Before diving deep into the SWOT analysis, let us get the Bank of America business overview (BoA). Bank of America Corporation (BoA) is one of the largest financial institutions in the United States and a leading global bank.

Bank of America Corporation (NYSE: BAC) is headquartered in Charlotte, North Carolina. As of December 31, 2022, BoA operated across

the United States, its territories, and more than 35 countries. Through its bank and various nonbank subsidiaries throughout the United

States and international markets, BoA provides a diversified range of banking and nonbank financial services and products through four business segments comprising eight lines of business:

- Consumer Banking (includes Retail and Preferred Banking): This segment provides consumers and small businesses with a wide range of banking and investment products and services. It includes checking and savings accounts, credit and debit cards, home and auto loans, small business loans, and investment products. The segment also offers digital banking services through its online and mobile platforms.

- In Retail Banking, BoA supports the financial health of nearly 68 million U.S. consumer clients through its financial center locations, ATMs, and digital banking capabilities, including Online and Mobile Banking platforms, Erica® and Zelle®.

- Global Wealth & Investment Management (includes Merrill and The Private Bank): This segment offers comprehensive wealth management solutions, including investment management, brokerage, banking, and trust and retirement services to high-net-worth individuals, families, and institutions.

- Global Banking (includes Business Banking, Commercial Banking, Global Corporate & Investment Banking): This segment serves large corporations, financial institutions, and institutional investors, providing a wide range of financial products and services such as corporate lending, commercial banking, investment banking, and transaction services. The segment also includes treasury management, leasing, and capital markets services.

- Global Markets: This segment offers sales and trading services, including research and risk management solutions, to institutional clients. The segment’s product offerings include fixed income, currencies, commodities, equities, and derivative products.

- Global Markets provides services across the world’s debt, equity, commodity, and foreign exchange markets to approximately 8,000 clients: asset managers, hedge funds, pensions and insurance, corporates, governments, and other financial institutions.

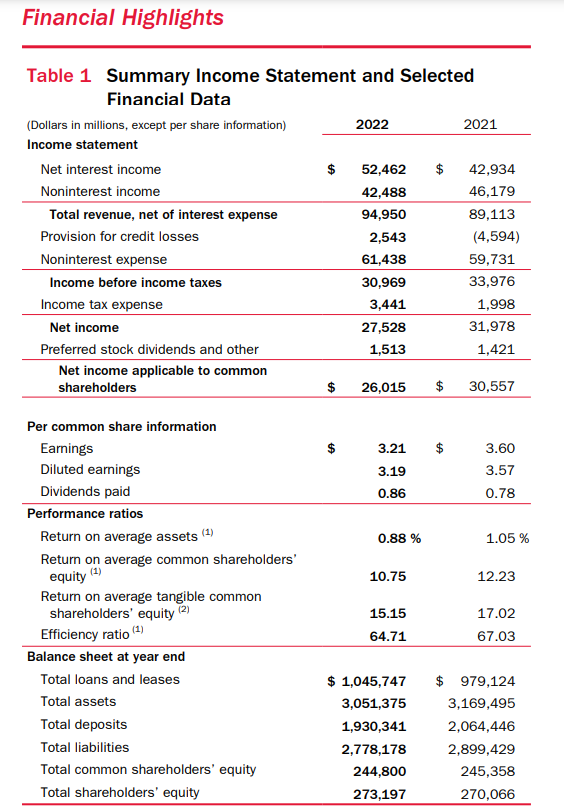

Financial Performance: In 2022, Bank of America generated $95 billion in revenue with a net after-tax income of $27.5 billion. As of 2022, BoA had assets of $3 Trillion.

Here is a SWOT analysis for Bank of America (BoA):

A SWOT analysis is a strategic planning tool used to evaluate the Strengths, Weaknesses, Opportunities, and Threats of a business, project, or individual. It involves identifying the internal and external factors that can affect a venture’s success or failure and analyzing them to develop a strategic plan. In this article, we do a SWOT Analysis of Bank of America.

SWOT Analysis: Meaning, Importance, and Examples

Strengths

- Strong brand recognition: Bank of America is a well-known and respected brand in the financial industry. Its long history and extensive operations have helped it build a strong reputation, fostering customer trust and loyalty.

- Diversified business model: The bank’s operations span multiple financial services sectors, including consumer banking, wealth management, corporate and investment banking, and global markets. This diversification helps spread risk and provides multiple revenue streams, making the bank less vulnerable to fluctuations in any one market.

- Large customer base: Bank of America serves millions of individual consumers, small and medium-sized businesses, large corporations, and institutional investors. This broad customer base provides a stable source of income and offers opportunities for cross-selling and up-selling products and services.

- Extensive branch and ATM network: Bank of America has a wide-reaching network of branches and ATMs across the United States, which allows it to effectively serve its customers and maintain a strong physical presence in the market.

- Digital innovation: The bank has invested heavily in digital technology and innovation to improve its online and mobile platforms. This has resulted in user-friendly and efficient digital banking services, which cater to customers’ evolving needs and help the bank maintain a competitive edge.

- With a record 11.6 billion digital logins and 56 million verified digital users in 2022, up 3% year-over-year, there are increasingly more digital touchpoints to make clients feel valued and in control of their financial well-being.

