Before we dive deep into the SWOT analysis, let’s get the business overview of EasyJet. EasyJet is a British low-cost airline carrier based at London Luton Airport. It is one of the largest airlines in Europe by the number of passengers flown, and along with competitors Ryanair, Wizz Air, and Eurowings, EasyJet has a predominant presence in the European low-cost air travel market.

Founded by Sir Stelios Haji-Ioannou in 1995, EasyJet has been characterized by its rapid expansion, fueled by the deregulation of the aviation industry in Europe in 1997 and the increasing consumer demand for low-cost air travel.

Key features of EasyJet’s business include:

- Point-to-Point Model: EasyJet operates on a point-to-point model rather than the traditional hub-and-spoke model used by many airlines. This means they operate non-stop flights between two cities, resulting in shorter travel times and lower costs.

- Cost Efficiency: A key part of EasyJet’s business strategy is keeping costs low. They achieve this through measures such as operating a single type of aircraft to reduce maintenance costs, maximizing aircraft utilization, using secondary airports with lower fees, and offering no-frills services with additional options available for purchase.

- Online Sales and Distribution: EasyJet was one of the first airlines to embrace the Internet for booking tickets. This has allowed them to keep costs low by cutting out intermediaries and has provided a convenient platform for customers to manage their bookings.

- Fleet: As of 2021, EasyJet operates a fleet of Airbus A319 and A320 aircraft. They have chosen to operate a single type of aircraft to simplify operations and reduce costs.

- Network: EasyJet serves numerous destinations across Europe and some outside of Europe in North Africa and the Middle East. This extensive network, combined with high-frequency flights, makes the airline popular for leisure and business travelers.

- Ancillary Revenue: In addition to revenue from ticket sales, EasyJet also earns income from ancillary services such as baggage fees, seat selection fees, in-flight sales, and car rental partnerships.

- Customer Segmentation: While initially focusing on leisure travelers, EasyJet has also attracted business travelers by offering flexible fares, fast-track security, and other services.

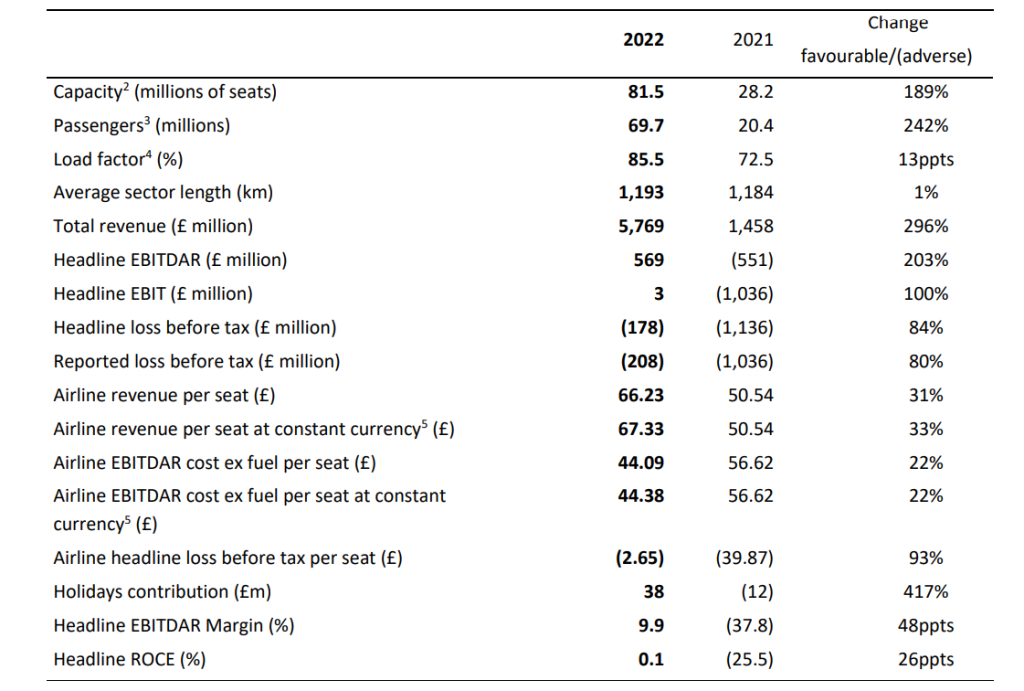

- Headline loss before tax of £178 million (2021: £1,136 million loss)

- Total revenue increased by 296% to £5,769 million (2021: £1,458 million), predominantly due to increased capacity flown and ancillary products continuing to deliver incremental revenue.

- Group headline costs increased by 129% to £5,947 million (2021: £2,594 million), primarily due to the increase in flow capacity.

