Before we dive deep into the SWOT analysis, let’s get the business overview of Xiaomi. Xiaomi Corporation is a Chinese multinational electronics company founded in April 2010 by Lei Jun and several other co-founders. Xiaomi has positioned itself as a major player in the global electronics market, focusing on smartphones, smart home devices, and associated software services.

Here’s a brief overview of Xiaomi’s main areas of business:

- Smartphones: Xiaomi’s primary business has been manufacturing and selling smartphones. They are known for their cost-effective phones that offer high-end features. Xiaomi’s smartphone lineup includes the popular Mi, Redmi, and POCO series, each targeting different market segments.

- IoT and Lifestyle Products: Xiaomi expanded into the Internet of Things (IoT) and lifestyle product segment, producing a wide range of devices, including smart TVs, fitness bands, air purifiers, electric scooters, and kitchen appliances. Their IoT ecosystem is one of the largest in the world, connecting numerous devices and facilitating smart home setups.

- Software Services: Xiaomi has also delved into software services with its MIUI custom Android-based interface that is installed on all Xiaomi smartphones. They offer cloud services, music, video streaming, app store services, and more, often monetizing these services through advertisements and premium subscriptions.

- AI and Big Data: Xiaomi has invested heavily in artificial intelligence (AI) and big data to enhance its products and services. AI plays a crucial role in their IoT ecosystem, and big data is utilized to gain insights and understand consumer needs better.

- Retail and Online Presence: Xiaomi operates both online and offline retail channels. Online, they sell products through their website and partnerships with various e-commerce platforms. Offline, they have been opening more “Mi Home” stores, Xiaomi’s offline retail initiative that displays and sells various Xiaomi products.

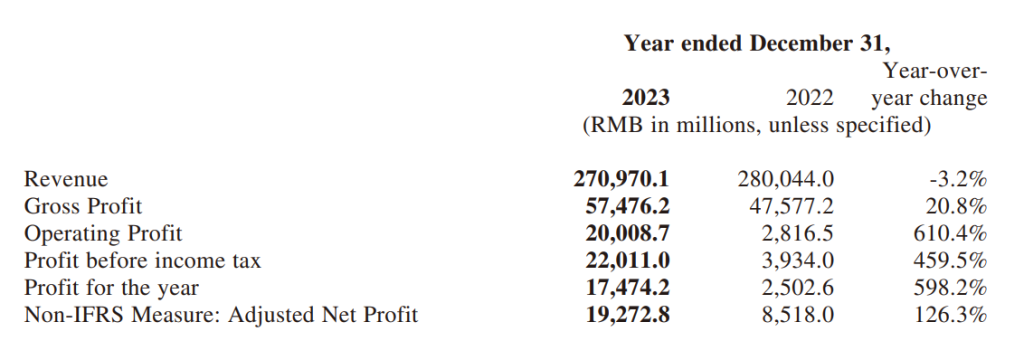

Financial Performance: In 2023, Xiaomi’s total revenue amounted to RMB270.970 billion ($37.33 bn); Xiaomi’s adjusted net profit was RMB17.174 billion ($2.37 bn).

Here is the SWOT analysis of Xiaomi

A SWOT analysis is a strategic planning tool used to evaluate the Strengths, Weaknesses, Opportunities, and Threats of a business, project, or individual. It involves identifying the internal and external factors that can affect a venture’s success or failure and analyzing them to develop a strategic plan. In this article, we do a SWOT Analysis of Xiaomi.

SWOT Analysis: Meaning, Importance, and Examples

Strengths

- Cost-effective Products: Xiaomi is known for offering feature-rich devices at competitive prices. This value-for-money proposition is a significant strength that has helped the company gain market share, particularly in emerging markets.

- Wide Product Range: Xiaomi’s product range is not limited to smartphones. They offer an array of products, from smart TVs to IoT devices, lifestyle products, and more. This diverse portfolio allows them to cater to a broad customer base and creates multiple revenue streams.

- Strong Brand Presence: Xiaomi has developed a strong brand image among younger demographics. The company has a reputation for innovation and delivering high-quality products, which has helped it build a loyal customer base.

- Innovative Marketing Strategy: Xiaomi’s unique marketing strategy, which initially relied heavily on social media and word-of-mouth, helped it create buzz and attract customers without massive advertising expenses. Their flash sales and limited edition models have created a sense of exclusivity and urgency that drives demand.

- Focus on User Experience: Xiaomi’s focus on user experience is another strength. Their MIUI user interface offers a lot of customization options and unique features, which have been well-received by users. They also actively solicit and incorporate user feedback to improve their products and services.

- Strong Online and Offline Retail Network: Xiaomi has a strong online presence and effectively uses e-commerce platforms to sell its products. In addition, they have been steadily building their offline retail network through Mi Home stores and partner outlets, allowing them to reach customers who prefer offline shopping.

