests from that country may find renting listings in dollars more expensive.

- Inflation: Inflation rates can affect the cost of travel and accommodation. Higher inflation can make travel more expensive, potentially reducing the demand for Airbnb’s services.

- Interest Rates: Interest rates can affect Airbnb indirectly. For instance, lower interest rates can lead to increased housing prices, which might incentivize people to rent out their homes to make extra income. Conversely, higher interest rates can increase the cost of mortgages, discouraging potential hosts.

- Unemployment Rates: Higher unemployment rates might lead to more people becoming hosts on Airbnb as a way to earn extra income. On the other hand, high unemployment rates might also reduce travel demand as people have less disposable income.

- Tourism Trends: The state of the economy can influence tourism trends. Economic prosperity generally boosts tourism, benefiting Airbnb, while economic downturns can lead to decreased travel.

Sociocultural

- Changing Travel Preferences: Over the years, there has been a shift in how people travel. Many travelers now prefer more authentic and localized experiences over traditional hotel stays. This trend aligns well with Airbnb’s business model of providing unique accommodations and experiences hosted by locals.

- Trust and Community: Trust is a significant sociocultural factor for Airbnb, given its peer-to-peer business model. The digital revolution fosters a culture of trust and community sharing, making users more comfortable with staying in others’ homes or having strangers stay in theirs. Airbnb has leveraged this by encouraging reviews and ratings.

- Demographics: Changes in demographics can influence Airbnb’s business. For example, younger generations, such as millennials and Generation Z, tend to be more tech-savvy and open to non-traditional accommodations like those offered by Airbnb. As these generations make up a significant portion of the travel market, it could benefit Airbnb.

- Concern for Safety and Privacy: Sociocultural attitudes towards safety and privacy can impact Airbnb. In regions where people value privacy highly or are more cautious about safety, Airbnb might face challenges in persuading them to rent out their homes or stay in others’ homes.

- Environmental Awareness: As societal concern for sustainability grows, more customers prefer environmentally friendly companies. Airbnb has positioned itself as a sustainable alternative to traditional accommodations, claiming that home-sharing leads to more efficient use of existing resources.

- Work and Travel Patterns: The rise of remote work and digital nomadism – trends accelerated by the COVID-19 pandemic – can influence the demand for Airbnb’s services. With more people able to work from anywhere, long-term stays in Airbnb rentals may increase.

Technological

- Digital Platforms: Airbnb’s existence and success are inherently tied to technological advances. The internet and smartphone usage growth has enabled platforms like Airbnb to thrive. Any advancements that make online transactions more straightforward and secure will likely benefit Airbnb.

- Big Data and AI: Airbnb uses advanced algorithms to match users, suggest prices to hosts, and offer personalized recommendations to guests. Data analytics, machine learning, and artificial intelligence improvements could enhance these aspects of Airbnb’s operations.

- Cybersecurity: As an online platform, Airbnb needs to prioritize cybersecurity to protect user data and maintain trust. Advances in encryption and other security technologies can benefit Airbnb, but the company also needs to stay vigilant against evolving cyber threats.

- Payment Technologies: Technological advancements in payment processing and financial technologies, such as digital wallets and blockchain technology, can influence Airbnb’s transaction processes. Adapting to and integrating these new technologies can make transactions more convenient for users.

- User Experience (UX) and User Interface (UI): Technological innovations can allow for more intuitive and user-friendly app design and functionality, enhancing the guest and host experience on Airbnb. A better UX/UI can give Airbnb a competitive advantage.

- Virtual Reality (VR) and Augmented Reality (AR): Emerging technologies like VR and AR could transform how guests explore accommodation options. For instance, they could take virtual property tours before booking, improving their decision-making process.

Environmental

- Sustainability and Climate Change: As societal awareness of climate change and environmental sustainability grows, businesses are expected to contribute to the solutions. Airbnb claims that its model of home-sharing is more sustainable than traditional hotel stays, as it utilizes existing resources rather than building new infrastructure. However, Airbnb could face scrutiny if the increased tourism resulting from its platform leads to environmental degradation.

- Natural Disasters: Airbnb’s business can be impacted by environmental phenomena like hurricanes, floods, wildfires, or other natural disasters. These events can disrupt travel plans or damage listed properties, affecting hosts and guests. On the positive side, Airbnb has implemented a disaster response program, where hosts can offer accessible accommodations to those affected by emergencies, enhancing its reputation for social responsibility.

- Carbon Footprint: Airbnb might face increasing pressure to reduce its carbon footprint and promote eco-friendly practices. While Airbnb’s direct carbon emissions may be lower than those of traditional accommodation providers, the travel facilitated by Airbnb still contributes to greenhouse gas emissions. Airbnb might need to take steps to offset these emissions, perhaps by promoting sustainable travel or supporting clean energy projects.

- Regulations: Airbnb could be affected by environmental regulations. For instance, in some areas, there may be restrictions on building rentals or regulations around waste disposal for hosts. Furthermore, some places might limit tourist numbers to protect the local environment, which could affect Airbnb’s business in those areas.

- Environmental Tourism Trends: Increasingly, travelers are seeking eco-tourism opportunities and environmentally friendly accommodations. Airbnb could cater to these preferences by highlighting listings that offer eco-friendly features or experiences.

Legal

- Regulation of Short-Term Rentals: Various cities worldwide have different regulations regarding short-term rentals. These regulations could limit the number of days a property can be rented out, require hosts to obtain a permit or license, or even ban short-term rentals entirely. Airbnb has faced legal challenges in cities like New York, Barcelona, and Paris, which have implemented strict regulations in response to concerns about housing availability and neighborhood disruption.

- Zoning Laws: Zoning laws can also impact Airbnb’s operations. In some areas, properties are zoned for specific uses, such as residential or commercial, and short-term rentals may be prohibited in certain zones.

- Tax Laws: Tax laws can influence Airbnb’s business, and compliance with these laws is critical. Some jurisdictions require Airbnb to collect and remit taxes on behalf of hosts, while in others, hosts are responsible for handling their taxes. Changes in tax laws or disputes over tax obligations could have significant implications for Airbnb.

- Data Protection and Privacy Laws: Airbnb handles a large amount of personal data from users worldwide. Compliance with data protection and privacy laws, such as the European Union’s General Data Protection Regulation (GDPR), is crucial. These laws can affect how Airbnb collects, stores, and uses user data, and non-compliance can result in significant penalties.

- Employment Laws: While hosts on Airbnb are typically considered independent contractors rather than employees, there is ongoing legal debate in many jurisdictions about the status of gig economy workers. Changes in employment laws could affect Airbnb’s business model.

- Consumer Protection Laws: Airbnb must comply with various consumer protection laws, which cover issues like advertising, cancellation policies, and refunds. Changes in these laws or legal disputes could impact Airbnb’s operations.