- From Erica®, BoA’s virtual financial assistant that makes it easier for consumers to manage day-to-day finances, to digital tools that modernize and streamline business operations, BoA is constantly innovating to deliver next-generation features and solutions that help clients manage their financial lives with increased ease, convenience and security.

- Strong capital position: Bank of America has a solid capital base and maintains a strong balance sheet, which allows it to withstand economic fluctuations and comply with regulatory capital requirements. On December 31, 2022, the Corporation had $3.1 trillion in assets.

Weaknesses

- Exposure to litigation and regulatory risks: Bank of America is a major financial institution subject to various legal and regulatory requirements. The bank has faced several legal disputes and regulatory actions in the past, resulting in significant fines, penalties, and reputational damage. Bank of America Racked up $1.2 Billion in Penalties, Settlements in 2022.

- Dependence on the U.S. market: Although Bank of America has a presence in more than 35 countries, a significant portion of its revenue is generated from the U.S. market. This dependence on a single market exposes the bank to economic fluctuations and changing regulatory environments in the United States.

- Competition: Bank of America faces intense competition from other financial institutions, including traditional banks, credit unions, fintech companies, and other non-banking financial service providers. This competition can pressure the bank’s market share, profitability, and ability to attract and retain customers.

- Vulnerability to the low-interest-rate environment: Prolonged periods of low interest rates can negatively impact Bank of America’s net interest income, as it can compress the spread between the bank’s lending and deposit rates. This can lead to reduced profitability and constrain the bank’s ability to grow its loan portfolio.

- Legacy issues: Bank of America’s past acquisitions, particularly its acquisition of Countrywide Financial and Merrill Lynch during the financial crisis, have resulted in ongoing legacy issues. These issues, including litigation and integration challenges, have led to financial and reputational risks for the bank.

- Cybersecurity risks: As a financial institution with a significant digital presence, Bank of America is exposed to cybersecurity risks, including data breaches, hacking, and other cyberattacks. These incidents can result in substantial financial losses, reputational damage, and regulatory scrutiny.

Opportunities

- Expansion in emerging markets: Bank of America can explore opportunities for growth in emerging markets, particularly in Asia and Latin America, where there is a growing demand for banking and financial services. This can help the bank diversify its revenue sources and reduce its dependence on the U.S. market.

- Digital banking and technological innovation: The ongoing shift towards digital banking and the increasing use of technology in financial services present significant growth opportunities for Bank of America. The bank can attract more customers and improve its operational efficiency by continuing to invest in its digital platforms, enhancing user experience, and adopting innovative technologies such as artificial intelligence, blockchain, and big data analytics.

- Strategic partnerships and collaborations: Bank of America can explore partnerships and alliances with fintech companies, technology firms, and other financial institutions to expand its product offerings, enhance its digital capabilities, and reach new customer segments.

- Sustainable finance and ESG investing: There is a growing demand for environmentally and socially responsible investment products and services. Bank of America can capitalize on this trend by developing and promoting sustainable finance products, such as green bonds, social impact investing, and ESG (Environmental, Social, and Governance) funds.

- Expanding wealth management services: With the increasing number of high-net-worth individuals globally, there is a growing demand for comprehensive wealth management services. Bank of America can expand its Global Wealth and Investment Management (GWIM) division to capture a larger share of this market.

- Financial inclusion initiatives: Bank of America can explore opportunities to promote financial inclusion by offering customized products and services to underbanked and unbanked populations. This can help the bank tap into new customer segments and foster long-term customer relationships.

- Mergers and acquisitions: Bank of America can consider strategic mergers and acquisitions to expand its business operations, enter new markets, or acquire new technologies and capabilities. This can help the bank grow its market share and strengthen its competitive position.

Threats

- Economic fluctuations: As a financial institution, Bank of America is exposed to the risks associated with economic fluctuations, such as recessions, changes in interest rates, and market volatility. These factors can affect the bank’s lending, investment, and trading activities, reducing revenues and profitability.

- Regulatory changes: The financial services industry is highly regulated, and changes in regulations or increased regulatory scrutiny can have a significant impact on Bank of America’s operations, compliance costs, and overall profitability. For example, implementing stricter capital requirements or consumer protection regulations could affect the bank’s business model and growth prospects.

- Intense competition: Bank of America faces fierce competition from other financial institutions, including traditional banks, credit unions, fintech companies, and non-banking financial service providers. This competition can lead to increased pricing pressure, lower margins, and challenges in retaining and attracting customers.

- Cybersecurity risks: As a financial institution with a significant digital presence, Bank of America is exposed to cybersecurity risks, including data breaches, hacking, and other cyberattacks. These incidents can result in financial losses, reputational damage, and regulatory scrutiny, hurting the bank’s business.

- Technological disruption: Rapid technological advancements in the financial services industry, such as the emergence of digital currencies, blockchain technology, and new payment platforms, pose a threat to traditional banking business models. Bank of America needs to adapt and innovate to stay competitive in this constantly evolving landscape.

- Reputational risk: litigation, regulatory actions, or public perceptions about its business practices can negatively impact Bank of America’s reputation. Reputational damage can result in loss of customer trust, reduced market share, and lower profitability.

- Geopolitical risks: Bank of America’s international operations expose it to geopolitical risks, including political instability, trade disputes, and economic sanctions. These factors can adversely affect the bank’s operations and overall performance in specific regions.