- Investments in Research and Development: Xiaomi invests heavily in R&D to drive product innovation and maintain competitiveness. They have made strides in areas like AI, IoT, and 5G technology, keeping them at the forefront of these emerging fields.

Weaknesses

- Reliance on Hardware Sales: Xiaomi’s revenues heavily depend on selling its hardware, particularly smartphones. This makes them vulnerable to market fluctuations and increased competition in the smartphone segment. Given the market saturation and declining growth rates in certain regions, it’s risky.

- Brand Perception: Xiaomi’s strategy of offering affordable devices has led to a perception in some markets that their products are ‘cheap’ or ‘lower-quality’ compared to competitors like Apple or Samsung. This can limit their ability to attract customers in the high-end market segment.

- Less Control Over Component Supply Chain: Unlike some competitors, Xiaomi doesn’t manufacture most of its device components, making them dependent on third-party suppliers. This can lead to potential supply chain disruptions, affecting their ability to deliver products on time.

- Overdependence on Few Markets: While Xiaomi has been expanding globally, a significant portion of its revenue comes from a few key markets, including China and India. Any adverse developments in these markets could significantly impact Xiaomi’s business.

- MIUI Software Monetization: Xiaomi’s MIUI user interface has been criticized for its ad-supported revenue model, which some users find intrusive. This could potentially alienate users and affect their perception of Xiaomi’s brand.

- Intellectual Property Concerns: Xiaomi, like other Chinese tech companies, has faced criticism and legal challenges over intellectual property rights. This leads to legal and financial challenges and can affect the brand’s reputation.

- Regulatory Risks: Being a global company, Xiaomi is subject to various regulatory risks in different countries. For instance, it was temporarily blacklisted by the U.S. government over national security concerns in 2021, though this decision was later reversed.

Opportunities

- Expansion into Emerging Markets: Many emerging markets still have relatively low smartphone penetration. Expanding into these markets can provide Xiaomi with a significant opportunity for growth.

- IoT and Smart Home Devices: The IoT market is expected to grow significantly in the coming years. With its wide range of smart home devices, Xiaomi is well-positioned to capitalize on this trend.

- 5G Technology: The global rollout of 5G is creating a new wave of demand for 5G-compatible devices. With its R&D capabilities, Xiaomi can take advantage of this opportunity to introduce new 5G devices and expand its market share.

- Services and Software: There’s an opportunity for Xiaomi to develop further its services and software offerings, including its MIUI interface, cloud services, and other digital content and services. This can help diversify their revenue streams and reduce dependence on hardware sales.

- Artificial Intelligence (AI): AI is becoming increasingly important in the tech industry, with applications ranging from virtual assistants to data analysis and automation. Xiaomi’s investment in AI research presents significant opportunities for new products and services.

- Sustainable Technology: With growing awareness and concern over environmental issues, there’s a rising demand for sustainable and energy-efficient technology. Xiaomi can seize this opportunity to develop and promote sustainable products.

- Health and Fitness Tech: The health and fitness tech segment has grown rapidly, driven by an increased focus on health and wellness. Xiaomi already has a presence in this market with products like the Mi Band, and there’s an opportunity to expand this further.

Threats

- Intense Competition: The consumer electronics market, particularly the smartphone segment, is highly competitive. Xiaomi competes with various multinational companies like Samsung, Apple, Huawei, and other emerging brands. These companies constantly innovate and launch new products, which could threaten Xiaomi’s market share.

- Geopolitical Risks: Given the international nature of its business, Xiaomi is exposed to geopolitical risks. Changes in international trade policies, political instability, and regulatory changes can affect the company’s operations and profitability.

- Dependence on External Manufacturers: Xiaomi depends on external manufacturers for key components of its products. Any disruption in the supply chain, perhaps due to geopolitical tensions, natural disasters, or pandemics, could impact the production and sales of Xiaomi’s products.

- Price Wars: Xiaomi may need to engage in price wars with competitors to retain its market share, especially in cost-sensitive markets. This could affect the company’s profit margins.

- Technological Obsolescence: In the fast-paced tech industry, products can quickly become obsolete as new technologies emerge. This constantly threatens Xiaomi, as it must continually innovate and update its product offerings to remain competitive.

- Intellectual Property Disputes: As seen in the past, Xiaomi faces potential threats from intellectual property disputes. Legal actions from competitors can lead to financial penalties and damage the company’s reputation.

- Data Privacy Concerns: Data privacy has become a significant issue for tech companies. If Xiaomi fails to protect user data adequately, it could face backlash from consumers and regulators, damaging its brand reputation and potentially leading to legal penalties.

- Global Economic Conditions: Economic downturns or instability can reduce consumer spending on non-essential items like smartphones and consumer electronics, potentially affecting Xiaomi’s sales and revenues.