Here is the SWOT analysis for Easyjet

A SWOT analysis is a strategic planning tool used to evaluate the Strengths, Weaknesses, Opportunities, and Threats of a business, project, or individual. It involves identifying the internal and external factors that can affect a venture’s success or failure and analyzing them to develop a strategic plan. In this article, we do a SWOT Analysis of Easyjet.

SWOT Analysis: Meaning, Importance, and Examples

Strengths

Some strengths of EasyJet as a company include:

- Low-cost business model: EasyJet’s low-cost business model offers affordable airfares to a wide range of travelers. This has helped the airline attract a large customer base, particularly among budget-conscious travelers.

- Strong brand recognition: EasyJet is a well-known brand, recognized for its orange and white livery and commitment to sustainability. This has helped the airline build a loyal customer base and attract new customers.

- Wide range of destinations: EasyJet operates flights to over 150 destinations in 36 countries, providing travelers with a wide range of options for both leisure and business travel.

- Strong focus on customer service: EasyJet strongly focuses on customer service, with a dedicated team and a user-friendly mobile app. This has helped the airline build a reputation for providing a positive customer experience.

- Emphasis on sustainability: EasyJet is committed to sustainability, to be net-zero carbon by 2030. The airline has implemented various measures to reduce its carbon footprint, including investing in more fuel-efficient aircraft, reducing single-use plastics, and using sustainable aviation fuels. This has helped EasyJet appeal to environmentally conscious travelers and investors.

Weaknesses

Some weaknesses of EasyJet as a company include:

- Limited focus on premium services: EasyJet’s low-cost business model does not offer the same range of premium services as some of its competitors, such as business class seating or in-flight meals. This can limit its appeal to some travelers, particularly those prioritizing comfort and luxury.

- Dependence on the European market: EasyJet’s operations are primarily focused on the European market, which makes it vulnerable to economic and political developments in the region. This can impact the airline’s financial performance if there is a downturn in the European economy or political instability in the region.

- Exposure to external risks: EasyJet is exposed to a range of external risks, such as changes in fuel prices, currency exchange rates, and weather disruptions. These risks can impact the airline’s profitability and operational efficiency.

- Limited brand differentiation: EasyJet’s branding and marketing strategy are similar to those of other low-cost airlines, which can limit its ability to differentiate itself in the market. This can make it difficult for the airline to stand out from its competitors and attract new customers.

- Negative customer perceptions: EasyJet has received criticism from some customers for its strict baggage policies, long queues, and delays. These negative perceptions can impact the airline’s reputation and make it difficult to attract new customers.

Opportunities

Some opportunities for EasyJet as a company include:

- Expanding into new markets: EasyJet can expand into new markets outside Europe, such as Asia or the Americas. This could help the airline diversify its operations and reduce its dependence on the European market.

- Growing demand for sustainable travel: As consumers become increasingly environmentally conscious, there is a growing demand for sustainable travel options. EasyJet’s commitment to sustainability puts it in a strong position to capitalize on this trend and appeal to environmentally conscious travelers.

- Digital transformation: EasyJet has the opportunity to invest in digital technologies and transform its operations to improve efficiency and enhance the customer experience. For example, the airline could develop mobile apps or implement new technologies to streamline check-in and reduce waiting times.

- Strategic partnerships: EasyJet could form strategic alliances with other airlines or travel companies to expand its reach and offer customers a more comprehensive range of travel options. For example, the airline could partner with hotels or rental car companies to offer bundled travel packages.

- Emerging technologies: Emerging technologies such as electric or hydrogen-powered aircraft could offer EasyJet new opportunities to reduce its carbon footprint and appeal to environmentally conscious customers. The airline could also explore using AI and automation to improve operational efficiency and reduce costs.

Threats

Some threats to EasyJet as a company include:

- Economic downturns: Economic downturns or recessions can impact consumer spending on travel, which can affect EasyJet’s financial performance.

- Increased competition: The low-cost airline industry is highly competitive, and EasyJet faces competition from both traditional airlines and other low-cost carriers. Increased competition can lead to pricing pressures and a reduction in market share.

- Political instability: Political instability, such as Brexit or other political developments, can impact EasyJet’s operations and financial performance, mainly as the airline heavily depends on the European market.

- Changing consumer preferences: Changes in consumer preferences, such as a shift towards premium travel options or a preference for sustainable travel, can impact EasyJet’s customer base and market share.

- External risks: EasyJet is exposed to external risks such as currency fluctuations, fuel price volatility, and natural disasters. These risks can impact the airline’s profitability and operational efficiency.